Plantronics 1998 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1998 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P.6

ANNUAL REPORT . 199 8

PLANTRONICS

Notes TO CONSOLIDATED

FINANCIAL STATEMENTS

NOTE. 1THE COMPANY:

Plantronics, Inc. (the Company), which introduced the first lightweight headset in 1962, is the world’s largest designer,

manufacturer and marketer of lightweight communications headsets. In addition, the Company manufactures and

markets specialty telephone products, such as amplified telephone handsets and specialty telephones for hearing-impaired

users and noise-cancelling headsets and handsets for use in high-noise environments.

NOTE. 2SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

MANAGEMENT’S USE OF ESTIMATES AND ASSUMPTIONS

The preparation of financial statements in accordance with generally accepted accounting principles requires manage-

ment to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of financial statements and the reported amounts of sales and expenses during

the reporting period. Actual results could differ from those estimates.

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of Plantronics and its subsidiary companies. Intercompany

transactions and balances have been eliminated in consolidation.

FISCAL YEAR

The Company’s fiscal year end is the Saturday closest to March 31. For purposes of presentation, the Company has

indicated its accounting year ending on March 31 or the month-end for interim quarterly periods. Results of operations

for fiscal years 1996, 1997 and 1998 each included 52 weeks.

CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

The Company considers all highly liquid investments with a maturity of 90 days or less at the date of purchase to be

cash equivalents. Pursuant to the provisions of Statement of Financial Accounting Standards No. 115, “Accounting

for Certain Investments in Debt and Equity Securities,” management determines the appropriate classification of debt

and equity securities at the time of purchase, and reassesses the classification at each reporting date. At March 31, 1998,

all of the Company’s short-term investments, consisting primarily of fixed maturity debt securities, have been classified

as “held to maturity.” Under this classification, the investments are recorded at amortized cost. The Company’s cash

and cash equivalents consist of the following:

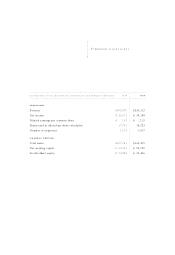

MARCH ,

(IN THOUSANDS)1997 1998

Cash $ 5,106 $ 9,662

Cash equivalents 37,156 55,239

Cash and cash equivalents $42,262 $64,901

INVENTORY

Inventory is stated at the lower of cost, determined on the first-in, first-out method, or market.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization of property, plant and equipment are principally calculated using the straight-line method

over the estimated useful lives of the respective assets.