Ross 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

• Our ability to lease or acquire acceptable new store sites with favorable demographics and long term financial returns.

• Our ability to identify and to successfully enter new geographic markets.

• Our ability to achieve planned gross margins, by effectively managing inventories, markdowns, and shrink.

• Our ability to effectively manage all operating costs of the business, the largest of which are payroll and benefit costs

for store and distribution center employees.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

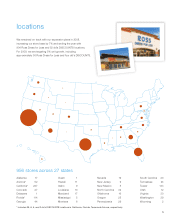

Stores

At January 31, 2009, we operated a total of 956 stores, of which 904 were Ross Dress for Less® (“Ross”) locations in

27 states and Guam and 52 were dd’s DISCOUNTS® stores in four states. All stores are leased, with the exception of

two locations which we own.

During fiscal 2008, we opened 72 new Ross stores and closed six existing stores. The average new Ross store in fiscal 2008

was approximately 29,500 gross square feet, yielding about 24,500 square feet of selling space. As of January 31, 2009, our

904 Ross stores generally ranged in size from about 25,000 to 35,000 gross square feet and had an average of 29,900 gross

square feet and 23,800 selling square feet.

During fiscal 2008, we opened five new dd’s DISCOUNTS stores and closed five existing stores. The average new dd’s

DISCOUNTS store in fiscal 2008 was approximately 23,600 gross square feet, yielding about 18,600 square feet of selling

space. As of January 31, 2009, our 52 dd’s DISCOUNTS stores had an average of 25,000 gross square feet and 20,300

selling square feet. Our dd’s DISCOUNTS stores are currently located in California, Florida, Texas, and Arizona.

During fiscal 2008, no one store accounted for more than 1% of our sales.

We carry earthquake insurance for business interruption, inventory and personal property to mitigate our risk on our

corporate headquarters, distribution centers, buying offices, and all of our stores.

Our real estate strategy in 2009 and 2010 is to open stores in states where we currently operate to increase

our market penetration and to reduce overhead and advertising expenses as a percentage of sales in each market.

Important considerations in evaluating a new store location are the availability and quality of potential sites, demographic

characteristics, competition, and population density of the local trade area. In addition, we continue to consider

opportunistic real estate acquisitions.