Ryanair 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New Routes and Bases

Of the 150 routes that Ryanair operates today, 73 were still in

their first 12 months of operation at the year end. In recent

months we have opened new bases at Girona Barcelona and

Rome Ciampino. We are continuing to add frequency to our

existing schedules as well as adding new routes to our existing

bases. We expect passenger growth to slow down in the

coming year to a more “normal” 20% after a number of years

of hectic but strategically very important growth. We believe

that this more modest growth will allow us to continue to

improve customer service, whilst at the same time resuming

our record of profitable growth for our shareholders.

O ver the past yea r, des p i te enormous growth, diffi cu l t

markets, and a downturn in profit, we have increased the basic

pay of our people by 3%, an increase that is significantly

greater than most, if not all, of our competitors. Average pay

in Ryanair co n t i n u es to be amongst the highest of any

European scheduled airline, and our people continue to enjoy

the best package of salary, terms and conditions, and share

options.

Regulatory Affairs

If there was a negative trend over the past year, it was the

increasing tendency of regulators to sacrifice the interests of

consumers and competition in favour of protecting the vested

interests of high cost national airlines and airports. A local

tribunal in France found in favour of an Air France complaint

against Ryanair’s low fares at Strasbourg Airport. As a result

we moved these flights to the nearby Karlsruhe Baden Airport

with no loss of traffic.

However Strasbourg airport has seen its traffic on the London

route collapse from just under 20,000 passengers a month to

just over 3,000, as passengers are de terred by Air France’s

high fare monopoly on the route. The only losers in this case

have been ordinary French consumers and visitors who cannot

afford to pay Air France’s high fares and therefore no longer

use Strasbourg Airport.

In February the European Commission held that Ryanair’s low

cost base at Brussels Charleroi constituted unlawful state aid

primarily on the basis that no privately owned airport would

enter into asimilarlong term low cost arrangement. This anti-

competitive decision is contrary to the reality of the current

European market which is characterised by many private and

publicly owned airports offering long term discounts to high

growth airlines such as Ryanair (among others) who are

capable of transforming an empty airport such as Charleroi

into a vibrant, high growth, profitable international airport.

The Commission’s findings in the Charleroi case ignore its own

private market investorprinciple and we remain confident that

this anti-consumer decision will be overturned on appeal to

the Eu ro p e an Co u rts. In the meantime Ryanair has

renegotiated its contract with Charleroi in order to comply

with the Commission’s decision, but without altering the low

cost base.

Ryanair’s growth in Europe has frequently been subjected to

these regulatory attacks from our competitors. We have over

the past 15 yea r s continuously ove rturned these anti-

competitive interventions in the courts upon appeal. US low

fare carriers, like Ryanair, had to overcome many regulatory

battles across the US in the 80’s and 90’s. Ryanair will

continue to suffer these anti-competitive actions for a number

of years simply because this is the only way that the high cost,

high fare incumbents can seek to block competition, limit

c h o i ce, and prevent a better deal for E U co n s u m e rs .

Eve n tu a l l y re g u l a to rs will rea l i se that protecting the

incumbents is anti-competitive and futile because the future

of air travel lies in more choice, more competition and more

low fare services for consumers, not less.

(Continued)

Chief Executive’s Report

6

A N N U A L R E P O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4

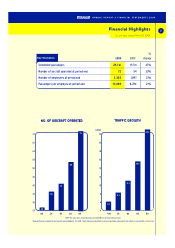

00 01 02 03 04

36

38

40

42

44

48

50

46

41.7

50.6

53.3

54.0

38.4

‘000’s

AVERAGE PAY