Ryanair 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

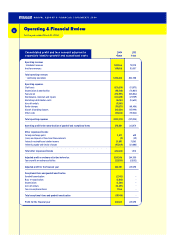

For the purpose of the Operating and Financial Review all figures and comments are

by reference to the adjusted profit and loss account which excludes certain

exceptional costs, and goodwill. Exceptional costs consisted of re-organistion costs

of 2.7m (net of tax) related to the closure of Buzz for one month post acquisition

to realign its business with Ryanair’s, an additional depreciation charge of 3.3m

relating to an adjustment to the residual value of six Boeing 737-200 aircraft that

retired earlier than planned as a result of scratch marks that occurred during an

aircraft painting programme which in turn gave rise to lease costs of 11.6m (net of

tax). Goodwill of 2.3m arising from the “Buzz” acquisition was amortised during

the period. Total exceptional costs and goodwill amounted to 19.9m (net of tax)

for the year ended March 31, 2004

Operating & Financial Review

10

A N N U A L R E P O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4

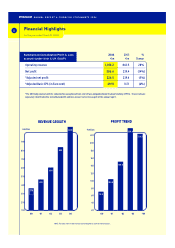

Profit for the Year

Adjusted profit after tax has decreased by 5% to 226.6m,

compared to 239.4m in the previous year driven by continued

strong growth in passenger volumes albeit at fares which were

on average 14% lower. Adjusted operating margins for the year

also decreased by 6 points to 25%. However despite this

reduction, a d j u s te d o p e rating profit increa s ed by 3% to

270.9m compared to the year ended March 31, 2003.

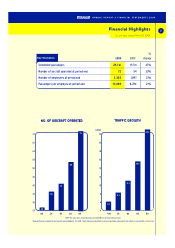

Operating Revenues

Total operating reve n u es for the year grew by 28% to 1 , 074.2 m

w h i l st passenger vo l u m es increa sed by 47% to 23.1 m .

Scheduled passenger revenues increased by 26% to 924.6m

due to strong passenger growth, offset by a 14% decline in the

average fare during the year to 39.97. Passenger volumes

increased due to the launch of new routes and two new bases.

Capacity increased by 54% due to the delivery of 18 Boeing 737-

800 “next generation” aircraft and the acquisition of Buzz

during April 20 03. Pa ssenger load fa c to rs decrea sed, as

expected by 4 percentage points from 85% to 81%.

A n c i l l a ry reve n u e i n c rea sed by 35% to 1 49.7m and refl e c ts

st rong growth in non-flight scheduled reve n u e, car hire and hote l

reve n u e, offset, by the cessation of the charter p ro g ramme as

Ryanair re p l a ced charter ca p a c i ty with scheduled se rv i ces.

A n c i l l a ry reve n u es we re also negatively impacted by the

st rengthening of the euro ve rsus sterling in the yea r, as 65% of

a n c i l la ry reve n u es are denominated in sterling. Ancillary

reve n u e, excluding charte rs increa sed by 52%, higher than the

g rowth in passenger numbers, and acco u n ted for 14% of tota l

reve n u es co m p a red to 13% in t h e year ended March 31, 20 03.

Operating Expenses

Total a d j u ste d o p e rating ex p e n ses increa sed by 39% to

803.4m due to the increase in the size of the fleet operated,

passenger volume activity, and increased costs, primarily fuel,

route charges and airport & handling costs associated with the

growth of the airline. Costs increased at a lower rate than the

g rowth in passenger numbers principally refl e c t i ng the

i n c rea sed operational effi c i e n c i es arising from the higher

p ro p o r tion of Boeing 737-800 “next genera t i o n” airc ra ft

operated. However costs have increased at a faster rate than

the growth in total revenues due to the decline in average fares

described above.

Staff costs have increased by 33% to 123.6m. This increase

reflects a 31% increase in average employee numbers to 2,288

and the impact of a 3% pay increase granted during the year

offset by savings arising from the stronger euro to sterling

exchange ra te. Pro d u ct i v i ty ca l cu l a ted on the basis of

passengers booked per employee continues to improveto 10,049

passengers per employee, an increase of 21%.

Depreciation and amortisation increased by 28% to 98.1m

due to an increase in the number of aircraft owned from 54 to

62 and the amortisation of capitalised maintenance costs offset

by savings arising as the base cost of all 737-200 aircraft now

has been fully depreciated.

Fuel costs increased by 36% to 175.0m due to a 58% increase

in the number of hours flown, offset b y a lower US$ cost per

gallon, a st ronger euro to US$ exchange ra te and an

improvement in the fleet fuel burn rate due to the higher

p ro p o r tion of Boeing 737-800 “next genera t i o n” airc ra ft

operated. The group consumed 210,024,169 US gallons of fuel at

an average cost of 0.82 cent per US gallon.

Aircraft rental costs of 11.5m arose during the year reflecting

the lease rental costs associated with the acquired “Buzz”

aircraft and the lease of 10 Boeing 737-800 “next generation”

aircraft operated during the year.