Royal Caribbean Cruise Lines 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other items affecting 2005 include the following:

•In December 2004, the Financial Accounting Standards

Board (“FASB”) issued Statement of Financial Accounting

Standards No. 123 (revised 2004), “Share-Based Payment,”

(“SFAS 123R”). SFAS 123R requires the measurement and

recognition of compensation expense at the fair value of

employee stock awards, except for employee share purchase

plans if they meet certain conditions. We expect this change

to reduce diluted earnings per share by approximately $0.02.

•

Enchantment of the Seas

is scheduled to undergo a length-

ening in the spring of 2005 with a new 73-foot midsection. In

connection with this project, the ship will be out of service

from May until early July 2005. In addition to lost revenue

associated with a decrease in APCD, we expect expenses

associated with this project to reduce diluted earnings per

share by approximately $0.04.

Including the revised assumption for fuel and our expectations

concerning other items set forth above, we now expect diluted

earnings per share for the first quarter of 2005 to be in the

range of $0.55 to $0.60. Notwithstanding the revised assump-

tion for fuel, our expectation for full year 2005 diluted earnings

per share remains unchanged in the range of $2.70 to $2.90.

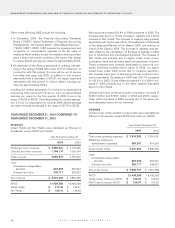

YEAR ENDED DECEMBER 31, 2004 COMPARED TO

YEAR ENDED DECEMBER 31, 2003

REVENUES

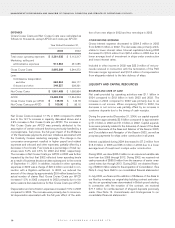

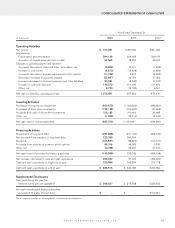

Gross Yields and Net Yields were calculated as follows (in

thousands, except APCD and Yields):

Year Ended December 31,

2004 2003

Passenger ticket revenues $ 3,359,201 $ 2,775,055

Onboard and other revenues 1,196,174 1,009,194

Total revenues 4,555,375 3,784,249

Less:

Commissions, transportation

and other ,822,206 684,344

Onboard and other ,300,717 249,537

Net revenues $ 3,432,452 $ 2,850,368

APCD 21,439,288 19,439,238

Gross Yields $212.48 $194.67

Net Yields $160.10 $146.63

Net revenues increased 20.4% in 2004 compared to 2003. The

increase was due to a 10.3% increase in capacity and a 9.2%

increase in Net Yields. The increase in capacity was primarily

associated with the full year effect of the additions of

Serenade

of the Seas

and

Mariner of the Seas

in 2003 and delivery of

Jewel of the Seas

in 2004. The increase in capacity was par-

tially offset by the cancellation of 54 days of sailings in 2004

due to hurricanes and unscheduled drydocks. The increase in

Net Yields was primarily due to higher cruise ticket prices,

occupancy levels and amounts spent per passenger onboard.

These increases were primarily attributable to improved con-

sumer sentiment towards leisure travel. In 2003, we experi-

enced lower cruise ticket prices due to consumer apprehen-

sion towards travel prior to and during the war in Iraq and eco-

nomic uncertainty. Occupancy in 2004 was 105.7% compared

to 103.2% in 2003. Gross Yields increased 9.1% in 2004 com-

pared to 2003 primarily due to the same reasons discussed

above for Net Yields.

Onboard and other revenues included concession revenues of

$196.3 million and $163.0 million in 2004 and 2003, respec-

tively,which increased in 2004 primarily due to the same rea-

sons discussed above for net revenues.

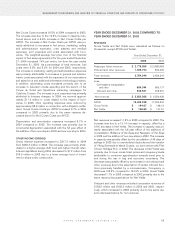

EXPENSES

Gross Cruise Costs and Net Cruise Costs were calculated as

follows (in thousands, except APCD and costs per APCD):

Year Ended December 31,

2004 2003

Total cruise operating expenses $ 2,819,383 $ 2,381,035

Marketing, selling and

administrative expenses ,588,267 514,334

Gross Cruise Costs 3,407,650 2,895,369

Less:

Commissions, transportation

and other ,822,206 684,344

Onboard and other ,300,717 249,537

Net Cruise Costs $ 2,284,727 $ 1,961,488

APCD 21,439,288 19,439,238

Gross Cruise Costs per APCD $158.94 $148.94

Net Cruise Costs per APCD $106.57 $100.90

ROYAL CARIBBEAN CRUISES LTD.

12

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)