PBF Energy 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 PBF Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TO OUR SHAREHOLDERS

2012 was a very good year for PBF Energy as fundamentally sound operations, in combination with

improved industry margins, resulted in operating earnings of $920 million, per share earnings of

$5.07, on a fully-exchanged and fully-diluted basis, and free cash flow of $593 million.

We finished 2012 in a financially strong position with a cash balance of $286 million, total liquidity of

$600 million and a net debt to capitalization ratio of 20% which is down from a net debt to

capitalization ratio of almost 40% at year-end 2011.

In February 2012, we successfully completed a $675 million bond offering and used the proceeds to

retire higher cost short-term debt that was used to acquire the Paulsboro and Toledo refineries.

On December 12th, 2012, we achieved a major milestone when we completed an initial public

offering of the Company during which our private equity partners, Blackstone and First Reserve, sold

approximately twenty-four percent of their interest to the public at a price of $26 per share.

Our top priority, as always, is to operate our facilities in a safe, reliable and environmentally

responsible manner. We fully understand that without this foundation firmly in place our success

cannot be assured. Safety performance in all three refineries improved in 2012 with our refining

system’s average total employee recordable incident rate (TRIR) at 0.65 versus the industry average

of 1.02. Our contractor TRIR also improved to 0.58 versus an industry average of 0.78.

We continue to improve the environmental performance at all three facilities, with each refinery

experiencing a lower number of environmental incidents in 2012 as compared to 2011. Our Delaware

City Refinery experienced the fewest number of flaring events as compared to frequency under prior

ownerships. After a thorough review by the federal Occupational Safety and Health Administration,

our Paulsboro refinery was re-approved as a “Star Site” in the Voluntary Protection Program of the

agency.

Reliable operations at all three refineries allowed us to capture the strong margins that existed in the

Midwest throughout 2012 and on the East Coast during the second half of the year.

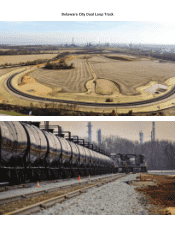

Capital expenditures during 2012 were $223 million including investment in crude-by-rail unloading

infrastructure that allows the Company to take advantage of the phenomenal growth of crude oil

production that is taking place in the Midwest and Canada. We currently have the ability to deliver

and discharge over 110,000 barrels per day of these attractively priced crudes into our East Coast

system and expect to increase this unloading capability by another 40,000 barrels per day by the end

of 2013.

We believe we are advantaged in two important areas relative to our competition in PADD 1 with

these investments. First, our Delaware City refinery sits on an industrial site of over 5,000 acres

allowing us to build the rail unloading infrastructure within our refinery boundaries versus using third

party facilities to trans-load and transport these crudes. This results in an embedded $2.50 per barrel

lower cost of supplying these crudes to our East Coast refineries versus other refiners in the region.

Secondly, and importantly, our Delaware City and Paulsboro refineries are the only refineries in the

region with the sophisticated capacity required to process the heavy crude oils that will be delivered

from Western Canada through these facilities.