PBF Energy 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 PBF Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PBF Energy Inc. 2012 Annual Report

Table of contents

-

Page 1

PBF Energy Inc. 2012 Annual Report -

Page 2

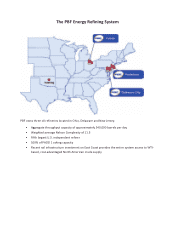

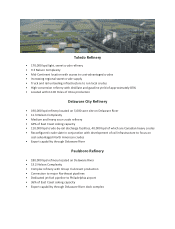

The PBF Energy Refining System PBF owns three oil refineries located in Ohio, Delaware and New Jersey Aggregate throughput capacity of approximately 540,000 barrels per day Weighted average Nelson Complexity of 11.3 Fifth largest U.S. independent refiner 100% of PADD 1 coking capacity Recent rail ... -

Page 3

... through Delaware River Paulsboro Refinery 180,000 bpd refinery located on Delaware River 13.2 Nelson Complexity Complex refinery with Group I lubricant production Connection to major Northeast pipelines Dedicated jet fuel pipeline to Philadelphia airport 36% of East Coast coking capacity Export... -

Page 4

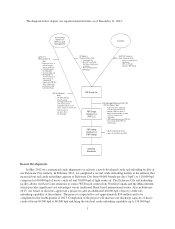

...debt that was used to acquire the Paulsboro and Toledo refineries. On December 12th, 2012, we achieved a major milestone when we completed an initial public offering of the Company during which our private equity partners, Blackstone and First Reserve, sold approximately twenty-four percent of their... -

Page 5

...to our shareholders. PBF's strong operating performance and value creation are built on the dedication of the Company's employees. Their spirit, ...thank our Board of Directors for the oversight and leadership that they provide. Our Board has been, and remains, a valuable strategic advisor for PBF and ... -

Page 6

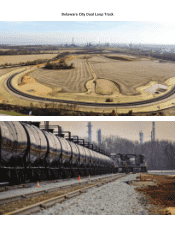

Delaware City Dual Loop Track -

Page 7

...35764 PBF Energy Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 45-3763855 (I.R.S. Employer Identification No.) One Sylvan Way, Second Floor Parsippany, New Jersey (Address of principal executive offices) 07054... -

Page 8

...and Procedures ...Item 9B. Other Information ...PART III Item 10. Directors, Executive Officers and Corporate Governance ...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Item 13. Certain Relationships and... -

Page 9

... are located in Toledo, Ohio, Delaware City, Delaware and Paulsboro, New Jersey. Our Midcontinent refinery at Toledo processes light, sweet crude, has a throughput capacity of 170,000 bpd and a Nelson Complexity Index of 9.2. The majority of Toledo's WTI based crude is delivered via pipelines that... -

Page 10

... Act. As of December 31, 2012, Blackstone and First Reserve and our executive officers and directors and certain employees beneficially owned 72,972,131 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC Series A Units as "the pre-IPO owners of PBF LLC") and we owned 23,571,221... -

Page 11

... Holding Company LLC (PBF Holding) • ABL Revolving Credit Facility • Senior Secured Notes due 2020 Operating Subsidiaries Recent Developments In May 2012 we commenced crude shipments via rail into a newly developed crude rail unloading facility at our Delaware City refinery. In February 2013... -

Page 12

... facility, and negotiated a new long-term contract with the relevant union at the refinery. As of December 31, 2012, we had received $37.4 million in economic support from the State of Delaware under this agreement. We believe that the refinery's ability to process lower quality crudes allows us to... -

Page 13

...both Delaware City and Paulsboro. Overview. The Delaware City refinery is located on a 5,000-acre site, with access to waterborne cargoes and an extensive distribution network of pipelines, barges and tankers, truck and rail. Delaware City is a fully integrated operation that receives crude via rail... -

Page 14

...barrels of storage capacity are dedicated to crude oil and other feedstock storage with the remaining approximately 6.4 million barrels allocated to finished products, intermediates and other products. Energy and Other Utilities. Under normal operating conditions, the Delaware City refinery consumes... -

Page 15

... the Delaware River in Paulsboro, New Jersey, just south of Philadelphia and approximately 30 miles away from Delaware City. Paulsboro receives crude and feedstocks via its marine terminal on the Delaware River. Paulsboro is one of two operating refineries on the East Coast with coking capacity, the... -

Page 16

... to crude oil storage with the remaining 5.4 million barrels allocated to finished products, intermediates and other products. Energy and Other Utilities. Under normal operating conditions, the Paulsboro refinery consumes approximately 30,000 MMBTU per day of natural gas. The Paulsboro refinery is... -

Page 17

... 2012. We currently anticipate paying the balance of the participation payment in April 2013. Overview. Toledo has a throughput capacity of approximately 170,000 bpd and a Nelson Complexity Index of 9.2. Toledo processes a slate of light, sweet crudes from Canada, the Midcontinent, the Bakken region... -

Page 18

... The Toledo refinery receives its crude through pipeline connections and a truck rack. Of the total, approximately 0.4 million barrels are dedicated to crude oil storage with the remaining 3.6 million barrels allocated to intermediates and products. Energy and Other Utilities. Under normal operating... -

Page 19

... and human resources support functions. Employees As of December 31, 2012, we had approximately 1,612 employees. At Paulsboro, 295 of our 457 employees are covered by a collective bargaining agreement that expires in March 2015. In addition, 652 of our 994 employees at Delaware City and Toledo are... -

Page 20

... of the Board of Directors Chief Executive Officer President Executive Vice President, Chief Commercial Officer Senior Vice President, Chief Financial Officer Senior Vice President, General Counsel Thomas D. O'Malley has served as Executive Chairman of the Board of Directors of PBF Energy since its... -

Page 21

...energy opportunities, from April 2007 to February 2008. Previously he served as Vice President, General Counsel and Secretary at Neurogen Corporation, a drug discovery and development company, from March 2006 to December 2007. Mr. Dill has over 15 years experience providing legal support to refining... -

Page 22

.... Further, in connection with the Delaware City and Paulsboro acquisitions, we purchased two individual ten-year, $75.0 million environmental insurance policies to insure against unknown environmental liabilities at each refinery. In connection with the acquisition of Toledo, the seller, subject to... -

Page 23

... Annual Report on Form 10-K have the following meanings: "ASCI" refers to the Argus Sour Crude Index, a pricing index used to approximate market prices for sour, heavy crude oil. "Bakken" refers to both a crude oil production region generally covering North Dakota, Montana and Western Canada, and... -

Page 24

"downstream" refers to the downstream sector of the energy industry generally describing oil refineries, marketing and distribution companies that refine crude oil and sell and distribute refined products. The opposite of the downstream sector is the upstream sector, which refers to exploration and ... -

Page 25

... New York Harbor market value of petroleum products. "Platts" refers to Platts, a division of The McGraw-Hill Companies. "PPM" refers to parts per million. "refined products" refers to petroleum products, such as gasoline, diesel and jet fuel, that are produced by a refinery. "sour crude oil" refers... -

Page 26

...above operating expenses (including the cost of refinery feedstocks, such as crude oil, intermediate partially refined petroleum products, and natural gas liquids that are processed and blended into refined products) at which we are able to sell refined products. Refining is primarily a margin-based... -

Page 27

... our Delaware City and Paulsboro refineries and the WTI based crude oils processed at our Toledo refinery. These crude oil differentials vary significantly from quarter to quarter depending on overall economic conditions and trends and conditions within the markets for crude oil and refined products... -

Page 28

... on pipelines for transportation of crude oil and refined products. Our Toledo refinery receives a substantial portion of its crude oil and delivers a portion of its refined products through pipelines. The Enbridge system is our primary supply route for crude oil from Canada, the Bakken region and... -

Page 29

.... We terminated our agreement with Statoil for our Paulsboro refinery effective March 31, 2013 and our MSCG Offtake Agreements for our Paulsboro and Delaware City refineries effective June 30, 2013. If we cannot adequately handle our crude oil and feedstock requirements without the benefit of the... -

Page 30

...our refined products. Because of their integrated operations and larger capitalization, these companies may be more flexible in responding to volatile industry or market conditions, such as shortages of crude oil supply and other feedstocks or intense price fluctuations. Newer or upgraded refineries... -

Page 31

... downturns in that region. These refineries are located within a relatively limited geographic area and we primarily market our refined products in that area. As a result, we are more susceptible to regional conditions than the operations of more geographically diversified competitors and any... -

Page 32

... As of December 31, 2012, approximately 295 of our 457 employees at Paulsboro are covered by a collective bargaining agreement that expires in March of 2015. In addition, 652 of our 994 employees at Delaware City and Toledo are covered by a collective bargaining agreement that expires in February of... -

Page 33

... to produce the anticipated results. We may not be able to procure adequate hedging arrangements due to a variety of factors. Moreover, such transactions may limit our ability to benefit from favorable changes in crude oil and refined product prices. In addition, our hedging activities may expose us... -

Page 34

...resource planning tools. We process a large number of transactions on a daily basis and rely upon the proper functioning of computer systems. If a key system was to fail or experience unscheduled downtime for any reason, even if only for a short period, our operations...refinery and pipeline operations... -

Page 35

... discharge" to the maximum extent possible. There may be accidents involving tankers transporting crude oil or refined products, and response service companies that we have contracted with, in the areas in which we transport crude oil and refined products, may not respond to a "worst case discharge... -

Page 36

.... Currently remediation projects are underway in accordance with regulatory requirements at the Paulsboro and Delaware City refineries. In connection with the acquisitions of our refineries, the prior owners have retained certain liabilities or indemnified us for certain liabilities, including those... -

Page 37

...obligated refineries must blend into their finished petroleum fuels increases annually ...operations and that we provide this information to employees, state and local governmental authorities, and local residents. Failure to comply with OSHA requirements, including general industry standards, process... -

Page 38

.... We were a development stage enterprise prior to our acquisition of Paulsboro on December 17, 2010. With the further acquisition of Toledo and the re-start of Delaware City, we have experienced rapid growth in a short period of time. Continued expansion may strain our resources and force management... -

Page 39

...general corporate and other purposes may be limited; and we may be at a competitive disadvantage to those of our competitors...operations, we may be required to sell assets, to refinance...number...extent new ...tests in certain circumstances. Our subsidiaries' ability to meet these financial condition tests... -

Page 40

... distributions from PBF LLC and its subsidiaries to pay our taxes, meet our other obligations and/or pay dividends in the future. We are a holding company and all of our operations are conducted through subsidiaries of PBF Holding. We have no independent means of generating revenue and no material... -

Page 41

companies. In addition, sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join our firm and to maintain appropriate operational and financial systems to adequately support expansion. These activities may ... -

Page 42

...the pre-IPO owners of PBF LLC may have different tax positions which could influence their decisions regarding whether and when to dispose of assets, whether and when to incur new or refinance existing indebtedness, especially in light of the existence of the tax receivable agreement described below... -

Page 43

... estimates based on assumptions that are subject to change due to various factors, including, among other factors, the timing when the pre-IPO owners of PBF LLC exchange their PBF LLC Series A Units for shares of PBF Energy's Class A common stock as contemplated by the tax receivable agreement, the... -

Page 44

... for expansion, tax, legal, regulatory and contractual restrictions and implications, including under our outstanding debt documents, and such other factors as our board of directors may deem relevant in determining whether to declare or pay any dividend. Because PBF Energy is a holding company with... -

Page 45

...that we issue, including under any equity incentive plans, would dilute the percentage ownership of the holders of our Class A common stock. In connection with our initial public offering, we, our executive officers and directors and Blackstone and First Reserve agreed with the underwriters, subject... -

Page 46

... or in the aggregate, would have a material adverse effect on our financial position, results of operations or cash flows. Our subsidiary, Paulsboro Refining, formerly known as Valero Refining Company-New Jersey, is party to certain legal proceedings that arose prior to our acquisition of the entity... -

Page 47

... PBF LLC to make tax distributions to its members). Our board of directors may take into account, among other things, general economic conditions, our financial condition and operating results, our available cash and current and anticipated cash needs, capital requirements, plans for expansion, tax... -

Page 48

... distributions to its members in the amount of $161.0 million during 2012. Immediately prior to the payment on March 15, 2013 of our dividend on our Class A common stock, we intend to cause PBF LLC to make distributions to the pre-IPO owners of PBF LLC and to us in an amount equal to $0.30 per unit... -

Page 49

... the following companies that are engaged in refining operations in the U.S.: Alon USA Energy, Inc.; CVR Energy Inc.; Delek US Holdings, Inc.; HollyFrontier Corporation; Marathon Petroleum Corporation; Phillips 66; Tesoro Corporation; Valero Energy Corporation; and Western Refining, Inc. COMPARISON... -

Page 50

... directors, executive officers or entities affiliated with Blackstone or First Reserve. Securities Authorized for Issuance Under Equity Compensation Plans The following table provides information about the securities authorized for issuance under our equity compensation plans as of December 31, 2012... -

Page 51

...date of inception) through December 31, 2008 have been derived from the audited financials of PBF LLC not included in this Annual Report on Form 10-K. As a result of the Paulsboro and Toledo acquisitions, the historical consolidated financial results of PBF LLC only include the results of operations... -

Page 52

... to the Paulsboro and Toledo acquisition as well as non-consummated acquisitions. (3) December 31, 2009 and 2008 balance sheet data is that of PBF Investments LLC. See footnote 1, "Organization and Basis of Presentation" in the PBF Energy Inc. consolidated financial statements, "Item 8. Financial... -

Page 53

... to Paulsboro as PBF LLC's "Predecessor" or "Predecessor Paulsboro," as prior to its acquisition PBF LLC generated substantially no revenues and prior to the acquisition of Paulsboro and the Delaware City assets, was a new company formed to pursue acquisitions of crude oil refineries and downstream... -

Page 54

PAULSBORO REFINING BUSINESS-PBF LLC'S PREDECESSOR Period from January 1, 2010 through Year Ended December 31, December 16, 2010 2009 2008 (in thousands) Statement of operations data: Operating revenues (1) ...Cost and expenses: Cost of sales (2) ...Operating expenses ...General and administrative ... -

Page 55

... both our key employees and unionized employees; our ability to operate our businesses efficiently, manage capital expenditures and costs (including general and administrative expenses) tightly and generate earnings and cash flow; our substantial indebtedness described in this Annual Report on Form... -

Page 56

... North America. We currently own and operate three domestic oil refineries and related assets located in Delaware City, Delaware, Paulsboro, New Jersey, and Toledo, Ohio, which we acquired in 2010 and 2011. Our refineries have a combined processing capacity, known as throughput, of approximately 540... -

Page 57

.... We refer to Paulsboro as PBF LLC's "Predecessor" or "Predecessor Paulsboro," because we generated substantially no revenues and prior to our acquisition of Paulsboro and the Delaware City assets, we were a new company formed to pursue acquisitions of crude oil refineries and downstream assets in... -

Page 58

... River in Paulsboro, New Jersey, just south of Philadelphia, and approximately 30 miles away from Delaware City. The refinery generally processes a variety of medium and heavy, sour crude oils. Acquisition of Toledo Refinery Through our subsidiary, Toledo Refining, we acquired the Toledo refinery on... -

Page 59

...of operations of the Toledo refinery have been included in our consolidated financial statements as of March 1, 2011. Toledo has a throughput capacity of 170,000 bpd and a Nelson Complexity Index of 9.2. Toledo processes a slate of light, sweet crudes from Canada, the Midcontinent, the Bakken region... -

Page 60

... transactions are those of PBF LLC. Tax Receivable Agreement In connection with our initial public offering, we entered into a tax receivable agreement pursuant to which we are required to pay the pre-IPO owners of PBF LLC, who exchange their units for PBF Energy Class A common stock or... -

Page 61

... 2013, we completed a second crude unloading facility at the refinery that increased our rail crude unloading capacity at Delaware City from 40,000 barrels bpd to 110,000 bpd, comprised of 40,000 bpd of heavy crude oil and 70,000 bpd of light crude oil. Also in February 2013, our board of directors... -

Page 62

... barrel of heating oil. We calculate this refining margin using the New York Harbor market value of gasoline and heating oil against the market value of Dated Brent crude oil and refer to the benchmark as the Dated Brent (NYH) 2-1-1 benchmark refining margin. Our Delaware City refinery has a product... -

Page 63

... oil and represent approximately 8% to 9.5% of our total production volume; and the Paulsboro refinery produces Group I lubricants which, through an extensive production process, has a low volume yield which limits the volume expansion on crude inputs. • Toledo Refinery. The benchmark refining... -

Page 64

... conjunction with our audited consolidated financial statements and the notes thereto. 2012 Year Ended December 31, 2011 2010 Revenue ...Cost of sales, excluding depreciation ...Non-GAAP gross margin (1) ...Operating expenses, excluding depreciation ...General and administrative expenses ...Gain on... -

Page 65

...24.4% equity interest in PBF LLC's pre-tax income, less applicable income taxes, for the period from December 18, 2012, the date of the closing of its initial public offering, through December 31, 2012. During the 2011 period, our results reflect twelve months of operations of our Paulsboro refinery... -

Page 66

... approximately 4.7%, lower in 2012 than in 2011. A reduction in the Dated Brent/Maya crude differential, our proxy for the light/heavy crude differential, has a negative impact on Paulsboro and Delaware City as both refineries process a large slate of medium and heavy, sour crude oil that is priced... -

Page 67

..., primarily driven by lower natural gas prices, and the increase in throughput barrels. Our operating expenses principally consist of salaries and employee benefits, maintenance, energy and catalyst and chemicals costs. General and Administrative Expenses-General and administrative expenses totaled... -

Page 68

....7 million in the year ended December 31, 2010. The revenue increase was primarily due to the operations of our Paulsboro and Toledo refineries, and the commencement of refining operations at our Delaware City refinery, which became operational in October 2011. The total throughput rate and barrels... -

Page 69

... impact on Toledo's gross margin because its primary feedstock is mainly WTI and WTI based light, sweet crude oil. A wide Dated Brent/Maya crude differential, our proxy for the light/heavy differential, has a positive impact on Paulsboro and Delaware City as both refineries process a large slate... -

Page 70

.... We incurred long-term debt in connection with our acquisitions of Delaware City, Paulsboro and Toledo, giving rise to interest expense. We also incurred interest expense in connection with our crude and feedstock supply agreements with Statoil and MSCG and letter of credit fees associated with the... -

Page 71

..., 2011 and 2010: Year Ended December 31, 2011 2012 2010 Net income (loss) attributable to PBF Energy Inc. Add: IPO-related expenses(1) Add: Net income (loss) attributable to the noncontrolling interest(2) Less: Income tax (expense) benefit(3) Adjusted pro forma net income (loss) Pro forma shares... -

Page 72

Paulsboro Refining Business-PBF LLC's Predecessor Period from January 1, 2010 through December 16, 2010 (in thousands) Operating revenues ...Cost of sales, excluding depreciation ...Non-GAAP gross margin (1) ...Operating expenses, excluding depreciation ...General and administrative expenses ...... -

Page 73

... Brent less WTS (sour) ...Dated Brent less ASCI (sour) ...WTI less WCS (heavy, sour) ...WTI less Bakken (light, sweet) ...WTI less Syncrude (light, sweet) ...Natural gas (dollars per MMBTU) ...Key Operating Information Production (barrels per day in thousands) ...Crude oil and feedstocks throughput... -

Page 74

... stage company focused on the acquisition of oil refineries and other downstream assets in North America and activities to turnaround, reconfigure and re-start our Delaware City refinery. Our cash flow in 2010 was related to those activities, plus the results of operations of our Paulsboro refinery... -

Page 75

... primarily of the acquisition of the Toledo refinery of $168.2 million, capital expenditures totaling $488.7 million, primarily related to the reconfiguration and re-start of our Delaware City refinery, expenditures for a turnaround at our Paulsboro refinery of $62.8 million and expenditures for... -

Page 76

... receivable of the Toledo refinery in the borrowing base. A portion of the proceeds of the ABL Revolving Credit Facility was used on the closing date... by PBF LLC, PBF Finance, and each of our domestic operating subsidiaries and secured by a lien on (y) PBF LLC's equity interests in PBF Holding and... -

Page 77

... We acquire crude oil for our Paulsboro and Delaware City refineries under supply agreements whereby Statoil generally purchases the crude oil requirements for each refinery on our behalf and under our direction. Our agreement with Statoil for Paulsboro will terminate effective March 31, 2013, at... -

Page 78

...accrued liability for such crude oil and feedstocks was $266.2 million at that date. Product Offtake Agreements Our Paulsboro and Delaware City refineries sell their light finished products, certain intermediates and lube base oils to MSCG under a products offtake agreement. Legal title transfers to... -

Page 79

... footnote to our financial statements, "Item 8. Financial Statements and Supplementary Data." During 2012, we entered into agreements to lease or purchase approximately 2,400 crude railcars that will be utilized to transport crude by rail to our Delaware City refinery. Any such leases will... -

Page 80

...or natural gas to certain of our refineries, contracts for the treatment of wastewater, and contracts for pipeline capacity. We enter into these contracts to ensure an adequate supply of energy or essential services to support our refinery operations. Substantially all of these obligations are based... -

Page 81

... assets to the extent tax basis is allocated to those capital assets. We have entered into a tax receivable agreement with our pre-IPO owners of PBF LLC that provides for the payment by PBF Energy to our previous owners of 85% of the amount of the benefits, if any, that PBF Energy is deemed to... -

Page 82

... in accordance with their respective agreements. Revenue for services is recorded when the services have been provided. Our Paulsboro and Delaware City refineries sell their light finished products, certain intermediates and lube base oils to MSCG under products offtake agreements. On a daily basis... -

Page 83

... principally on the weighted average cost method. Our Paulsboro and Delaware City refineries acquire substantially all of their crude oil from Statoil under our crude supply agreements whereby we take title to the crude oil as it is delivered to our processing units. We have risk of loss while the... -

Page 84

... of our initial public offering on December 18, 2012. Effective with the completion of our initial public offering, we recognize an income tax expense or benefit in our consolidated financial statements based on our allocable share of PBF LLC's pre-tax income (loss). We do not recognize any income... -

Page 85

... finished refined products are sold. Our offtake agreements with MSCG for our Paulsboro and Delaware City refineries allow us to sell our light finished products and certain intermediates and lube base oils as they are produced. We carry inventories of crude oil, intermediates and refined products... -

Page 86

... as required by Exchange Act Rule 13a-15(b) as of December 31, 2012. Based on that evaluation, the Company's principal executive officer and the principal financial officer have concluded that the Company's disclosure controls and procedures are effective at the reasonable assurance level. 78 -

Page 87

...to materially affect, our internal control over financial reporting. This Annual Report on Form 10-K does not include a report of management's assessment regarding internal control over financial reporting or an attestation report of the Company's independent registered public accounting firm due to... -

Page 88

... be disclosed on the Company's website. See also Executive Officers of the Registrant under "Item 1. Business" of this Annual Report on Form 10-K. ITEM 11. EXECUTIVE COMPENSATION The information required under this Item will be contained in our 2013 Proxy Statement, incorporated herein by reference... -

Page 89

... and Restated Products Offtake Agreement, dated as of October 11, 2012, between Morgan Stanley Capital Group Inc., PBF Holding Company LLC and Paulsboro Refining Company LLC (Incorporated by reference to Exhibit 10.25.1 filed with PBF Energy Inc.'s Amendment No. 4 to Registration Statement on Form... -

Page 90

... PBF Energy Inc.'s Amendment No. 3 to Registration Statement on Form S-1 (Registration No. 333-177933)) Second Amended and Restated Revolving Credit Agreement dated as of October 26, 2012, among PBF Holding Company LLC, Delaware City Refining Company LLC, Paulsboro Refining Company LLC and Toledo... -

Page 91

Number Description 10.8.1 Amendment No. 1 and Increase Joinder Agreement to Second Amended and Restated Revolving Credit Agreement, dated as of December 28, 2012, entered into by and among PBF Holding Company LLC, Delaware City Refining Company LLC, Paulsboro Refining Company LLC and Toledo ... -

Page 92

...of PBF Energy Inc. Consent of Deloitte & Touche LLP Consent of KPMG LLP Power of Attorney (included on signature page) Certification by Chief Executive Officer pursuant ... granted by the SEC as to certain portions, which portions have been omitted and filed separately with the SEC. (1) This exhibit... -

Page 93

... of Equity For the Years Ended December 31, 2012, 2011 and 2010 ...Consolidated Statements of Cash Flows For the Years Ended December 31, 2012, 2011 and 2010 ...Notes to Consolidated Financial Statements ...PBF Energy Inc. Quarterly Financial Data ...Financial Statements of Paulsboro Refining... -

Page 94

... balance sheets of PBF Energy Inc. and subsidiaries (combined and consolidated with PBF Energy Company LLC and subsidiaries) (the "Company") as of December 31, 2012 and 2011, and the related combined and consolidated statements of operations, comprehensive income (loss), equity, and cash flows... -

Page 95

... (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE DATA) December 31, 2012 2011 ASSETS Current assets: Cash and cash equivalents ...Accounts receivable ...Inventories ...Deferred tax asset ...Prepaid expenses and... -

Page 96

...CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT SHARE DATA) 2012 Year ended December 31, 2011 2010 Revenues ...Costs and expenses Cost of sales, excluding depreciation ...Operating expenses, excluding depreciation ...General and... -

Page 97

... WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (IN THOUSANDS) Year ended December 31, 2012 2011 2010 Net income (loss) ...Other comprehensive income (loss): Unrealized gain on available for sale securities ...Amortization of defined benefit... -

Page 98

... PBF Energy Company LLC units from former controlling interest holders ...- Record deferred tax assets and liabilities and tax receivable agreement obligation ...- Record initial allocation of noncontrolling interest upon completion of initial public offering ...- Exchange of PBF Energy Company LLC... -

Page 99

......Deferred revenue ...Other assest and liabilities ...Net cash provided by (used in) operations ...Cash flows from investing activities Acquisition of Toledo refinery, net of cash received from sale of assets ...Acquisition of Paulsboro refinery and pipeline ...Acquisition of Delaware City refinery... -

Page 100

... operates oil refineries and related facilities in North America. Delaware City Refining Company LLC, Delaware Pipeline Company LLC, PBF Power Marketing LLC, Paulsboro Refining Company LLC, Paulsboro Natural Gas Pipeline Company LLC and Toledo Refining Company LLC are PBF LLC's principal operating... -

Page 101

... offering price of $26.00 per share. The IPO closed on December 18, 2012. PBF Energy used proceeds from the offering in the amount of $571.2 million to purchase 21,967,686 PBF LLC Series A Units from funds affiliated with The Blackstone Group L.P. and First Reserve Management, L.P., PBF LLC's F-9 -

Page 102

... owners ...Purchase newly-issued PBF LLC Series C Units ...PBF Energy Inc.net proceeds ...PBF Energy Company LLC Gross proceeds from sale of PBF LLC Series C Units to PBF Energy ...Use of Proceeds: IPO related expenses, including aggregate underwriting discounts of $33,700 ...PBF Energy Company LLC... -

Page 103

... WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 1- ORGANIZATION AND BASIS OF PRESENTATION (Continued) Noncontrolling Interest As a result of the IPO and the related reorganization transactions, PBF Energy is... -

Page 104

... the recognition of deferred tax assets and liabilities and the tax receivable agreement obligation in connection with the IPO. Comprehensive income includes net income and other comprehensive income arising from activity related to the Company's defined benefit employee benefit plan and unrealized... -

Page 105

... 16, 2010, PBF LLC was considered to be in the development stage. With the acquisition of the Paulsboro refinery and commencement of refining operations on December 17, 2010, it ceased to be a development stage company. Use of Estimates The preparation of the financial statements in conformity with... -

Page 106

... production. The Toledo refinery also sells its products through short-term contracts or on the spot market. The Company's Paulsboro and Delaware City refineries sell light finished products, certain intermediates and lube base oils to MSCG under products offtake agreements with each refinery (the... -

Page 107

... Paulsboro refinery effective March 31, 2013. On October 31, 2012, the Delaware City crude supply agreement was amended and modified to among other things, allow the Company to directly purchase U.S. and Canadian onshore origin crude oil and feedstock that is delivered to the Delaware City refinery... -

Page 108

... PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Inventory (Continued) Company took title to the crude oil as it was delivered to the refinery processing... -

Page 109

.... Stock-Based Compensation Stock-based compensation includes the accounting effect of options to purchase PBF Energy Class A common stock granted by the Company to certain employees, Series A warrants issued or granted by PBF LLC to employees in connection with their acquisition of PBF LLC Series... -

Page 110

...ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Stock-Based Compensation (Continued) restricted PBF LLC Series A Units granted by PBF LLC to certain directors... -

Page 111

... AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Pension and Other Post-Retirement Benefits PBF Energy recognizes an asset for... -

Page 112

...WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN...operating activities. Economic hedges are hedges not designated as fair value or cash flow hedges for accounting purposes that are used to (i) manage price volatility in certain refinery feedstock and refined... -

Page 113

... PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 3 - ACQUISITIONS Toledo Acquisition On March 1, 2011, a subsidiary of the Company completed the acquisition of the Toledo refinery in Ohio from Sunoco. The Toledo... -

Page 114

...agreements with subsidiaries of Valero Energy Corporation ("Valero") to acquire its Paulsboro, New Jersey refining business. The purchase price of $364,911 included $357,657 for the refinery, which has a crude oil throughput capacity of 180,000 barrels per day, and an associated natural gas pipeline... -

Page 115

... April 2010, subsidiaries of the Company entered into an asset purchase agreement with subsidiaries of Valero to acquire refining and pipeline assets of Valero's Delaware City refinery. The acquired assets included the idled refinery, which has a crude oil throughput capacity of 190,000 barrels per... -

Page 116

...COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 3 - ACQUISITIONS (Continued) Delaware City Acquisition (Continued) does not purport to present what the Company's actual results would... -

Page 117

... a counterparty that the Company will repurchase; and light finished products sold to a counterparty in connection with the offtake agreement and stored in the Paulsboro and Delaware City refineries' storage facilities pending shipment by the counterparty. At December 31, 2012 and December 31, 2011... -

Page 118

...AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 6 - DEFERRED CHARGES AND OTHER ASSETS, NET (Continued) The Company recorded amortization expense related to deferred... -

Page 119

PBF ENERGY INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 8 - DELAWARE ECONOMIC DEVELOPMENT AUTHORITY LOAN In June 2010, in connection with the Delaware City ... -

Page 120

...INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 9 - CREDIT FACILITY AND LONG-TERM DEBT (Continued) Revolving Loan (Continued) the Applicable Margin, as defined... -

Page 121

... WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 9 - CREDIT FACILITY AND LONG-TERM DEBT (Continued) Catalyst Leases (Continued) was $267. This lease was amended in December 2012 to extend the maturity date to... -

Page 122

... PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 9 - CREDIT FACILITY AND LONG-TERM DEBT (Continued) Debt Maturities Debt maturing in the next five years and thereafter is as follows: Year Ending December 31, 2013... -

Page 123

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 11 - STOCKHOLDERS' AND MEMBERS' EQUITY STRUCTURE (Continued) Class B Common Stock Holders of shares of Class... -

Page 124

.... 12 - STOCK-BASED COMPENSATION Stock-based compensation expense included in general and administrative expenses consisted of the following: Years Ended December 31, 2012 2011 2010 PBF LLC Series A Unit compensatory warrants and options ...PBF LLC Series B Units ...PBF Energy options ... $1,589... -

Page 125

...the IPO of PBF Energy. A total of 205,000 and 620,000 options to purchase PBF LLC Series A units were granted to certain employees, management and directors, in 2012 and 2011, respectively. Options vest over equal annual installments on each of the first three anniversaries of the grant date subject... -

Page 126

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 12 - STOCK-BASED COMPENSATION (Continued) PBF LLC Series A warrants and options (Continued) The following... -

Page 127

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 12 - STOCK-BASED COMPENSATION (Continued) PBF LLC Series B Units (Continued) The following table summarizes... -

Page 128

... COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 12 - STOCK-BASED COMPENSATION (Continued) PBF Energy options (Continued) The following table summarizes activity for PBF Energy options for the year ended December 31, 2012... -

Page 129

...AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 13 - INCOME TAXES (Continued) The provision for (benefit from) income taxes consisted of: For the Year Ended December 31, 2012 Current expense... -

Page 130

... Federal ...New Jersey ...Delaware ...Ohio ...The Company does not have any unrecognized tax benefits. 14 - RELATED PARTY TRANSACTIONS The Company engaged Fuel Strategies International, Inc, the principal of which is the brother of the Executive Chairman of the Board of Directors of the Company, to... -

Page 131

...automatic annual renewals, unless canceled. Under some of the agreements, certain of the executives would receive a lump sum payment of between one and a half to 2.99 times of their base salary and continuation of certain employee benefits for the same period upon termination by the Company "Without... -

Page 132

...rata basis to its owners, which currently include PBF Energy, which holds a 24.4% interest, and PBF LLC Series A Unit holders who hold a 75.6% interest in PBF LLC. Accordingly, based on current ownership percentages, the total cash payments related to the Tax Receivable Agreement, including pro-rata... -

Page 133

PBF ENERGY INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 16 - EMPLOYEE BENEFIT PLANS (Continued) Defined Contribution Plan (Continued) their annual salary ... -

Page 134

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 16 - EMPLOYEE BENEFIT PLANS (Continued) Defined Benefit and Post Retiree Medical Plans (Continued) The changes... -

Page 135

... WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 16 - EMPLOYEE BENEFIT PLANS (Continued) Defined Benefit and Post Retiree Medical Plans (Continued) The Company's funding policy for its defined benefit plans... -

Page 136

.... AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 16 - EMPLOYEE BENEFIT PLANS (Continued) Defined Benefit and Post Retiree Medical Plans (Continued) The following... -

Page 137

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 16 - EMPLOYEE BENEFIT PLANS (Continued) Defined Benefit and Post Retiree Medical Plans (Continued) Assumed... -

Page 138

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 17 - FAIR VALUE MEASUREMENTS (Continued) Level 1 As of December 31, 2011 Level 2 Level 3 Total Assets: Money... -

Page 139

...PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 18 - DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company uses derivative instruments to mitigate certain exposures to commodity price risk. The Company's crude... -

Page 140

... INC. AND SUBSIDIARIES (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 18 - DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES (Continued) The Company's policy is to net the fair value... -

Page 141

... (COMBINED AND CONSOLIDATED WITH PBF ENERGY COMPANY LLC AND SUBSIDIARIES) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (IN THOUSANDS, EXCEPT SHARE, UNIT AND BARREL DATA) 19 - REVENUES The following table provides information relating to the Company's revenues from external customers for each... -

Page 142

... tax (based on a 39.5% effective tax rate) attributable to the converted units. Dilutive earnings per share excludes the effects of options to purchase 682,500 shares of PBF Energy Class A common stock because they are anti-dilutive. 21 - SUBSEQUENT EVENTS Toledo Refinery Fire On January 30, 2013... -

Page 143

...31 (c) Revenues ...Income (loss) from operations ...Net ...2012, PBF Energy Inc. completed an initial public offering which closed on December 18, 2012. (b) The Company acquired the Toledo refinery on March 1, 2011 from Sunoco. (c) In October 2011 the Delaware City refinery became fully operational... -

Page 144

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of PBF Holding Company LLC: We have audited the accompanying balance sheet of the Paulsboro Refining Business as of December 16, 2010, and the related statement of income, changes in net parent investment, and cash flows... -

Page 145

PAULSBORO REFINING BUSINESS BALANCE SHEET (In thousands) December 16, 2010 ASSETS Current assets: Restricted cash ...Accounts receivable, net ......lease obligation ...Accounts payable ...Accrued expenses ...Taxes other than income taxes ...Total current liabilities ...Capital lease obligation,... -

Page 146

PAULSBORO REFINING BUSINESS STATEMENT OF INCOME (In thousands) Period from January 1, 2010 through December 16, 2010 Operating revenues ...Costs and expenses: Cost of sales ...Operating expenses ...General and administrative expenses ...Asset impairment loss ...Depreciation and amortization expense... -

Page 147

PAULSBORO REFINING BUSINESS STATEMENT OF CHANGES IN NET PARENT INVESTMENT (In thousands) Balance as of January 1, 2010 ...Net loss ...Net cash advances from parent ...Balance as of December 16, 2010 ...$1,083,268 (691,751) 76,106 $ 467,623 See accompanying notes to the financial statements. F-55 -

Page 148

PAULSBORO REFINING BUSINESS STATEMENT OF CASH FLOWS (In thousands) Period from January 1, 2010 Through December 16, 2010 Cash flows from operating activities: Net income (loss) ...Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and ... -

Page 149

... western Pennsylvania and Ohio, a local truck rack owned by NuStar Energy L.P., railcars, and the Colonial pipeline, which allowed products to be sold into the New York Harbor market. The Paulsboro Refinery was acquired by a subsidiary of Valero Energy Corporation (Valero) from Mobil Oil Corporation... -

Page 150

... reviewed its estimates based on currently available information. Changes in facts and circumstances could result in revised estimates. Inventories Inventories represent inventories located at the refinery and consisted of refinery feedstocks purchased for processing, refined products, and materials... -

Page 151

PAULSBORO REFINING BUSINESS NOTES TO FINANCIAL STATEMENTS-(Continued) asset is not recoverable, an impairment loss is recognized in an amount by which its carrying amount exceeds its fair value, with fair value determined based on discounted estimated net cash flows or other appropriate methods. On ... -

Page 152

... the tax reporting for the Business as a stand-alone taxpayer. The Business elected to classify any interest expense and penalties related to the underpayment of income taxes in income tax expense. Segment Disclosures The Business operated in only one segment, the refining segment of the oil and gas... -

Page 153

PAULSBORO REFINING BUSINESS NOTES TO FINANCIAL STATEMENTS-(Continued) 3 - SALE OF BUSINESS On December 17, 2010, the Business was sold to PBF...thousands): December 16, 2010 Refinery feedstocks ...Refined products and blendstocks ...Materials and... Land ...Crude oil processing facilities ...Buildings... -

Page 154

... ...Uncertain income tax position liabilities ...Employee wage and benefit costs ...Other ...Total ... $3,500 1,405 625 - 501 15 $6,046 $ 7,867 11,459 1,983 1,981 - - $23,290 Environmental Liabilities In connection with the acquisition of the Paulsboro Refinery in 1998, Valero assumed certain... -

Page 155

... June 23, 2011, Valero and several of its subsidiaries are named in numerous cases involving claims related to MTBE contamination in groundwater based on the manufacture, marketing and supply of gasoline containing MTBE. With respect to the historic operations at the Paulsboro Refinery, ten of these... -

Page 156

... industry companies. Valero is being sued primarily as a refiner and distributor of MTBE and gasoline containing MTBE. Valero does not own or operate gasoline station facilities in most of the geographic locations in which damage is alleged to have occurred. The lawsuits generally seek individual... -

Page 157

PAULSBORO REFINING BUSINESS NOTES TO FINANCIAL STATEMENTS-(Continued) 9 - INCOME TAXES The amounts presented below relate only to the Business and were calculated as if the Business filed separate federal and state income tax returns. Components of income tax expense (benefit) were as follows (in ... -

Page 158

... liabilities were as follows (in thousands): December 16, 2010 Deferred income tax assets: Tax credit carryforwards ...Net operating losses (NOL) ...Environmental liabilities ...Compensation and employee benefit liabilities ...Property, plant and equipment ...Other assets ...Total deferred income... -

Page 159

...the purchase of feedstocks by the Business from Valero, operating revenues received by the Business from its sales of refined products to Valero, and the allocation of insurance and security costs and certain general and administrative costs from Valero to the Business. Purchases of feedstock by the... -

Page 160

... to the Business for the periods presented, with this allocation based on investments in property, operating revenues, and payroll expenses. Management believed that the amount of general and administrative expenses allocated to the Business was a reasonable approximation of the costs related... -

Page 161

... the undersigned, thereunto duly authorized. PBF ENERGY INC. (Registrant) By: /s/ Thomas J. Nimbley (Thomas J. Nimbley) Chief Executive Officer (Principal Executive Officer) Date: February 28, 2013 POWER OF ATTORNEY Each of the officers and directors of PBF Energy Inc., whose signature appears below... -

Page 162

Signature Title Date /s/ David I. Foley (David I. Foley) /s/ Dennis Houston (Dennis Houston) /s/ Edward F. Kosnik (Edward F. Kosnik) /s/ Neil A. Wizel (Neil A. Wizel) Director February 28, 2013 Director February 28, 2013 Director February 28, 2013 Director February 28, 2013 -

Page 163

Exhibit 10.22 PBF ENERGY INC. 2012 EQUITY INCENTIVE PLAN RESTRICTED STOCK AGREEMENT FOR DIRECTORS THIS AGREEMENT (the "Agreement"), is made effective as of the date set forth on the signature page hereto (the "Date of Grant"), between PBF Energy Inc. (the "Company") and the individual named on the ... -

Page 164

... Directors, in consultation with the Chief Executive Officer, so determines, upon retirement, and (E) by the Grantee for Good Reason. (d) Ownership of Shares. Subject to the restrictions set forth in the Plan and this Agreement, the Grantee shall possess from Date of Grant all incidents of ownership... -

Page 165

...PBF Energy Inc. 2012 Equity Incentive Plan, as amended from time to time, and an agreement entered into between the registered owner and the Company, copies of which are on file at the principal offices of the Company... the Company's obligations for the payment of such withholding or other taxes. The... -

Page 166

... the laws of the state of Delaware without regard to conflicts of laws. 10. Arbitration. Any dispute with regard to the enforcement of this Agreement shall be exclusively resolved by a single experienced arbitrator licensed to practice law in the State of New York, selected in accordance with the... -

Page 167

... such counsel, at the Company's expense, in resisting or otherwise responding to such order or process), (ii) disclosing information and documents to his attorney or tax adviser for the purpose of securing legal or tax advice, (iii) disclosing the post-employment restrictions in this Agreement to... -

Page 168

...by the parties hereto. PBF ENERGY INC. By Name: Title: [NAME OF GRANTEE] The Date of Grant is . ]. ] per Share. The number of Restricted Shares is [ The Fair Market Value on the date of grant shall be $[ Subject to the Grantee's continued service or employment with the Company Group through the... -

Page 169

...reported in Item 5 The undersigned taxpayer will files this election with the Internal Revenue Service office with which taxpayer files his or her annual income tax return not later than 30 days after the date of transfer of the property. A copy of the election also will be furnished to the Company... -

Page 170

... Company LLC PBF Holding Company LLC PBF Services Company LLC PBF Investments LLC Delaware City Refining Company LLC Delaware Pipeline Company LLC PBF Power Marketing LLC Paulsboro Natural Gas Pipeline Company LLC Paulsboro Refining Company LLC Toledo Refining Company LLC PBF Finance Corporation PBF... -

Page 171

... No. 333-185968 on Form S-8 of our report dated February 28, 2013 relating to the combined and consolidated financial statements of PBF Energy Inc. and subsidiaries (combined and consolidated with PBF Energy Company LLC and subsidiaries) as of December 31, 2012 and 2011 and for each of the three... -

Page 172

... Accounting Firm The Board of Directors PBF Energy Inc. We consent to the incorporation by reference in the registration statement on Form S-8 (Registration No. 333-185968) of PBF Energy Inc. of our reported dated June 23, 2011, with respect to the balance sheet of Paulsboro Refining Business as of... -

Page 173

... TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Thomas J. Nimbley, certify that: 1. I have reviewed this annual report on Form 10-K of PBF Energy Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary... -

Page 174

... 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Matthew C. Lucey, certify that: 1. I have reviewed this annual report on Form 10-K of PBF Energy Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the... -

Page 175

...results of operations of the Company. Date: February 28, 2013 /s/ Thomas J. Nimbley Thomas J. Nimbley Chief Executive Officer (Principal Executive Officer) A signed original of the written statement required by Section 906 has been provided to PBF Energy Inc. and will be retained by PBF Energy Inc... -

Page 176

... and results of operations of the Company. Date: February 28, 2013 /s/ Matthew C. Lucey Matthew C. Lucey Senior Vice President, Chief Executive Officer (Principal Financial Officer) A signed original of the written statement required by Section 906 has been provided to PBF Energy Inc. and will... -

Page 177

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 178

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 179

... & TRUST COMPANY Operations Center 6201 15th Avenue Brooklyn, NY 11219 (800) 937-5449 www.amstock.com AUDITORS Deloitte & Touche LLP CORPORATE OFFICERS Thomas J. Nimbley Chief Executive Officer BOARD OF DIRECTORS Thomas D. O'Malley Executive Chairman Spencer Abraham Member of Compensation and... -

Page 180