Plantronics 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

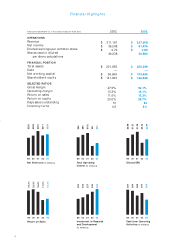

Consolidated Balance Sheets

March 31,

(in thousands, except per share data) 2002 2003

ASSETS

Current assets:

Cash and cash equivalents $43,048 $54,704

Marketable securities 17,262 5,021

Accounts receivable, net 43,838 50,503

Inventory, net 36,103 33,758

Deferred income taxes 5,866 6,357

Other current assets 2,452 2,674

Total current assets 148,569 153,017

Property, plant and equipment, net 35,700 36,957

Intangibles, net 4,584 3,682

Goodwill, net 9,542 9,386

Other assets 2,663 2,167

Total assets $201,058 $205,209

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $14,071 $13,596

Accrued liabilities 25,868 27,235

Income taxes payable 11,961 8,581

Total current liabilities 51,900 49,412

Deferred tax liability 7,165 8,867

Total liabilities 59,065 58,279

Commitments and contingencies (Note 8)

Stockholders’ equity:

Preferred stock, $0.01 par value per share; 1,000,000 shares

authorized, no shares outstanding ——

Common stock, $0.01 par value per share; 100,000 shares

authorized, 59,226 shares and 59,728 shares issued

at 2002 and 2003, respectively 592 597

Additional paid-in capital 152,194 158,160

Accumulated other comprehensive income (loss) (1,203) 209

Retained earnings 243,874 285,350

395,457 444,316

Less: Treasury stock (common: 13,368 and 16,090

shares at 2002 and 2003, respectively) at cost (253,464) (297,386)

Total stockholders’ equity 141,993 146,930

Total liabilities and stockholders’ equity $201,058 $205,209

The accompanying notes are an integral part of these consolidated financial statements.

25

Consolidated Statements of Income

Fiscal Year Ended March 31,

(in thousands, except earnings per share) 2001 2002 2003

Net sales $390,748 $311,181 $337,508

Cost of sales 180,946 163,336 168,565

Gross profit 209,802 147,845 168,943

Operating expenses:

Research, development and engineering 26,999 30,303 33,877

Selling, general and administrative 80,789 76,273 80,605

Total operating expenses 107,788 106,576 114,482

Operating income 102,014 41,269 54,461

Interest and other income, net 138 1,931 2,299

Income before income taxes 102,152 43,200 56,760

Income tax expense 28,602 6,952 15,284

Net income $73,550 $ 36,248 $41,476

Net income per share - basic $1.49 $ 0.77 $0.92

Shares used in basic per share calculations 49,213 47,304 45,187

Net income per share - diluted $1.38 $ 0.74 $0.89

Shares used in diluted per share calculations 53,263 49,238 46,584

The accompanying notes are an integral part of these consolidated financial statements.