Plantronics 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

Deferred Taxes. We record deferred tax assets at the amounts estimated to be realizable.

While we have considered future taxable income and ongoing prudent and feasible tax

planning strategies in assessing the value of the corresponding assets, if we were to determine

that we would not be able to realize all or part of our net deferred tax assets in the future, then

an adjustment would be required.

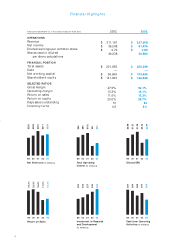

ANNUAL RESULTS OF OPERATIONS

Net Sales. Net sales in fiscal 2003 increased 8.5% to $337.5 million compared to $311.2

million in fiscal 2002, which in turn decreased 20.4% compared to fiscal 2001 net sales of

$390.7 million. Each of these fiscal years contained 52 weeks.

In fiscal 2003, our growth primarily came from revenues on new products developed within

the last 24 months including office, mobile and computer products, as well as sales from the

acquired Ameriphone product line. Compared to the prior year, on a worldwide basis,

revenues grew in all major geographies and channels with the exception of original equiptment

manufacturer (“OEM”) sales. The decrease in OEM sales was more than offset by sales through

Walker – Ameriphone distribution channels, and through our traditional distribution and retail

channels.

Fiscal 2002 was a challenging year for Plantronics. Compared to fiscal 2001, on a worldwide

basis, fiscal 2002 revenues declined in all major geographies and channels. While revenues

from mobile products grew, revenues declined in all other product markets. The growth in our

mobile products reflected modest overall market growth and, in our opinion, an improved

market position.

Domestic sales increased 7.2% to $228.9 million in fiscal 2003, compared to a decrease of

19.8% to $213.7 million in fiscal 2002 from $266.3 million in fiscal 2001. Domestic sales in fiscal

2003 as compared to fiscal 2002 increased in all major U.S. channels, with the exception of

OEM, with the most significant increases in sales of our Walker – Ameriphone products for the

hearing impaired, as well as sales of our headsets. Ameriphone, Inc. was acquired in the fourth

quarter of fiscal 2002.

Domestic sales in fiscal 2002 as compared to fiscal 2001 decreased in all major U.S. channels,

including U.S. distribution, OEM and retail. We believe the decline was due to the recession

in the U.S. and the severe cutbacks in IT and telecom equipment spending.

International sales accounted for approximately 32.2% of total net sales in fiscal 2003, up from

31.3% of total net sales in fiscal 2002 and 31.9% in fiscal 2001. International sales in fiscal 2003

as compared to fiscal 2002 increased 11.3% to $108.6 million compared to $97.5 million in fiscal

2002, which in turn decreased 21.7% compared to $124.5 million in fiscal 2001. The sales

increase in fiscal 2003 reflected growth in each of the European, Asia Pacific/Latin American

and Canadian regions and was favorably affected by the strengthening of the Euro and the

Great British Pound during the year.

International sales in fiscal 2002 decreased as compared to fiscal 2001, in each of the European,

Asia Pacific/Latin American and Canadian regions reflecting lagging economies.

18

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Revenue Recognition. We recognize revenue net of estimated product returns and

expected payments to resellers for customer programs including cooperative advertising,

marketing development funds, volume rebates, and special pricing programs. Product returns

are provided against revenues upon shipment, based on historical return rates, the product

stage relative to its expected life cycle, and assumptions regarding the rate of sell-through to

end users from our various channels based on historical sell-through rates. Should product

lives vary significantly from our estimates, or should a particular selling channel experience a

higher than estimated return rate, or a slower sell-through rate causing inventory build-up,

then our estimated returns, which net against revenue, may need to be revised. Reductions to

revenue for expected and actual payments to resellers for volume rebates and pricing

protection are based on actual expenses incurred during the period, on estimates for what is

due to resellers for estimated credits earned during the period and any adjustments for credits

based on actual activity. If market conditions warrant, Plantronics may take action to stimulate

demand, which could include increasing promotional programs, decreasing prices, or

increasing discounts. Such actions could result in incremental reductions to revenue and

margin at the time incentives are offered. To the extent that we reduce pricing, we may incur

reductions to revenue for price protection based on our estimate of inventory in the channel

that is subject to such pricing actions.

Accounts Receivable. We perform ongoing credit evaluations of our customers’ financial

condition and generally require no collateral from our customers. Plantronics maintains

allowances for doubtful accounts for estimated losses resulting from the inability of our

customers to make required payments. The allowance for doubtful accounts is reviewed

monthly and adjusted if deemed necessary. If the financial condition of our customers should

deteriorate, resulting in an impairment of their ability to make payments, additional

allowances may be required.

Inventory. We maintain reserves for estimated excess and obsolete inventory based on

projected future shipments using historical selling rates, and taking into account market

conditions, inventory on-hand, purchase commitments, product development plans and life

expectancy, and competitive factors. If markets for Plantronics’ products and corresponding

demand decline, then additional reserves may be necessary.

Warranty. We provide for the estimated cost of warranties at the time revenue is recognized.

Our warranty obligation is affected by product failure rates and our costs to repair or replace

the products. Should actual failure rates and costs differ from our estimates, revisions to the

warranty obligation may be required.

Goodwill and Intangibles. As a result of acquisitions we have made, we have goodwill and

intangible assets on our balance sheet. These assets affect the amount of future amortization

expense and possible impairment charges that we may incur. The determination of the value

of goodwill and intangible assets, as well as the useful life of amortizable intangible assets,

requires management to make estimates and assumptions that affect our financial statements.

We perform an annual impairment review of goodwill. If actual or expected revenue

significantly declines, we may be required to record an impairment charge.