Plantronics 1998 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1998 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P.8

ANNUAL REPORT . 199 8

PLANTRONICS

Notes TO CONSOLIDATED

FINANCIAL STATEMENTS

Effective December 27, 1997 the Company adopted Statement of Financial Accounting Standards No. 128 “Earnings

per Share”, (“SFAS 128”). The new standard requires presentation of both basic EPS and diluted EPS on the face of

the income statement. Basic EPS, which replaces primary EPS, is computed by dividing net income available to common

stockholders (numerator) by the weighted average number of common shares outstanding (denominator) during the

period. Unlike the computation of primary EPS, basic EPS excludes the dilutive effect of stock options. Diluted EPS

replaces fully diluted EPS and gives effect to all dilutive potential common shares outstanding during a period.

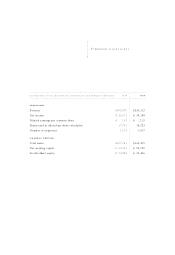

The following is a reconciliation of the numerators and denominators of the Basic and Diluted EPS computations for

the periods presented below:

YEAR ENDED MARCH ,

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)199 6 1997 1998

Numerator for earnings per common share— income $25,470 $29,671 $39,189

Denominator for basic earnings per common share 16,593 17,003 16,481

Effect of dilutive securities 1,371 789 1,742

Denominator for diluted earnings per common share 17,964 17,792 18,223

Net income per common share:

Basic $ 1.53 $ 1.75 $ 2.38

Diluted $ 1.42 $ 1.67 $ 2.15

RECENT ACCOUNTING PRONOUNCEMENTS

In June 1997, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 130,

“Reporting Comprehensive Income” (“SFAS 130”). This statement is effective for the Company’s fiscal year ending

March 27, 1999. The statement establishes presentation and disclosure requirements for reporting comprehensive income.

Comprehensive income includes charges or credits to equity that are not the result of transactions with owners. The

Company plans to adopt the disclosure requirements and report comprehensive income as part of the Consolidated

Statements of Shareholders’ Equity as required under SFAS 130, and expects there to be no material impact on the

Company’s financial position and results of operations as a result of the adoption of this new accounting standard.

In June 1997, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 131,

“Disclosures About Segments of an Enterprise and Related Information”(“SFAS 131”). The statement requires the

Company to report certain information about operating segments in annual financial statements. It also establishes

standards for related disclosures about products and services, geographic areas and major customers. The Company

will adopt SFAS 131 beginning in fiscal 1999 and does not expect such adoption to have a material effect on

the consolidated financial statement disclosures.