Ryanair 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Financial Highlights

4 Chairman’s Report

5 Chief Executive’s Report

8 Operating & Financial Review

14 Directors’ Report

20 Directors

21 Social, Environmental and Ethical report

23 Report of the Remuneration Committee to the Board

24 Statement of Directors’ Responsibilities

24 Independent Auditors’ Report to the Members of Ryanair Holdings plc

26 Statement of Accounting Policies

29 Consolidated Balance Sheet

30 Consolidated Profit & Loss Account

31 Consolidated Cash Flow Statement

32 Consolidated Statement of Changes in Shareholders’ Funds - equity

33 Company Balance Sheet

34 Notes Forming Part of the Consolidated Financial Statements

63 Summary of Differences between Irish, UK and US GAAP

74 Directors and Other Information

CONTENTS

1

A N N U A L R E P O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4

Financial Statements

Certain of theinformationincludedinthis release is forward lookingandissubject to importantrisksanduncertainties that could cause actual results to differmaterially. It

isnot reasonablypossible to itemise all of themany factors andspecific events that couldaffecttheoutlookand results of anairlineoperatinginthe Europeaneconomy.

Amongthe factors thatare subject to changeand couldsignificantlyimpactthegroup’s expected results are theairlinepricingenvironment, fuel costs, competitionfromnew

and existing carriers, market prices for replacementaircraft, costs associatedwithenvironmental, safety and security measures, actions of the Irish,UK, European Union

(“EU”)and othergovernments andtheir respective regulatory agencies, fluctuationsin currency exchange rate andinterest rates, airport access andcharges, labour relations,

theeconomicenvironment of theairlineindustry, thegeneraleconomicenvironmentinIreland,theUKand Continental Europe, thegeneralwillingness of passengers to travel

and othereconomics, socialandpolitical factors.

Table of contents

-

Page 1

...'s Report Operating & Financial Review Directors' Report Directors Social, Environmental and Ethical report Report of the Remuneration Committee to the Board Statement of Directors' Responsibilities Independent Auditors' Report to the Members of Ryanair Holdings plc Statement of Accounting Policies... -

Page 2

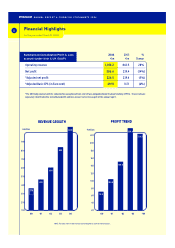

... profitis statedbefore exceptionalitems (net of tax) andgoodwillamortisation totalling 19.9m. These itemsare separately identifiedinthe consolidatedprofit andloss account set outon page 8 of the annual report. REVENUE GROWTH million 1,074 PROFIT TREND million 220 239.4 226.5 900 200... -

Page 3

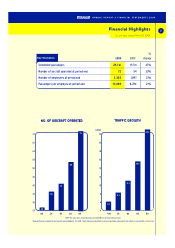

... 3 % Key Statistics 2004 2003 Change Scheduled passengers Number of aircraft operated at period end Number of employees at period end Passengers per employee at period end 23.1 m 72 2,302 10,049 15.7m 54 1,897 8,296 47% 33% 21% 21% NO. OF AIRCRAFT OPERATED million 70 72 TRAFFIC GROWTH 23... -

Page 4

... rank number 1 among our peers for punctuality, fewest cancellations, and fewest lost bags. We aim continuously to improve these customer service statistics as we grow over the coming years. Unit cost reductions of 6% were achieved. Our staff efficiency ratio improved by 21% to an industry leading... -

Page 5

... for low cost, low fare, high growth operations. Ancillary revenues continue to grow faster than passenger volumes. While mo st of our competitor airline s spend their time trying to increase fares and yields, the * flights arriving within 15 minut es of scheduled time of arrival Ryanair monthly... -

Page 6

... have been ordinary French consumers and visitors who cannot afford to pay Air France's high fares and therefore no longer use Strasbourg Airport. In February the European Commission held that Ryanair's low cost base at Brussels Charleroi constituted unlawful state aid primarily on the basis that no... -

Page 7

... to develop low cost, low fare, new route business, which will sustain rapid traffic growth at those airports over the coming years. The enormous growth of secondary airports such as Glasgow Prestwick, Brussels Charleroi and Frankfurt Hahn (among others) highlights how Cork and Shannon can stimulate... -

Page 8

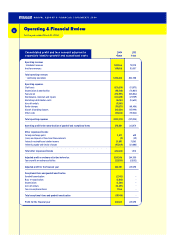

...exceptional costs Operating revenues Scheduled revenues Ancillary revenues Total operating revenues - continuing operations Operating expenses Staff costs Depreciation & amortisation Fuel and oil Maintenance, materials and repairs Marketing & distribution costs Aircraft rentals Route charges Airport... -

Page 9

...O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4 Operating & Financial Review for the year ended March 31, 2004 9 Consolidated profit and loss account adjusted to separately identify goodwill and exceptional costs Earnings per ordinary share (in - Basic - Diluted cent) 2004 000 2003 000 27... -

Page 10

..." aircraft operated. However costs have increased at a faster rate than the growth in total revenues due to the decline in average fares described above. Staff costs have increased by 33% to 123.6m. This increase reflects a 31% increase in average employee numbers to 2,288 and the impact of a 3% pay... -

Page 11

...0 4 Operating & Financial Review (Continued) 11 Operating Expenses (continued) Maintenance costs increased by 46% to 43.4m reflecting an increase in the size of the fleet operated, an increase in the number of flight hours, and higher maintenance charges relating to the "Buzz" aircraft, offset by... -

Page 12

... Buzz Stansted Ltd and this company has successfully obtained a UK air operator's certificate. Buzz Stansted Ltd operates these aircraft on a contractsub-service basis for Ryanair. The BAe 146-200's were returned to KLM UK Ltd in January 2004, however the rentals continued to b ep a i du n t i lt... -

Page 13

... revenues are used to fund forward foreign exchange contracts to hedge US dollar currency exposures that arise in relation to fuel, maintenance, aviation insurance, and capital expenditure costs - including aircraft related payments to Boeing. The group's objective for interest rate risk management... -

Page 14

... out in the consolidated profit and loss account on page 30 and in the relatednotes. Share Capital The number of shares in issue at March 31, 2004 was 759,271,140. Accounting Policies The accounting policies followed in the preparation of these consolidated financial statements for the year ended... -

Page 15

... expertise and by providing adequate resources to the financial function. The books of account of the company are maintained at its registered office, Corporate Headquarters, Dublin Airport, Co. Dublin. NAME SHARES HELD % OF ISSUED SHARE CAPITAL Fidelity Investements Gilder Gagnon Howe & Co LCC... -

Page 16

... Code on Corporate Governance (published by the Irish S tock Exchange and applicable for reporting years beginning on or after November 1, 2003) and the Sarbanes-Oxley Act (issued in 2002 by the US Securities and Exchange Commission). business and implementation of the Board's strategy and policy... -

Page 17

... senior management, comprising of the Chief Pilot, the Director of Flight and Ground Operations, the Flight Safety Officer and the Director of Engineering. The Air Safety Committee meets regularly to discuss relevant issues and reports to the Board on a quarterly basis. Directors' Remuneration The... -

Page 18

... clearly defined organisational structure along functional lines and a clear division of responsibility and authority in the group; • a very comprehensive system of internal financial reporting which includes preparation of detailed monthly management accounts, providing key performance indicators... -

Page 19

... 62 of the financial statements. Annual General Meeting The Annual General Meeting will be held on September 23, 2004 at 11am in the Holiday Inn Hotel, Dublin Airport, Co. Dublin. On behalf of the Board D. Bonderman Chairman August 13, 2004 M. O' Leary Chief Executive Directors and their Interests... -

Page 20

... since January 2001, and is Head of Equities at Davy Stockbrokers. Mr. McLaughlin also advised Ryanair during its initial flotation on the Dublin and NASDAQ stock markets in 1997. He is also a director of Elan Corporation plc, and he serves as a director of a number of Irish private companies. -

Page 21

..., Environmental and Ethical report 21 Social The group's aim is that employees understand the group's strategy and are committed to Ryanair. The motivation and commitment of our people is key to our performance. The group's policy is that training, career development and promotion opportunities... -

Page 22

... load factors • Operating fuel efficient Boeing 737-800 "next generation" aircraft thereby reducing fuel usage per seat by 45%. • Better utilisation of existing infrastructure by operating out of under-utilised airports throughout Europe. Emissions charging Ryanair is fundamentally opposed... -

Page 23

... basic salary, performance bonus and pension. Full details of the executive director's remuneration are set out in note 23(a) on page 50 of the financial statements. Executive Director's Service Contract Ryanairenteredinto a new employmentagreement with the only executive director of the Board,Mr... -

Page 24

... The directors are responsible for keeping proper books of account which disclo se with reasonable accuracy at any time the financial position of the company and of the group and to enable them to ensure that the financial statements comply with the Companies Acts 1963 to 2003 and all Regulations to... -

Page 25

... has kept proper books of account; • the directors' report is consistent with the financial statements; • at the balance sheet date a financial situation existed that may require the company to hold an extraordinary general meeting, on the grounds that the net assets of the company, as shown in... -

Page 26

... 3(2) of the Companies (Amendment) Act 1986. The retained profit for the year attributable to the company was Nil (2003: Nil). Revenues Scheduled revenues comprise the invoiced value of airline and other services, net of government taxes. Revenue from the sale of flight seats is recognised in... -

Page 27

...foreign exchange and interest rates. Derivative financial instruments are utilised to cap aircraft fuel prices, foreign exchange and interest rate exposures. Gains and losses on derivative financial instruments are recognised in the profit and lo ss ac count when realised as an offset to the related... -

Page 28

... fixed assets. On acquisition of the related aircraft these payments are included as part of the cost of aircraft and are depreciated from that date. Statement of Cash Flows Cash represents cash held at bank and available on demand, offset by bank overdrafts. Liquid resources are current asset... -

Page 29

... Fixed assets Intangible assets Tangible assets Total fixed assets Current assets Cash and liquid resources Accounts receivable Other assets Inventories Total current assets Total assets Current liabilities Accounts payable Accrued expenses and other liabilities Current maturities of long term debt... -

Page 30

... Foreign exchange gains (Loss) on disposal of fixed assets Interest receivable and similar income Interest payable and similar charges Total other (expenses)/income Profit on ordinary activities before tax Tax on profit on ordinary activities Profit for the financial year Profit and loss account... -

Page 31

... return on investments and servicing of finance Taxation Corporation tax paid Capital expenditure Purchase of tangible fixed assets Sale of tangible fixed assets Net cash (outflow) from capital expenditure Acquisitions Purchase consideration Onerouslease payments Net cash (outflow) from acquisition... -

Page 32

...-up share capital 000 Balance at April 1, 2003 Issue of ordinary equity shares Profit for the financial year Balance at March 31, 2004 9,588 55 9,643 Share premium account 000 553,512 6,894 560,406 Profit and loss account 000 678,628 206,611 885,239 Total 000 1,241,728 6,949 206,611 1,455,288... -

Page 33

... 2004 000 Fixed assets Financial assets Current assets Other assets Total assets 2003 000 3 71,994 71,994 6 533,859 605,853 526,910 598,904 Other liabilities Amounts due to group undertakings Shareholders' funds - equity Called-up share capital Share premium account Profit and loss account... -

Page 34

... - forming part of the consolidated financial statements 1 INTANGIBLE FIXED ASSETS - GOODWILL 1 (a) Intangible fixed assets: GROUP Cost At beginning of year Acquisitions in year At end of year Amortisation At beginning of year Amortisiationin year At end of year Net book value At March 31, 2004 At... -

Page 35

... of these leases. Transfer of 110 Buzz employees to Buzz StanstedLimited; and Transfer of certainlandingand take-off slots at Stanstedairport. - 1 (c) Re-organisation costs relating to theacquisition: Buzz StanstedLimited, the new operating company, wasclosedfromApril11, 2004 to May 1, 2004, to... -

Page 36

... 2004, the cost and net book value of aircraft includes 327.0m (2003: 259.4m) in respect of advance payments on aircraft. This amount is not depreciated. The cost and net book value also includes capitalised aircraft maintenance and aircraft simulators. At March 31, 2004 fixed asset additions of 325... -

Page 37

... 3 FINANCIAL FIXED ASSETS GROUP 2004 000 Investment in subsidiary undertakings2003 000 2004 000 71,994 COMPANY 2003 000 71,994 In the opinion of the directors the fair value of the investments in subsidiary undertakings is at least equal to c ost as stated above. 4 CASH AND LIQUID RESOURCES Cash... -

Page 38

...represents trade creditors payable within one year. Accounts payable falling due after one year: - consists of long term minimumobligations arising from an engine maintenance contract and deferred gains arising from the sale and leaseback of aircraft. During the year, Ryanair entered into a sale and... -

Page 39

... are secured with a first fixed mortgage on the delivered aircraf t. At March 31, 2004 the group had taken delivery of 41 of these aircraft. The remaining balance of long term debt relates to debt drawn down to fund the acquisition of an aircraft simulator. Details of the interest rates and terms of... -

Page 40

... DUE TO GROUP COMPANIES COMPANY Due to Ryanair Limited 2004 000 35,172 2003 000 35,172 At March 31, 2004, Ryanair Holdings plc had ...aircraft maintenance At beginning of year Charge for year At end of year (b) Deferred taxation: (see note 25) At beginning of year Charge for year At end of year Total... -

Page 41

...O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4 Notes (Continued) 41 14 SHARE CAPITAL AND SHARE PREMIUM ACCOUNT GROUP AND COMPANY Authorised 840,000,000 ordinary equity shares of 1.27 cents each Allotted, called up and fully paid 759,271,140 ordinary equity shares of 1.27 ... -

Page 42

...foreign exchange rates, interest rates and aircraft fuel prices. The group does not enter into these instruments for speculative purposes. Derivative financial instruments are contractual agreements with a value which reflects price movements in an underlying asset. Ryanair uses derivative financial... -

Page 43

...the Operating and Financial Review, the group's objective is to reduce interest rate risk through a combination of financial instruments which lock in interest rates on debt and by matching a proportion of floating rate assets with floating rate liabilities. In line with this strategy, the group has... -

Page 44

... RISK (Continued) Interest rate related derivative arrangements (continued) The table below illustrates the effect of swap transactions (each of which is with an established international financial counterparty) onthe profile of thegroup's debt. 2004 2003 Fixed Floating Total Fixed Floating Total... -

Page 45

...45 17 CURRENCY RATE RISK AND AIRCRAFT FUEL PRICE RISK Currency rate risk Ryanair has exposure to various reporting currencies (principally Sterling pounds and US dollars) due to the international nature of its operations. The following table shows the net amount of monetary assets of R yanair that... -

Page 46

... be exchanged in an arm's length transaction between informed and willing parties, other than as part of a forced liquidation or sale. The following methods and assumptions were used to estimate the fair value of each material class of the group's financial instruments: • Cash and liquid resources... -

Page 47

... Cash on hand Liquid resources Short term borrowings Long term debt Off balance sheet instruments Forward starting interest rate swaps (loss) Interest rate swaps (loss) US dollar currency forward contracts (loss) Sterling currency forward contracts (loss) Aircraft fuel price contracts gain 25... -

Page 48

... European routes. No individual customer accounts for a significant portion of t otal revenue. 20 ANALYSIS OF OPERATING REVENUES All revenues derive from the group's principal activity as an airline and include scheduled and charter services, car hire, internet income, inflight and related sales... -

Page 49

... salaries and related costs Social welfare costs Other pension costs 2004 000 112,258 9,660 1,706 123,624 2003 000 82,633 7,835 2,605 93,073 22 OTHER OPERATING EXPENSES 2004 000 Fuel and oil Maintenance, materials and repairs Marketing and distribution costs Aircraft rentals Route charges Airport... -

Page 50

... emoluments, including consultancy fees, bonus and pension contributions Depreciation of owned tangible fixed assets Auditors' remuneration - audit(i) - audit related(ii) - tax services (iii) - all other fees (iv) Operating lease charges - aircraft (note 28(b)) Amortisation of goodwill (i) 2003... -

Page 51

... Total accumulated accrued benefit 12,374 61,529 85,067 11,216 43,919 70,394 2003 There have been no changes in pension benefits provided to directors during the year. No pension benefits are provided for nonexecutive directors. The executive director is a member of a defined benefit plan. The cost... -

Page 52

...,000 50,000 50,000 The number of share options held by directors at the year end were: David...date of grant) under the 2003 share optionplan. ****On June 24, 2003 Delan F. R yan resigned from the board of directors. Richard P. Shifter did not stand for re-election at the shareholders' annual general... -

Page 53

...each of fiscal 2004 and 2003 relates to domestic taxcharges. Ryanair.com Limited is engaged in international data processing and reservations services. In these circumstances, Ryanair.com Limited is entitled to claim effective 10% corporation tax rate on profits derived from qualifying activities in... -

Page 54

... AS FOLLOWS: Rate of long term investment returns will exceed rates of pensionable increases by Rate of long term investment will exceed the rate of post retirement pension increases by 3.0% 6.5% The actuarial report showed that at the valuation date the market value of the scheme's assets was 11... -

Page 55

...Continued) 55 26 PENSIONS (Continued) (b) FRS 17 disclosures (continued) The assets in the Ryanair pension scheme (excluding AVC's) and expected rates of return were: Expected rate of return Value at March 31, 2004 Expected rate of return Value March 31, 2003 Expected rate of return Value March 31... -

Page 56

... components of the defined benefit costs which would have been included in the profit and loss account for the year ended March 31, 2004 and 2003 if FRS 17 had been applied: 2004 000 Included in finance costs Expected return on pension scheme assets Interest on pension scheme liabilities Net finance... -

Page 57

... year Current service costs Contributions Other finance income/investment return Actuarial gains/(losses) Deficit in scheme at end of year History of actuarial gains and lo sses: Difference between expected and actual return on assets Expressed as a percentage of scheme assets Experience losses on... -

Page 58

... of adjustedEPS BasicEPS Adjusted by: Amortisation of goodwill Buzz re-organisation Depreciation Aircraft rentals Taxation Adjusted BasicEPS AdjustedDilutedEPS Number of ordinary shares (in000's) -Basic -Diluted Details of share options in issue have been described more fully in note 14... -

Page 59

... cost of leasing10 Boeing 737-800 "next generation" and 6 Boeing 737-300's at March 31, 2004. As part of the "Buzz" acquisition 6 Boeing 737-300's which were leased by KLM UK Ltd from International Lease Finance Corporation "ILFC" were novated to Buzz Stansted Limited, a subsidiary of Ryanair... -

Page 60

... in relation to the fuel levy. 29 NOTES TO CASH FLOW STATEMENT (a) Reconciliation of operating profit to net cash inflow from operating activities: Operating profit excluding goodwillamortisation Foreign exchange gains Depreciation of tangible fixed assets (Increase) in inventories Decrease... -

Page 61

... O RT & F I N A N C I A L S T A T E M E N T S 2 0 0 4 Notes (Continued) 61 29 NOTES TO CASH FLOW STATEMENT (Continued) (b) Analysis of cash and liquid resources balances: Cash at bank, net of overdraft Liquid resources Liquid resources attheend of year 2004 000 25,433 1,231,572 1,257,005 2004 000... -

Page 62

... Dublin Corporate Headquarters Dublin Airport Co Dublin Satellite 3 London StanstedAirport Essex CM 24-1QW Nature of Business Airline operator Darley Investments Limited* 23 August 1996 Investment holding company Ryanair.com Limited * 23 August 1996 International data processing services Buzz... -

Page 63

... taxation using the full liability method on all material timing differences thathave originatedbutnot reversedatthebalance sheet date. Deferred tax assets are recognised to the extent that they are expected to be recoverable. Under US GAAP, as set out in Statement of Financial Accounting Standards... -

Page 64

... the discounted present value of expected future income. US GAAP requires that plan assets are valued by reference to their market value. Under Irish and UK GAAP, pension costs for defined benefit plans are assessed in accordance with the advice of independent actuaries using assumptions and methods... -

Page 65

... were as follows: Discount rate Rate of increase in remuneration Expected long term rate of return on assets 2004 % 5.25 3.50 7.75 2003 % 6.25 4.25 7.75 The net periodic pension cost in accordance with SFAS No. 132(R) were as follows: Service cost - present value of benefits earned during the... -

Page 66

... 7.50 3.25 Assumptions used to determine projected benefit obligation 2004 % Discount rate Rate of compensationincrease 5.00 3.50 2003 % 5.25 3.50 Benefitpayments fromthe planare expected to beless than 3% of the liabilities in each of the next ten years. Ryanair expects to pay 900,000 to theplan... -

Page 67

... Under US GAAP interest costs associated with the cost of acquiring and making ready for their intended use certain 'qualifying' assets must be capitalised as part of the acquisition cost of the asset. Ryanair pays deposits in respect of its aircraft acquisition programme and in accordance with... -

Page 68

... fair value of the acquired landing rights and takeoff slots at Stansted Airport is 46.841m based on the net present value of the estimated cashflows generated from these access rights. This intangible asset is not amortised as Ryanair has a right to use the landing and takeoff slots in perpe tuity... -

Page 69

...year as reported in the consolidated profit and loss account and in accordance with Irish and UK GAAP Adjustments Pensions Derivative financial instruments (net of tax) Amortisation of goodwill Employment grants Capitalised interest regarding aircraft acquisition programme Darley Investments Limited... -

Page 70

...(d) Total assets Total assets as reported in the consolidated balance sheets andin accordance with Irish andUK GAAP March 31, 2004 000 March 31, 2003 000 2,938,998 Adjustments Pension Amortisation of goodwill Capitalised interest regarding aircraft acquisition programme Darley Investments Limited... -

Page 71

... market rates in relation to its current and planned debt financing. The following table reconciles cash and cash equivalents as presented under US GAAP with cash and liquid resources as presented under Irish and UK GAAP: Cash and cash equivalents under US GAAP Restricted cash Deposits with... -

Page 72

... revenues Total operating revenues - continuing operations Operating expenses Staff costs Depreciation & amortisation Other operating expenses Total operating expenses Operating income - continuing operations Other (expenses)/income Foreign exchange gains/(loss) (Loss) on disposal of fixed assets... -

Page 73

... amends SFAS Statements No. 133, to address (1) decisions reached by the Derivatives Implementation Group, (2) developments in other FASB projects that address financial instruments, and (3) implementation issues related to the definition of a derivative. SFAS No. 149 has multiple effective date... -

Page 74

...DIRECTORS D. Bonderman M. O'Leary E. Faber M. Horgan K. Kirchberger R. Mac Sharry K. McLaughlin J. Osborne P. Pietrogrande T. A. Ryan Corporate Headquarters Dublin Airport Co. Dublin Ireland J. Callaghan KPMG Chartered Accountants 1 Stokes Place St. Stephen's Green Dublin 2 Ireland Bank of Ireland...