Regions Bank 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 REGIONS 2014 ANNUAL REVIEW

FINANCIAL

STRENGTH

UNDERPINS

OUR GROWTH

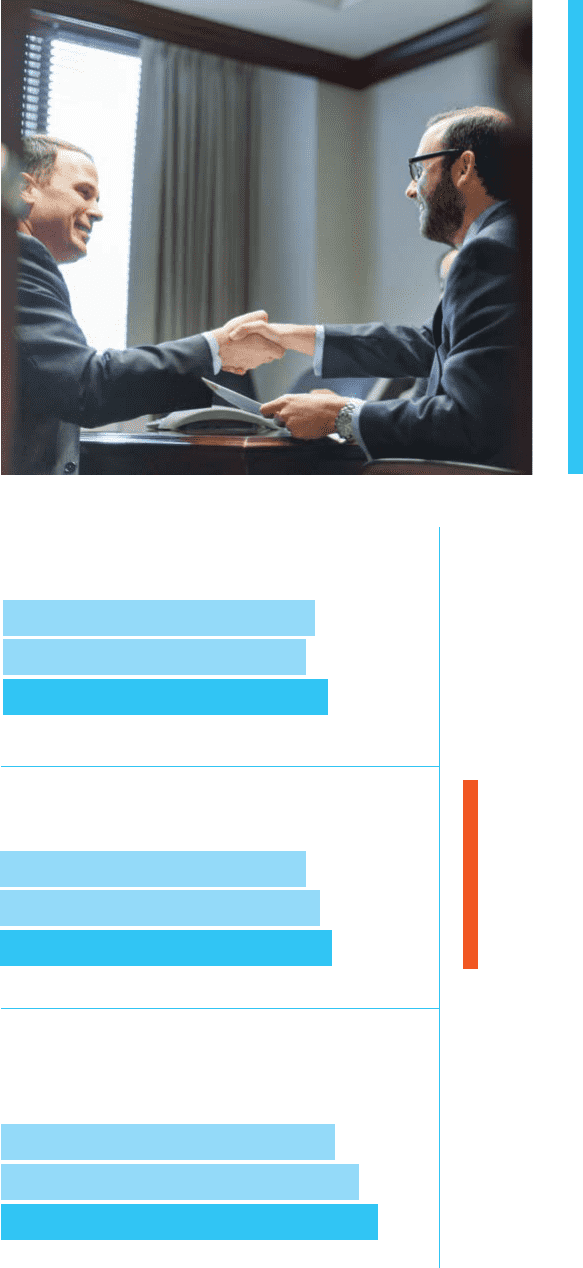

Regions’ strong capital position and favorable liquidity profile establish a

strong foundation for growth, while also supporting an appropriate return

of capital to shareholders.

At year-end, Regions’ Tier 1 Common ratio* stood at 11.7%, substantially

above our peer median. Liquidity is also strong as we concluded 2014 with

a loan-to-deposit ratio at 82%. We are focused on achieving organic loan

growth, and our financial strength well positions us to reach that objective

and make other prudent growth investments.

Individual deposits represent 44% of our deposit book, also well above

average among peer institutions, and low-cost deposits are 91% of our

total. These more “sticky” deposits create a stable deposit profile that is

another source of strength for Regions, one that is likely to be beneficial

in any future rising-rate environment.

Sustained and prudent growth is our objective. Regions completed 2014

with the financial strength to support investments to expand our franchise,

broaden our solution set and reach more customers.

XX

bps Improvement

Tier 1 Capital*

12.0%

12.5%

2012

2013

2014

11.7%

*

Current year capital ratios are estimated

XXbps Improvement

Liquidity

78%

82%

2012

2013

2014

81%

(Loans/Deposits)

XX

bps Improvement

Tangible Common Stockholders’

Equity to

Tangible Assets*

8.63%

9.75%

2012

2013

2014

9.24%

* See Table 2 in Form 10-K for GAAP to non-GAAP reconciliations

Regions’ strong capital position and

favorable liquidity profile establish a

strong foundation for growth, while

also supporting an appropriate return

of capital to shareholders.

Above: (left to right) Scott R., Mike D.