Ross 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are pleased to report that our ongoing ability

to deliver compelling bargains drove another year of

solid sales and earnings growth in 2008. This was

especially noteworthy considering that these results

were achieved in one of the most difficult business

climates on record.

Efficient execution of our resilient and flexible

off-price strategies enabled us to navigate

successfully through the very challenging retail

landscape. Our merchandise assortments benefited

from the huge amount of close-out opportunities

in the marketplace, helping us to deliver a consistent

flow of sharply-priced, fresh and exciting name-brand

fashions for the family and the home. Equally important

was our discipline in operating the business with

leaner in-store inventories to drive faster turns

and reduced markdowns.

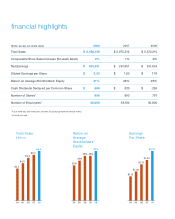

Record Sales and Earnings

For the 52 weeks ended January 31, 2009, sales

increased 9% to a record $6.5 billion, with same store

sales up 2% for the year. Dresses and Shoes were the

best performing merchandise categories in 2008, while

the Mid-Atlantic and Texas regions had the highest

same store sales gains.

Net earnings for the year grew 17% to a record

$305.4 million, up from $261.1 million in 2007.

Earnings per share rose 23% to $2.33 from $1.90 in

the prior year. Operating margin increased about 60

basis points to 7.6%. Our improved profitability was

driven mainly by better merchandise gross margin and

lower distribution and shortage costs as a percent of

sales. These favorable trends were partially offset by

some deleveraging pressure on occupancy and store

operating costs as well as higher incentive plan

expenses as a percent of sales.

Efficient Inventory Management

Boosts Profitability

As we ended 2008, consolidated inventories were

down about 14% from the prior year, as an 18% decline

in average in-store inventories was partially offset by an

increase in the number of stores. We are planning to

further reduce in-store inventories in 2009, with

average levels targeted down in the double digit

percentage range compared to the prior year.

Operating the business on lower inventory

levels enables us to get more fresh and exciting

merchandise in front of the customer. As we saw

with our 2008 results, it also drives faster inventory

turn, which typically results in lower markdowns

and higher merchandise gross margin.

We believe this ongoing focus on tight inventory

management will enhance our ability to meet, or

possibly exceed, our financial targets in what we

expect will be another very challenging year in 2009.

2

to our stockholders

32% Ladies

23% Home Accents, Bed and Bath

14% Men’s

12% Accessories, Lingerie, Fine Jewelry, Fragrances

10% Shoes

9% Children’s

32%

23%

9%

10%

12%

14%