Singapore Airlines 2016 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

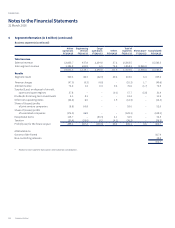

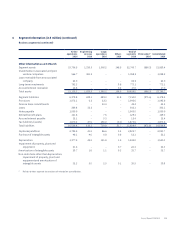

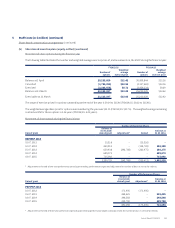

10 Exceptional Items (in $ million) (continued)

6. In respect of the air cargo investigations by competition authorities, SIA Cargo’s appeal against the Seoul High Court judgment to the

Supreme Court was partially successful. As a result, in September 2014, the South Korean Fair Trade Commission refunded KRW793.2

million ($1.0 million) to SIA Cargo, being part of the fine amount paid previously.

7. With regard to anti-trust litigation in the United States, SIA entered into a settlement agreement (with no admission of liability) with

the plaintis in August 2014. In accordance with the agreement, SIA has made payment of USD9.2 million ($11.4 million) into an escrow

account pending court approval. Final approval of the settlement was granted by the court in June 2015. Subsequently, one of the class

members filed an appeal against the court judgment approving the settlement. This appeal is currently pending.

8. In March 2015, SIA Cargo reached a settlement with a customer to resolve all pending and potential civil damage claims regarding the air

cargo issues. Arising from this settlement, a provision of USD10.1 million ($13.7 million) was recorded.

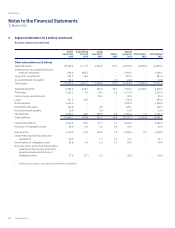

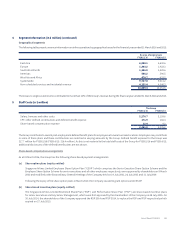

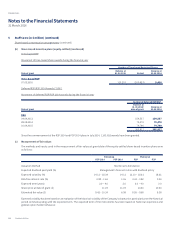

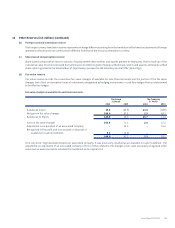

11 Taxation (in $ million)

The Group is subject to income taxes in numerous jurisdictions. Judgment is involved in determining the provision for income taxes. There are

certain transactions and computations for which the ultimate tax determination is uncertain during the ordinary course of business. The Group

recognises liabilities for expected tax issues based on estimates of whether additional taxes will be due. Where the final tax outcome of these

matters is dierent from the amounts that were initially recognised, such dierences will impact the income tax and deferred tax provisions in

the period in which such determination is made.

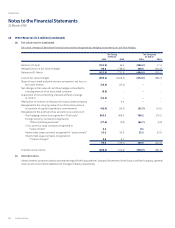

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2016 and 2015 are:

The Group

FY2015/16 FY2014/15

Current taxation

Provision for the year 145.4 126.2

(Over)/Under provision in respect of prior years (8.6) 3.1

136.8 129.3

Deferred taxation

Movement in temporary differences (16.9) (37.7)

Under/(Over) provision in respect of prior years 0.7 (55.4)

(16.2) (93.1)

120.6 36.2

Deferred taxation related to other comprehensive income:

The Group

FY2015/16 FY2014/15

Available-for-sale financial assets (0.4) –

Cash flow hedges 37.8 (159.2)

Actuarial (loss)/gain on revaluation of defined benefit plans (0.3) 2.1

37.1 (157.1)

The Group has tax losses (of which no deferred tax asset has been recognised) of approximately $155.3 million (2015: $163.3 million) that are

available for oset against future taxable profits of the companies. This is due to the uncertainty of the recoverability of the deferred tax asset.

Annual Report FY2015/16 147