PBF Energy 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 PBF Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

During 2012 and 2013, we expanded and upgraded existing on-site railroad infrastructure at our Delaware

City refinery, including the expansion of the crude rail unloading facilities that was completed in February 2013.

Currently, crude delivered to this facility is consumed at our Delaware City refinery. We also transport some of

the crude delivered by rail from Delaware City via barge to our Paulsboro refinery or other third party destinations.

The Delaware City rail unloading facility allows our East Coast refineries to source WTI based crudes from Western

Canada and the Midcontinent, which we believe provides significant cost advantages versus traditional Brent based

international crudes.

PBF Energy, a Delaware corporation formed on November 7, 2011, is a holding company that manages its

consolidated subsidiary, PBF LLC. Our sole asset is a controlling equity interest as of December 31, 2013 of

approximately 40.9% in PBF LLC as discussed more fully in “History” below.

Available Information.

Our website address is www.pbfenergy.com. Information contained on our website is not part of this Annual

Report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, and any other materials filed with (or furnished to) the Securities and Exchange Commission (SEC) by

us are available on our website (under “Investors”) free of charge, soon after we file or furnish such material. In

this same location, we also post our corporate governance guidelines, code of business conduct and ethics, and the

charters of the committees of our board of directors. These documents are available free of charge in print to any

stockholder that makes a written request to the Secretary, PBF Energy Inc., One Sylvan Way, Second Floor,

Parsippany, New Jersey 07054.

History

PBF Energy is the sole managing member of PBF LLC. PBF Holding is a wholly-owned subsidiary of PBF

LLC and PBF Finance is a wholly-owned subsidiary of PBF Holding. PBF Holding is the parent company for PBF

LLC's operating subsidiaries.

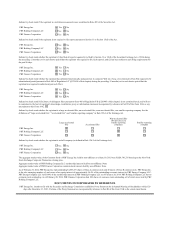

On December 18, 2012, we completed the initial public offering of 23,567,686 shares of our Class A common

stock at an offering price of $26.00 per share. In connection with the offering, our shares of Class A common stock

began trading on the New York Stock Exchange under the symbol “PBF”. The proceeds to us from the offering,

before deducting underwriting discounts, were approximately $612.8 million of which we used approximately

$571.2 million to purchase 21,967,686 PBF LLC Series A Units from our financial sponsors, funds affiliated with

The Blackstone Group L.P. (“Blackstone”) and First Reserve Management L.P. (“First Reserve”).

Additionally, on June 12, 2013, we completed a public offering of 15,950,000 shares of our Class A common

stock at a price of $27.00 per share, less underwriting discounts and commissions, in a secondary public offering

(the "June 2013 Secondary Offering"). All of the shares were sold by funds affiliated with Blackstone and First

Reserve. In connection with this offering, Blackstone and First Reserve exchanged 15,950,000 Series A Units of

PBF LLC for an equivalent number of shares of our Class A common stock. The holders of PBF LLC Series B

Units, which include certain executive officers of PBF Energy, had the right to receive a portion of the proceeds

of the sale of the PBF Energy Class A common stock by Blackstone and First Reserve.

As of December 31, 2013, Blackstone and First Reserve and our executive officers and directors and certain

employees beneficially owned 57,201,674 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC

Series A Units as “the members of PBF LLC other than PBF Energy”) and we owned 39,665,473 PBF LLC Series

C Units, and the members of PBF LLC other than PBF Energy through their holdings of Class B common stock

have 59.1% of the voting power in us, and the holders of our issued and outstanding shares of Class A common

stock have 40.9% of the voting power in us. As a result of the ownership of the Class B common stock and the

PBF LLC Series A Units, prior to the January 2014 secondary offering discussed below under "Recent

Developments", Blackstone and First Reserve controlled us as of December 31, 2013, and we in turn, as the sole

managing member of PBF LLC, control PBF LLC and its subsidiaries.