PBF Energy 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 PBF Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

In this Annual Report on Form 10-K, unless the context otherwise requires, references to the “Company,”

“we,” “our,” “us” or “PBF” refer to PBF Energy Inc. (“PBF Energy”), and, in each case, unless the context

otherwise requires, its consolidated subsidiaries, including PBF Energy Company LLC (“PBF LLC”), PBF

Holding Company LLC (“PBF Holding”), PBF Investments LLC (“PBF Investments”), Toledo Refining

Company LLC (“Toledo Refining”), Paulsboro Refining Company LLC (“Paulsboro Refining”), and Delaware

City Refining Company LLC (“Delaware City Refining”). In this Annual Report on Form 10-K, we make certain

forward-looking statements, including statements regarding our plans, strategies, objectives, expectations,

intentions, and resources, under the safe harbor provisions of the Private Securities Litigation Reform Act of

1995. You should read our forward-looking statements together with our disclosures under the heading:

“Cautionary Statement for the Purpose of Safe Harbor Provisions of the Private Securities Litigation Reform Act

of 1995.” When considering forward-looking statements, you should keep in mind the risk factors and other

cautionary statements set forth in this Annual Report on Form 10-K under “Risk Factors” in Item 1A.

ITEM 1. BUSINESS

Overview

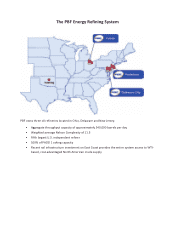

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels,

heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our

products throughout the Northeast and Midwest of the United States, as well as in other regions of the United

States and Canada, and are able to ship products to other international destinations. We were formed in 2008 to

pursue acquisitions of crude oil refineries and downstream assets in North America. We currently own and

operate three domestic oil refineries and related assets, which we acquired in 2010 and 2011. Our refineries have

a combined processing capacity, known as throughput, of approximately 540,000 bpd, and a weighted average

Nelson Complexity Index of 11.3.

Our three refineries are located in Toledo, Ohio, Delaware City, Delaware and Paulsboro, New Jersey. Our

Midcontinent refinery at Toledo processes light, sweet crude, has a throughput capacity of 170,000 bpd and a

Nelson Complexity Index of 9.2. The majority of Toledo’s WTI based crude is delivered via pipelines that

originate in both Canada and the United States. Since our acquisition of Toledo in 2011, we have added

additional truck and rail crude unloading capabilities that provide feedstock sourcing flexibility for the refinery

and enables Toledo to run a more cost-advantaged crude slate. Our East Coast refineries at Delaware City and

Paulsboro have a combined refining capacity of 370,000 bpd and Nelson Complexity Indices of 11.3 and 13.2,

respectively. These high conversion refineries process primarily medium and heavy, sour crudes and have

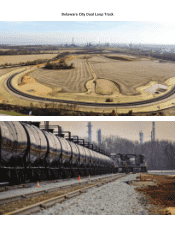

historically received the bulk of their feedstock via ships and barges on the Delaware River. Importantly, in May

2012 we commenced crude shipments via rail into a newly developed crude rail unloading facility at our

Delaware City refinery. Currently, crude delivered to this facility is consumed at our Delaware City refinery. In

the future we plan to transport some of the crude delivered by rail from Delaware City via barge to our Paulsboro

refinery. The Delaware City rail unloading facility allows our East Coast refineries to source WTI based crudes

from Western Canada and the Midcontinent, which provides significant cost advantages versus traditional Brent

based international crudes.

PBF Energy, a Delaware corporation formed on November 7, 2011, is a holding company that manages its

consolidated subsidiary, PBF LLC. Our sole asset is a controlling equity interest as of December 31, 2012 of

approximately 24.4% of the outstanding Series A Units in PBF LLC as discussed more fully in “History” below.

Available Information.

Our website address is www.pbfenergy.com. Information contained on our website is not part of this Annual

Report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, and any other materials filed with (or furnished to) the Securities and Exchange Commission (SEC)

1