Royal Caribbean Cruise Lines 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

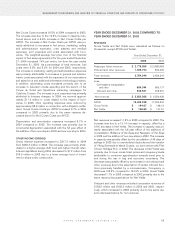

Net Yields represent Gross Yields less commissions, trans-

portation and other expenses and onboard and other expens-

es (each of which is described under the

Summary of Historical

Results of Operations

heading) per APCD. We utilize Net

Yields to manage our business on a day-to-day basis and

believe that it is the most relevant measure of our pricing per-

formance. We have not provided a quantitative reconciliation of

projected Gross Yields to projected Net Yields due to the sig-

nificant uncertainty in projecting the costs deducted to arrive at

this measure. Accordingly, we do not believe that reconciling

information for such projected figures would be meaningful.

Occupancy Percentage, in accordance with cruise vacation

industry practice, is calculated by dividing Passenger Cruise

Days by APCD. A percentage in excess of 100% indicates that

three or more passengers occupied some cabins.

Passenger Cruise Days represent the number of passengers

carried for the period multiplied by the number of days of their

respective cruises.

OVERVIEW

Our revenues consist of the following:

Passenger ticket revenues consist of revenue recognized from

the sale of passenger tickets and the sale of air transportation

to our ships.

Onboard and other revenues consist primarily of revenues

from the sale of goods and/or services onboard our ships, can-

cellation fees, sales of vacation protection insurance and pre

and post tours. Also included are revenues we receive from

independent third party concessionaires that pay us a percent-

age of their revenues in exchange for the right to provide

selected goods and/or services onboard our ships.

Our cruise operating expenses consist of the following:

Commissions, transportation and other expenses consist of

those costs directly associated with passenger ticket rev-

enues, including travel agent commissions, air and other trans-

portation expenses, port costs that vary with passenger head

counts and related credit cardfees.

Onboardand other expenses consist of the direct costs asso-

ciated with onboard and other revenues. These costs include

the cost of products sold onboard our ships, vacation protec-

tion insurance premiums, costs associated with preand post

tours and related credit cardfees. Concession revenues have

minimal costs associated with them, as the costs related to

these activities are incurred by the concessionaires.

Payroll and related expenses consist of costs for shipboard personnel.

Food expenses include food costs for both passengers and crew.

Other operating expenses consist of operating costs such as fuel,

repairs and maintenance, port costs that do not vary with passenger

head counts, insurance, entertainment and all other operating costs.

We do not allocate payroll and related costs, food costs or other

operating costs to the expense categories attributable to pas-

senger ticket revenues or onboard and other revenues since

they are incurred to provide the total cruise vacation experience.

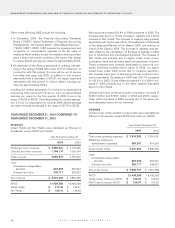

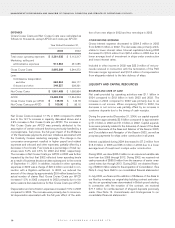

SUMMARY OF HISTORICAL RESULTS OF OPERATIONS

We reported historical total revenues, operating income, net

income and earnings per share as shown in the following table

(in thousands, except per share data):

Year Ended December 31,

2004 2003 2002

Total revenues $4,555,375 $3,784,249 $ 3,434,347

Operating income 753,589 526,185 550,975

Net income 474,691 280,664 351,284

Basic earnings

per share $ 2.39 $ 1.45 $ 1.82

Diluted earnings

per share1$ 2.26 $ 1.42 $ 1.76

1We adopted the provisions of Emerging Issues Task Force 04-8 “Accounting

Issues Related to Certain Features of Contingently Convertible Debt and the

Effect on Diluted Earnings Per Share,” (“EITF 04-8”) in our fourth quarter of 2004

and restated prior period diluted earnings per share amounts for comparative pur-

poses. The implementation of EITF 04-8 did not change our previously reported

2003 diluted earnings per share; however, it reduced our previously reported

2002 diluted earnings per shareby $0.03.

Unaudited selected historical statistical information is shown in

the following table:

Year Ended December 31,

2004 2003 2002

Passengers Carried 3,405,227 2,990,607 2,768,475

Passenger Cruise Days 22,661,965 20,064,702 18,112,782

APCD 21,439,288 19,439,238 17,334,204

Occupancy Percentage 105.7% 103.2% 104.5%

ROYAL CARIBBEAN CRUISES LTD.

10

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)