Ross 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ross Stores, Inc.

2008 Annual Report

ng bargains everyday delivering bargains everyday delivering barg

veryday delivering bargains everyday delivering bargains everyday

ins everyday delivering bargains everyday delivering bargains ever

ng bargains everyday delivering bargains everyday delivering barg

ng bargains everyday delivering bargains everyday delivering barg

veryday delivering bargains everyday delivering bargains everyday

ins everyday delivering bargains everyday delivering bargains ever

y delivering bargains everyday delivering bargains everyday delive

s everyday delivering bargains everyday delivering bargains every

g bargains everyday delivering bargains everyday delivering barga

veryday delivering bargains everyday delivering bargains everyday

ins everyday delivering bargains everyday delivering bargains ever

Table of contents

-

Page 1

... everyday delivering bargains every bargains everyday delivering bargains everyday delivering barg eryday delivering bargains everyday delivering bargains everyda s everyday delivering bargains everyday delivering bargains eve Ross Stores, Inc. 2008 Annual Report -

Page 2

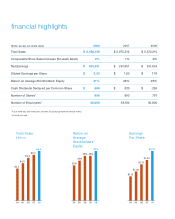

... ($000, except per share data) 2008 2007 2006 1 Total Sales Comparable Store Sales Increase (52-week basis) Net Earnings Diluted Earnings per Share Return on Average Stockholders' Equity Cash Dividends Declared per Common Share Number of Stores 2 Number of Employees 2 1 2 $ 6,486,139 2% $ $ 305... -

Page 3

... largest off-price retailer, with 904 Ross Dress for Less® stores in 27 states and Guam and 52 dd's DISCOUNTS® locations in four states. Ross Dress for Less was founded in 1982 and offers a wide array of first-quality, in-season, name brand and designer apparel, accessories, footwear and home... -

Page 4

... flow of sharply-priced, fresh and exciting name-brand fashions for the family and the home. Equally important was our discipline in operating the business with leaner in-store inventories to drive faster turns and reduced markdowns. Record Sales and Earnings For the 52 weeks ended January 31... -

Page 5

... Planned We added 66 net new stores in 2008, for a 7% increase in units. This growth included 72 new Ross Dress for Less and five new dd's DISCOUNTS locations. After closing eleven existing stores, we ended 2008 with a total of 956 locations in 27 states and Guam. Over the next year, we are planning... -

Page 6

... confident that over the longer term these new tools will drive gradual improvement in sales and profitability, not only in our newer markets but also across the chain. Resilient and Flexible Off-Price Business Model Despite the very tough economic and retail climate, we were able to deliver strong... -

Page 7

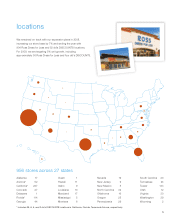

... 50 Ross Dress for Less and four dd's DISCOUNTS. 956 stores across 27 states Alabama Arizona* California* Colorado Delaware Florida* Georgia 17 52 247 27 1 114 44 Guam Hawaii Idaho Louisiana Maryland Mississippi Montana 1 11 9 10 17 5 6 Nevada New Jersey New Mexico North Carolina Oklahoma Oregon... -

Page 8

... Analysis Financial Statements and Supplementary Data Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Signatures Index to Exhibits Certifications 8 20 22 32 36 54 60 61 67 index to other information Directors and Officers Corporate Data 70 Inside... -

Page 9

... file number 0-14678 Ross Stores, Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 4440 Rosewood Drive, Pleasanton, California (Address of principal executive offices) Registrant's telephone number, including area... -

Page 10

... to the locations of our stores, are aimed at these customer bases. Ross offers first-quality, in-season, name brand and designer apparel, accessories, footwear and home fashions for the entire family at everyday savings of 20% to 60% off department and specialty store regular prices. dd's DISCOUNTS... -

Page 11

...inventory. We believe that our ability to effectively execute certain off-price buying strategies is a key factor in our success. Our buyers use a number of methods that enable us to offer our customers brand-name and fashion merchandise at strong everyday discounts relative to department, specialty... -

Page 12

... of scale in advertising, distribution and field management. We believe a key element of our success is our organized, attractive, easy-to-shop, in-store environments at both Ross and dd's DISCOUNTS, which allow customers to shop at their own pace. Our stores are designed for customer convenience... -

Page 13

... to drive gradual increases in store sales productivity and profitability by improving our ability to plan, buy and allocate product at a more local level. We plan to complete this rollout in fiscal 2010. • We implemented additional supply chain enhancements to support expansion of processing and... -

Page 14

...department and discount store regular prices. The dd's DISCOUNTS business generally has similar merchandise departments and categories to those of Ross, but features a different mix of brands at lower average price points. The typical dd's DISCOUNTS store is located in an established shopping center... -

Page 15

.... Our existing strategies and store expansion programs may not result in a continuation of our anticipated revenue or profit growth. In executing our off-price retail strategies and working to improve efficiencies, expand our store network, and reduce our costs, we face a number of operational risks... -

Page 16

...in California, Florida, Texas, and Arizona. During fiscal 2008, no one store accounted for more than 1% of our sales. We carry earthquake insurance for business interruption, inventory and personal property to mitigate our risk on our corporate headquarters, distribution centers, buying offices, and... -

Page 17

... 2, 2008, we had 36 dd's DISCOUNTS stores in California, 9 in Florida, 5 in Texas, and 2 in Arizona. State/Territory Alabama Arizona California Colorado Delaware Florida Georgia Guam Hawaii Idaho Louisiana Maryland Mississippi Montana Nevada New Jersey New Mexico North Carolina Oklahoma Oregon... -

Page 18

... the term to February 2013. In June 2008, we purchased a 423,000 square foot warehouse also in Fort Mill, South Carolina. All four of these properties are used to store our packaway inventory. We also lease a 10-acre parcel of land that has been developed for trailer parking adjacent to our Perris... -

Page 19

..., providing consulting advice to retail, consumer goods, financial services and private equity clients. Ms. Panattoni has served as Executive Vice President, Merchandising since October 2005. She joined the Company as Senior Vice President and General Merchandise Manager, Home in January 2005. In... -

Page 20

...repurchase program. In January 2008 our Board of Directors approved a two-year $600 million stock repurchase program for fiscal 2008 and 2009. 2 See Note H of Notes to Consolidated Financial Statements for equity compensation plan information. The information under Item 12 of this Annual Report on... -

Page 21

... Index S&P Retailing Group * $100 invested on 1/30/04 in stock or index, including reinvestment of dividends. Fiscal year ending January 31. Indexes calculated on month-end basis. Indexed Returns for Years Ending Company / Index Base Period 2004 2005 2006 2007 2008 2009 Ross Stores, Inc. S&P 500... -

Page 22

...10âˆ'K and our consolidated financial statements and notes thereto. ($000, except per share data) 2008 2007 20061 2005 2004 Operations Sales Cost of goods sold Percent of sales Selling, general and administrative Percent of sales Impairment of long-lived assets2 Interest (income) expense, net... -

Page 23

... equipment, net Total assets Return on average assets Working capital Current ratio Long-term debt Long-term debt as a percent of total capitalization Stockholders' equity Return on average stockholders' equity Book value per common share outstanding at year-end Operating Statistics Number of stores... -

Page 24

... second largest off-price apparel and home goods retailer in the United States. At the end of fiscal 2008, we operated 904 Ross Dress for Less ("Ross") locations in 27 states and Guam, and 52 dd's DISCOUNTS stores in four states. Ross offers first-quality, in-season, name brand and designer apparel... -

Page 25

...We expect to address the competitive climate for off-price apparel and home goods by pursuing and refining our existing strategies and by continuing to strengthen our organization, to diversify our merchandise mix, and to more fully develop our organization and systems to improve regional and local... -

Page 26

... improvement was mainly the result of a 20 basis point improvement in merchandise gross margin primarily due to lower markdowns and shortage as a percent of sales. We cannot be sure that the gross profit margins realized in fiscal 2008, 2007 and 2006 will continue in future years. Selling, general... -

Page 27

... implement information technology systems, build or expand distribution centers and install material handling equipment and related distribution center systems, and various other expenditures related to our stores, buying and corporate offices. In fiscal 2008 we also purchased land in South Carolina... -

Page 28

... centers in Carlisle, Pennsylvania, Moreno Valley, California, and Fort Mill, South Carolina. In January 2008, our Board of Directors approved a two-year $600 million stock repurchase program for fiscal 2008 and 2009. We repurchased 9.3 million shares of common stock for an aggregate purchase price... -

Page 29

...our two buying offices, our corporate headquarters, one distribution center, one trailer parking lot, three warehouse facilities, and all but two of our store locations. Except for certain leasehold improvements and equipment, these leased locations do not represent long-term capital investments. We... -

Page 30

... the term to February 2013. In June 2008, we purchased a 423,000 square foot warehouse also in Fort Mill, South Carolina. All four of these properties are used to store our packaway inventory. We also lease a 10-acre parcel of land that has been developed for trailer parking adjacent to our Perris... -

Page 31

... and estimates used in the preparation of our consolidated financial statements. Merchandise inventory. Our merchandise inventory is stated at the lower of cost or market, with cost determined on a weighted average cost basis. We purchase manufacturer overruns and canceled orders both during... -

Page 32

... areas in which management's judgment in selecting one alternative accounting principle over another would not produce a materially different result. See our audited consolidated financial statements and notes thereto under Item 8 in this Annual Report on Form 10-K, which contain accounting policies... -

Page 33

... fiscal 2008, and information we provide in our Annual Report to Stockholders, press releases, telephonic reports and other investor communications including on our corporate website, may contain a number of forward-looking statements regarding, without limitation, planned store growth, new markets... -

Page 34

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. Consolidated Statements of Earnings Year ended January 31, 2009 Year ended February 2, 2008 Year ended February 3, 2007 ($000, except per share data) Sales Costs and Expenses Cost of goods sold Selling, general and administrative Interest income... -

Page 35

... 2, 2008 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventory Prepaid expenses and other Deferred income taxes Total current assets Property and Equipment Land and buildings Fixtures and equipment Leasehold improvements Construction... -

Page 36

... Balance at February 2, 2008 Comprehensive income: Net earnings Unrealized investment loss Total comprehensive income Common stock issued under stock plans, net of shares used for tax withholding Tax benefit from equity issuance Stock based compensation Common stock repurchased Dividends declared... -

Page 37

... equity issuance Excess tax benefit from stock-based compensation Change in assets and liabilities: Merchandise inventory Other current assets, net Accounts payable Other current liabilities Other long-term, net Net cash provided by operating activities Cash Flows From Investing Activities Purchase... -

Page 38

...price retailer of first-quality, name brand apparel, shoes and accessories for the entire family, as well as gift items, linens and other home-related merchandise. At the end of fiscal 2008, the Company operated 904 Ross Dress for Less® ("Ross") locations in 27 states and Guam and 52 dd's DISCOUNTS... -

Page 39

... costs at the time the liability is incurred. In 2008, the Company closed six Ross Dress for Less and five dd's DISCOUNTS locations. In connection with the dd's store closures, the Company recognized a lease loss liability of approximately $1.0 million. Operating costs, including depreciation... -

Page 40

...Deferred rent Deferred compensation Tenant improvement allowances Income taxes (See Note F) Other Total Estimated fair value of ï¬nancial instruments. The carrying value of cash and cash equivalents, short-term and long-term investments, accounts receivable, and accounts payable approximates their... -

Page 41

...requires recognition of compensation expense based upon the grant date fair value of all stock-based awards, typically over the vesting period. See Note C for more information on the Company's stock-based compensation plans. Taxes on earnings. The Company accounts for income taxes in accordance with... -

Page 42

...has one reportable segment. The Company's operations include only activities related to off-price retailing in stores throughout the United States and, therefore, comprise only one segment. Sales Mix. The Company's sales mix is shown below for fiscal 2008, 2007 and 2006: 2008 Ladies Home accents and... -

Page 43

...Asset-backed, corporate, U.S. Government and agency, and mortgagebacked securities are classified within Level 1 or Level 2 because these securities are valued using quoted market prices or alternative pricing sources and models utilizing market observable inputs. The Company's investment in auction... -

Page 44

... assets in the Company's non-qualified deferred compensation program totaling $37.3 million as of January 31, 2009 (included in Other long term assets) primarily consist of money market, stable value, stock, and bond funds. The fair value measurement for funds that are quoted market prices in active... -

Page 45

... 32.5% 4.6% 0.8% Employee Stock Purchase Plan Expected life from grant date (years) Expected volatility Risk-free interest rate Dividend yield 2008 - - - - 2007 1.0 26.4 % 5.0 % 0.9 % 2006 1.0 26.7% 4.5% 0.8% Total stock-based compensation recognized in the Company's consolidated Statements of... -

Page 46

... February 2, 2008, respectively. Note E: Leases The Company leases all but two of its store sites with original, non-cancelable terms that in general range from three to ten years. In addition, the Company leases selected information technology related equipment under operating leases. Store leases... -

Page 47

... to February 2013. In June 2008, the Company purchased a 423,000 square foot warehouse also in Fort Mill, South Carolina. All four of these properties are used to store the Company's packaway inventory. The Company also leases a 10-acre parcel that has been developed for trailer parking adjacent to... -

Page 48

...,069 In fiscal 2008, 2007 and 2006, the Company realized tax benefits of $8.5 million, $6.5 million and $12.1 million, respectively, related to employee equity programs that were credited to additional paid-in capital. The provision for taxes for financial reporting purposes is different from the... -

Page 49

The components of deferred income taxes at January 31, 2009 and February 2, 2008 are as follows: ($000) 2008 2007 Deferred Tax Assets Deferred compensation Deferred rent Employee benefits Accrued liabilities California franchise taxes Stock-based compensation Other $ 25,015 10,490 7,861 18,776 ... -

Page 50

...2009 and February 2, 2008, respectively, of long-term investments, at market value, set aside or designated for the Non-qualified Deferred Compensation Plan. Plan investments are designated by the participants, and investment returns are not guaranteed by the Company. The Company has a corresponding... -

Page 51

... price Repurchased (in millions) Fiscal Year 2008 2007 2006 9.3 6.9 7.1 $ $ $ 32.09 29.10 28.17 $ $ $ 300.0 200.0 200.0 Dividends. In January 2009, the Company's Board of Directors declared a quarterly cash dividend of $.11 per common share, payable on March 31, 2009. The Company's Board... -

Page 52

...$ 27,304 27,258 26,565 The following table summarizes information about the weighted average remaining contractual life (in years) and the weighted average exercise prices for stock options both outstanding and exercisable as of January 31, 2009 (number of shares in thousands): Options outstanding... -

Page 53

...Plan, eligible full-time employees participating in the annual offering period can choose to have up to the lesser of 10% or $21,250 of their annual base earnings withheld to purchase the Company's common stock. Starting in 2008, the purchase price of the stock is 85% of the market price on the date... -

Page 54

...financial information for fiscal 2008 and 2007 is presented in the tables below. Year ended January 31, 2009: Quarter ended May 3, 2008 Quarter ended August 2, 2008 Quarter ended November 1, 2008 Quarter ended January 31, 2009 ($000, except per share data) Sales Cost of goods sold Selling, general... -

Page 55

...$ .170 1 29.89 21.48 Includes $.075 per share dividend declared in November 2007 and $.095 dividend declared in January 2008. Quarterly EPS results may not equal full year amounts due to rounding. Ross Stores, Inc. common stock trades on The NASDAQ Global Select Market® under the symbol ROST. 53 -

Page 56

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Board of Directors and Stockholders Ross Stores, Inc. Pleasanton, California We have audited the accompanying consolidated balance sheets of Ross Stores, Inc. and subsidiaries (the "Company") as of January 31, 2009 and February 2, 2008, and ... -

Page 57

... financial position of Ross Stores, Inc. and subsidiaries as of January 31, 2009 and February 2, 2008, and the results of their operations and their cash flows for each of the three years in the period ended January 31, 2009, in conformity with accounting principles generally accepted in the United... -

Page 58

... in Exchange Act Rule 13a-15(f). Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting... -

Page 59

... for Senior Financial Officers by posting any changed version on the same corporate website. ITEM 11. EXECUTIVE COMPENSATION. The information required by Item 402 of Regulation S-K is incorporated herein by reference to the sections of the Proxy Statement entitled "Compensation of Directors" and... -

Page 60

...Equity Incentive Plan, which was approved by the Company's Board of Directors in March 2000. 2 3 4 The information required by Item 403 of Regulation S-K is incorporated herein by reference to the section of the Proxy Statement entitled "Stock Ownership of Certain Beneficial Owners and Management... -

Page 61

..., February 2, 2008 and February 3, 2007. Notes to Consolidated Financial Statements. Report of Independent Registered Public Accounting Firm. 2. List of Consolidated Financial Statement Schedules. Schedules are omitted because they are not required, not applicable, or such information is included in... -

Page 62

..., thereunto duly authorized. ROSS STORES, INC. (Registrant) Date: March 31, 2009 By: /s/Michael Balmuth Michael Balmuth Vice Chairman, President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 63

... 28, 2006. Lease dated July 23, 2003 of Certain Property located in Perris, California, incorporated by reference to Exhibit 10.1 to the Form 10-Q filed by Ross Stores, Inc. for its quarter ended August 2, 2003. 3.2 4.1 10.1 Management Contracts And Compensatory Plans (Exhibits 10.2 âˆ' 10... -

Page 64

... quarter ended July 30, 2005. Ross Stores, Inc. 2008 Equity Incentive Plan, incorporated by reference to the appendix to the Definitive Proxy Statement on Schedule 14A filed by Ross Stores, Inc. on April 14, 2008. Form of Nonemployee Director Equity Notice of Grant of Restricted Stock and Restricted... -

Page 65

10.27 Form of Indemnity Agreement between Ross Stores, Inc. for Directors and Executive Officers, incorporated by reference to Exhibit 10.27 to the Form 10-K filed by Ross Stores, Inc. for its fiscal year ended February 2, 2002. Independent Contractor Consultancy Agreement effective February 1, ... -

Page 66

...Ross Stores, Inc. for its quarter ended July 30, 2005. Third Amendment to the Employment Agreement executed April 2007 between Michael Balmuth and Ross Stores... Employment Agreement executed December 29, 2008 between Michael Balmuth and Ross Stores, Inc. Consulting Agreement between Ross Stores, Inc. ... -

Page 67

... to the Employment Agreement effective December 31, 2008 between Michael O'Sullivan and Ross Stores, Inc. Subsidiaries. Consent of Independent Registered Public Accounting Firm. Certification of Chief Executive Officer Pursuant to Sarbanes-Oxley Act Section 302(a). Certification of Chief Financial... -

Page 68

..., Inc. Ross Merchandising, Inc. Ross Dress for Less, Inc. Retail Assurance Group, Ltd. Domiciled Delaware Delaware Virginia Bermuda Date of Incorporation November 22, 2004 January 12, 2004 January 14, 2004 October 15, 1991 EXHIBIT 23 Consent Of Independent Registered Public Accounting Firm We... -

Page 69

... Chief Executive Officer Pursuant to Sarbanes-Oxley Act Section 302(a) I, Michael Balmuth, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Ross Stores, Inc.; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 70

... of Chief Financial Officer Pursuant to Sarbanes-Oxley Act Section 302(a) I, John G. Call, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Ross Stores, Inc.; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 71

... In connection with the Annual Report of Ross Stores, Inc. (the "Company") on Form 10-K for the year ended January 31, 2009 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Michael Balmuth, as Chief Executive Officer of the Company, hereby certify, pursuant... -

Page 72

... the Board Ross Stores, Inc. Michael Balmuth Vice Chairman, President and Chief Executive Officer Ross Stores, Inc. K. Gunnar Bjorklund 2, 3 Managing Director Sverica International Michael J. Bush 1, 3 President and Chief Executive Officer 3 Day Blinds, Inc. and Managing Member B IV Investments, LLC... -

Page 73

corporate data Corporate Headquarters Ross Stores, Inc. 4440 Rosewood Drive Pleasanton, California 94588-3050 (925) 965-4400 Corporate Website: www.rossstores.com Inquiries by: New York Buying Ofï¬ce Ross Stores, Inc. 1372 Broadway, 10th Floor New York, New York 10018 (212) 382-2700 Los Angeles ... -

Page 74

... deliverin elivering bargains everyday delivering bargains everyday deliverin Ross Stores, Inc. ring everyday delivering bargains everyday delivering bargains e 4440 Rosewood Drive bargains everyday delivering bargains everyday delivering bargai Pleasanton, CA 94588-3050 (925) 965-4400 eryday...