Plantronics 1998 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1998 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P.12

ANNUAL REPORT . 199 8

PLANTRONICS

Notes TO CONSOLIDATED

FINANCIAL STATEMENTS

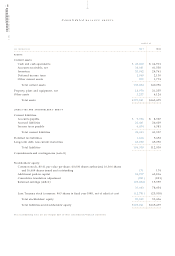

NOTE. 7EMPLOYEE BENEFIT PLANS:

Subject to eligibility requirements, substantially all domestic employees are covered by quarterly cash and annual

deferred profit sharing plans. Employees also have the option of participating in a salary deferral plan qualified under

Section 401(k) of the Internal Revenue Service Code. The Quarterly Profit Sharing Plan benefits are paid on the

basis of profitability and the relationship of each participating employee’s base salary as a percent of all participants’

base salaries. The Annual Profit Sharing Plan benefits are based on 10% of the Company’s results of operations

before interest and taxes, adjusted for other items, minus quarterly profit sharing cash distributions and administrative

expenses, and are allocated to employees based on the relationship of each participating employee’s base salary as a

percent of all participants’ base salaries. The Annual Profit Sharing Plan distributions include a cash distribution and

a tax deferred distribution made to individual accounts of participants held in trust. The deferred portion is subject

to a two year vesting schedule based on an employee’s date of hire. Total annual and quarterly profit sharing contributions

were $5.4 million, $5.5 million and $6.9 million for fiscal 1996, 1997 and 1998, respectively.

NOTE. 8COMMITMENTS AND CONTINGENCIES:

MINIMUM FUTURE RENTAL PAYMENTS

The Company leases certain equipment and facilities under operating leases expiring in various years through and

after 2003. Minimum future rental payments for the next five years under non-cancelable operating leases having

remaining terms in excess of 1 year as of March 31, 1998:

FISCAL YEAR ENDING MARCH ,

(IN THOUSANDS)Amount

1999 $1,253

2000 1,118

2001 864

2002 420

2003 412

Total minimum future rental payments $4,067

Rent expense for operating leases was approximately $1.1 million in fiscal 1996, $1.1 million in fiscal 1997 and $1.3 million

in fiscal 1998.

EXISTENCE OF RENEWAL OPTIONS

Certain operating leases provide for renewal options for periods from 1 to 3 years. In the normal course of business,

operating leases are generally renewed or replaced by other leases.

CLAIMS AND LITIGATION

In the opinion of management, litigation, contingent liabilities and claims against the Company arising in the ordinary

course of business are not expected to involve any judgments or settlements which would be material to the Company’s

consolidated financial condition or results of operations.