Royal Caribbean Cruise Lines 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

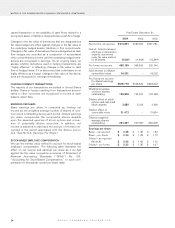

NOTE 3. TERMINATION OF PROPOSED

COMBINATION WITH P&O PRINCESS CRUISES PLC

In October 2002, our proposed combination with P&O Princess

Cruises plc (“P&O Princess”) was terminated prior to its con-

summation and P&O Princess paid us a break fee of $62.5 mil-

lion. We incurred approximately $29.5 million of merger-related

costs. The net proceeds of $33.0 million were included in other

income. We also agreed to terminate, effective as of January

1, 2003, our joint venture with P&O Princess. The venture was

terminated before it commenced business operations.

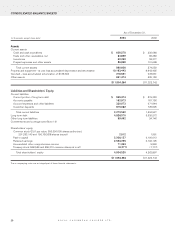

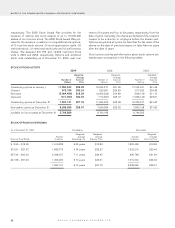

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment consists of the following (in thousands):

2004 2003

Land $7,056 $7,056

Ships 11,056,851 10,536,947

Ships under capital leases 773,562 772,986

Ships under construction 153,415 121,167

Other 415,785 365,535

12,406,669 11,803,691

Less – accumulated

depreciation and amortization (2,213,226) (1,860,196)

$10,193,443 $9,943,495

Ships under construction include progress payments for the con-

struction of new ships as well as planning, design, interest, com-

mitment fees and other associated costs. We capitalized interest

costs of $7.2 million, $15.9 million and $23.4 million for the years

2004, 2003 and 2002, respectively. Accumulated amortization

related to ships under capital leases was $206.5 million and

$183.3 million at December 31, 2004 and 2003, respectively.

NOTE 5. OTHER ASSETS

Wehold redeemable convertible preferred stock in First

Choice Holidays PLC denominated in British pound sterling val-

ued at approximately $300 million. The redeemable convertible

preferred stock carries a 6.75% coupon. Dividends of $24.7

million, $21.5 million and $20.3 million were earned in 2004,

2003 and 2002, respectively and recorded in other income. If

fully converted, our holding would represent approximately a

17% interest in First Choice Holidays PLC.

VARIABLE INTEREST ENTITY

We have determined that one of our minority interests, a ship repair

facility in which we invested in April 2001, is a variable interest enti-

ty; however,we arenot the primarybeneficiaryand accordingly we

do not consolidate this entity. As of December 31, 2004, our

investment in this entity including equity and loans, which is also our

maximum exposure to loss, was approximately $42 million.

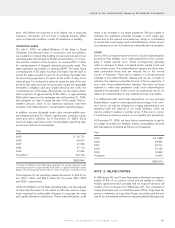

NOTE 6. LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

2004 2003

Unsecured revolving

credit facilities $–$ –

Unsecured senior notes

and senior debentures,

6.75% to 8.75%, due

2005 through 2013,

2018 and 2027 2,258,436 2,400,284

Liquid Yield OptionTM Notes

with yield to maturity of

4.875%, due 2021 694,316 661,640

Zero coupon convertible

notes with yield to maturity

of 4.75%, due 2021 408,484 390,535

$625 million unsecured term

loan, LIBOR plus

1.25%, due 2005 575,000 625,000

$360 million unsecured

term loan, LIBOR plus

1.0%, due 2006 360,000 360,000

$300 million unsecured

term loan, LIBOR plus 0.8%,

due 2009 through 2010 200,000 200,000

$225 million unsecured

termloan, LIBOR plus 1.75%,

due 2006 through 2012 225,000 –

Unsecured term loan, 8.0%,

due through 2006 35,694 59,919

Term loans, 7.1% to 8.0%,

due through 2010, secured

by certain Celebrity ships 225,964 308,842

Term loans, LIBOR plus 0.45%

to 1.535%, due through 2010,

secured by certain Celebrity ships 401,390 459,586

Capital lease obligations

with implicit interest rates

ranging from 6.5% to 7.2%,

due through 2011 347,660 369,998

5,731,944 5,835,804

Less – current portion (905,374) (315,232)

Long-term portion $4,826,570 $5,520,572

ROYAL CARIBBEAN CRUISES LTD.

26

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)