PBF Energy 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 PBF Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

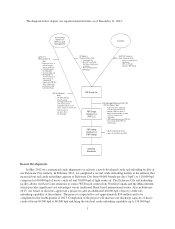

The diagram below depicts our organizational structure as of December 31, 2012:

The Pre-IPO

Owners of

PBF LLC and

Management

72,972,131

PBF LLC Series A

41 Shares of

Class B common stock

Investors

PBF Energy Inc.

PBF Energy

Company LLC

(PBF LLC)

PBF Holding

Company LLC

(PBF Holding)

Operating

Subsidiaries

• Represents 75.6% of

the total economic

interest of PBF LLC

• Not publicly traded

• Voting rights only

• 75.6% of voting power in

PBF Energy

• One vote for each PBF

LLC Series A Unit held by

such holder

23,571,221 shares of

Class A common stock

• 24.4% of voting power in

PBF Energy

• 100% of economic

interests in PBF Energy

• No voting rights

• Economic rights only

• Exchangeable on

one-for-one basis for

shares of Class A

common stock

• Certain of the PBF LLC

Series A Units share

profits with the PBF

LLC Series B Units

PBF LLC Series B

Units

• Are profits interests

• Share in varying

percentages in the profits

of the existing owners,

including the right to receive

shares of Class A common stock

• Held solely by our

executive officers

• No voting rights

PBF LLC Series C Units

Sole Managing Member and 23,571,221

•

Represents 24.4% of the total

economic interest of PBF LLC

•

Number of PBF LLC Series C

Units held equals number of shares

of Class A common stock

outstanding

• 100% management power in PBF LLC

• ABL Revolving Credit Facility

• Senior Secured Notes due 2020

• Do not share with the PBF LLC

Series B Units

Units

Recent Developments

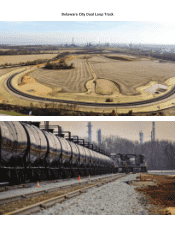

In May 2012 we commenced crude shipments via rail into a newly developed crude rail unloading facility at

our Delaware City refinery. In February 2013, we completed a second crude unloading facility at the refinery that

increased our rail crude unloading capacity at Delaware City from 40,000 barrels per day (“bpd”) to 110,000 bpd,

comprised of 40,000 bpd of heavy crude oil and 70,000 bpd of light crude oil. The Delaware City rail unloading

facility allows our East Coast refineries to source WTI based crudes from Western Canada and the Midcontinent,

which provides significant cost advantages versus traditional Brent based international crudes. Also in February

2013, our board of directors approved a project to add an additional 40,000 bpd of heavy crude rail

unloading capability at the refinery. The project is expected to cost approximately $50 million and to be

completed in the fourth quarter of 2013. Completion of the project will increase our discharge capacity of heavy

crude oil from 40,000 bpd to 80,000 bpd and bring the total rail crude unloading capability up to 150,000 bpd.

3