Progressive 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

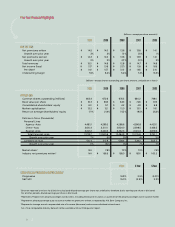

Agency, more so than Direct, maintained a rea-

sonably consistent pattern throughout the year.

Our policies in force for Agency had fallen from

our all-time highs and, while not happy for that

experience, we are now back to levels closely

approximating our best, with reason to believe

in continued momentum and new highs in

2011.

We ended the year with both channels and all

Personal Lines products meeting targets both on

the GAAP presentation of numbers and our more

preferred accident-year presentation. We started

the year with significant problems in several

large states and personal injury protection (PIP)

coverage was one common denominator. Efforts

throughout the year to manage these states, in-

volving actions and rate level changes to position

us for future profitable growth, were generally

effective, with profitability first among priorities.

We now have reason to be more optimistic for

the

growth outlook in these states for 2011.

In Personal Lines, 4 out of 51 regulatory juris-

dictions in which we operate failed to make

a profit. One, a recent market entry that in retro-

spect was mispriced and the recovery while

slow is very much on track; one in which extreme

and unusual weather is an identifiable condition;

one where our management of the PIP coverage

is still a work in progress; and a fourth just

missed. Several others, while profitable, did not

meet their planned targets. I offer this perspec-

tive to reinforce the point that we manage the

business at the local level with talented product

managers focused on the issues and condi-

tions of their state, a view which is not always

visible from the aggregate reporting offered

in our financial presentations.

Our Commercial Auto business, largely dis-

tributed by our agents, had about as good of

a year as we could expect. Our year-over-year

reduction in active policies was a very small

negative by year-end, down somewhat more on

a multi-year basis, reflecting general economic

and employment conditions. Profitability was

strong at an

87. 5

combined ratio and meaningful

signs of growth were emerging during the year.

We will need large and important states to reflect

greater growth going forward to regain lost

ground in this segment. Similar to our work in all

products, our Commercial Auto group has been

actively redesigning its product offering to reflect

our best knowledge and experience and has

done a great deal of work, in a period of less

robust growth, to position for the future.

11

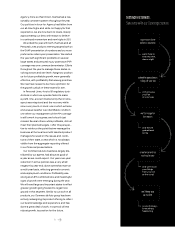

and we’ll move

your things

from your car

to the rental

so you’ll always

know what’s

happening

and they’re

guaranteed

for life

in 15 minutes,

you’ll be

on your way

we’re here to

help anytime,

day or night

DISTINCTIVE SERVICE.

Save time with our Concierge service.

a rental car will be

waiting for you

we’ll keep you

up-to-date

we’ll arrange for

the repairs

schedule appointment

+ drop off your car

report your claim

online or by phone