Pentax 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HOYA REPORT 2014

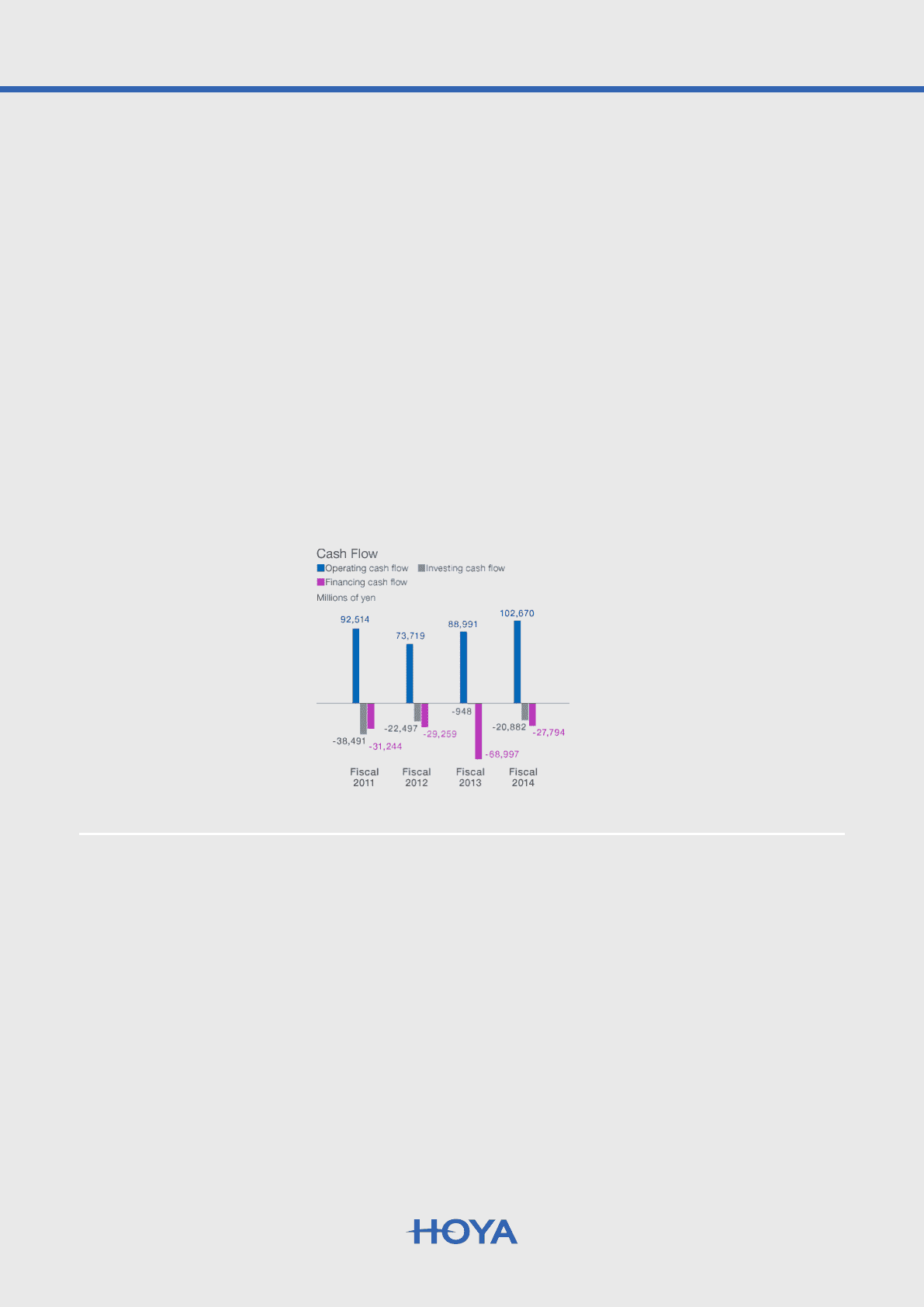

Cash Flow Cash and cash equivalents at the end of fiscal 2014 increased by ¥82,198 million from the

end of the previous year to ¥331,094 million, including the effects of exchange rate changes

of ¥28,204 million.

Net cash provided by operating activities amounted to ¥102,670 million, an increase of

¥13,680 million from the end of the previous year. This was mainly attributable to profit

before tax from continuing operations of ¥85,486 million (down ¥5,718 million year-on-year),

depreciation and amortization of ¥33,891 million (up ¥3,019 million), and decrease in

inventories of ¥11,785 million (down ¥6,755 million), which were partly offset by factors such

as an increase in trade and other receivables of ¥4,548 million (up ¥3,669 million) and a

decrease of trade and other payables of ¥2,171 million (down ¥5,521 million).

Net cash used in investing activities amounted to ¥20,882 million, an increase of ¥19,934

million in capital outflow compared with the end of the previous year. The capital inflow

stemmed from proceeds from sales of property, plant and equipment of ¥950 million (down

¥6,623 million) and other factors, while the capital outflow included payments for acquisition

of property, plant and equipment of ¥16,546 million (down ¥26,504 million) and net cash

outflow on acquisition of subsidiary of ¥6,390 million (down ¥3,737 million).

Net cash used in financing activities amounted to ¥27,794 million, a decrease of ¥41,203

million from the end of the previous year. This was mainly due to ¥28,101 million in dividends

paid (up ¥29 million).

Capital Expenditures /

Depreciation

and Amortization

The total capital expenditures of all operations of the HOYA Group amounted to 16,838

million yen during the consolidated fiscal year under review, a decrease of 28,173 million

yen over the preceding consolidated fiscal year.

In the consolidated fiscal year under review, investment in the Information Technology

business amounted to 8,735 million yen and investment in the Life Care business

amounted to 7,834 million yen, which account for 51.9% and 46.5%, respectively, of the

total capital expenditures by the Group.

The investment was covered by internally generated funds.

Capital investment was made in the consolidated fiscal year under review in the

Information Technology business to heighten the efficiency of the production system

and to improve productivity so that changes in the market environment can be dealt

with swiftly. Capital investment was also conducted to diversify production bases, a

need that was keenly felt following the Great East Japan Earthquake of March 2011,

and to heighten competitiveness in cutting-edge areas. As for the Life Care business,

and in particular the eyeglass lenses business, investment to reinforce capabilities at

Copyright 2014 © HOYA CORPORATION