Prudential 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SELECTED FINANCIAL DATA

We derived the selected consolidated income statement data for the years ended December 31, 2015, 2014 and 2013, and the selected

consolidated balance sheet data as of December 31, 2015 and 2014, from our Consolidated Financial Statements included elsewhere herein.

We derived the selected consolidated income statement data for the years ended December 31, 2012 and 2011, and the selected

consolidated balance sheet data as of December 31, 2013, 2012 and 2011, from consolidated financial statements not included herein.

See Note 3 to the Consolidated Financial Statements for a discussion of acquisitions and dispositions during 2015, 2014 and 2013.

Results for the year ended December 31, 2012, included approximately $32 billion of premiums reflecting two significant pension risk

transfer transactions. On November 1, 2012, we issued a non-participating group annuity contract to the General Motors Salaried

Employees Pension Trust, and assumed responsibility for providing specified benefits to certain participants. On December 10, 2012, we

issued a non-participating group annuity contract to the Verizon Management Pension Plan and assumed responsibility for providing

specified benefits to certain participants. The premiums from these transactions were largely offset by a corresponding increase in

policyholders’ benefits, including the change in policy reserves.

On February 1, 2011, we acquired the AIG Star Life Insurance Co., Ltd, AIG Edison Life Insurance Company, AIG Financial

Assurance Japan K.K. and AIG Edison Service Co., Ltd. (collectively, the “Star and Edison Businesses”) from American International

Group, Inc. (“AIG”). The results of these companies are reported with the Gibraltar Life operations and are included in the results

presented below from the date of acquisition. The Star and Edison companies were merged into Gibraltar Life on January 1, 2012.

Our Gibraltar Life operations use a November 30 fiscal year end. Consolidated balance sheet data as of December 31, 2015, 2014,

2013, 2012 and 2011, include Gibraltar Life assets and liabilities as of November 30 for each respective year. Consolidated income

statement data for the years ended December 31, 2015, 2014, 2013, 2012 and 2011, include Gibraltar Life results for the twelve months

ended November 30 for each respective year.

This selected consolidated financial information should be read in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and the Consolidated Financial Statements included elsewhere herein.

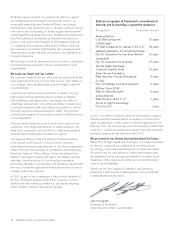

Year Ended December 31,

2015 2014 2013 2012 2011

(in millions, except per share and ratio information)

Income Statement Data:

Revenues:

Premiums .................................................................... $28,521 $29,293 $26,237 $65,354 $24,301

Policy charges and fee income .................................................... 5,972 6,179 5,415 4,489 3,924

Net investment income .......................................................... 14,829 15,256 14,729 13,661 13,124

Asset management and service fees ................................................ 3,772 3,719 3,485 3,053 2,897

Other income .................................................................. 0 (1,978) (3,199) (269) 2,008

Realized investment gains (losses), net .............................................. 4,025 1,636 (5,206) (1,441) 2,831

Total revenues ............................................................. 57,119 54,105 41,461 84,847 49,085

Benefits and expenses:

Policyholders’ benefits .......................................................... 30,627 31,587 26,733 65,131 23,614

Interest credited to policyholders’ account balances ................................... 3,479 4,263 3,111 4,234 4,484

Dividends to policyholders ....................................................... 2,212 2,716 2,050 2,176 2,723

Amortization of deferred policy acquisition costs ..................................... 2,120 1,973 240 1,504 2,695

General and administrative expenses ............................................... 10,912 11,807 11,011 11,094 10,605

Total benefits and expenses .................................................. 49,350 52,346 43,145 84,139 44,121

Income (loss) from continuing operations before income taxes and equity in earnings of operating

joint ventures .................................................................... 7,769 1,759 (1,684) 708 4,964

Income tax expense (benefit) ......................................................... 2,072 349 (1,058) 213 1,515

Income (loss) from continuing operations before equity in earnings of operating joint ventures ..... 5,697 1,410 (626) 495 3,449

Equity in earnings of operating joint ventures, net of taxes .................................. 15 16 59 60 182

Income (loss) from continuing operations ............................................... 5,712 1,426 (567) 555 3,631

Income (loss) from discontinued operations, net of taxes .................................... 0 12 7 15 35

Net income (loss) .................................................................. 5,712 1,438 (560) 570 3,666

Less: Income (loss) attributable to noncontrolling interests .................................. 70 57 107 50 34

Net Income (loss) attributable to Prudential Financial, Inc. .................................. $ 5,642 $ 1,381 $ (667) $ 520 $ 3,632

10 Prudential Financial, Inc. 2015 Annual Report