Omron 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

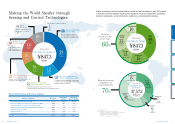

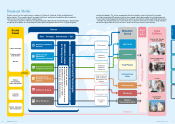

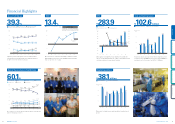

Financial Highlights

ROIC Cash and Cash EquivalentsGross Profit Margin

Ratio of Overseas Sales to Total Net Sales

EPS

Capital Expenditures

¥283.9

Omron paid a record-high ¥71 per-share dividend for fiscal 2014. We

expect to record a dividend payout ratio of 30% for fiscal 2015, achieving

our stated commitment one year ahead of schedule.

-150

0

150

100

50

250

200

-100

-50

300

0

40

20

60

80

100

120

1408 09 10 11 12 13

25.0%

71

FY

283.9

209.8

(Yen) (%)

Earnings per share

Cash dividends per share Dividend payout ratio

106.4%

24.7%

37.6%

27.0% 25.3%

-132.2

25 16.0 17

121.7

30

74.5

28

137.2

37 53

¥102.6

billion

We prioritize cash allocation to growth investments designed to achieve

our long-term vision (VG2020) goals. We forecast a total of ¥10 0 billion in

investments over the three years of our EARTH-1 STAGE plan.

0

60

90

30

120

1408 09 10 11 12 13

0

102.6102.6

53.0

46.646.6

36.6

51.751.7

45.5

74.774.7

18.8

45.345.3

5.6

0.5

55.755.7

90.390.3

FY

(Billions of yen)

Total interest-bearing liabilities

Cash and cash equivalents

(%)

Our expected cost of capital for the EARTH-1 STAGE is set at 6%.

ROIC management has led to fiscal 2014 ROIC significantly higher

than our expected cost of capital.

13.4

%

-10

0

5

10

-5

15

1408 09 10 11 12 13

-7.6

13.4

1.0

7.8

4.8

8.6

11.3

FY

Return on invested capital (ROIC)

Expected cost of

capital 6%

*Invested capital represents prior year-end actual

and average of current year quarterly forecasts

ROIC= Net Income

Invested Capital*

(Net Assets + Interest-Bearing Debt)

10.2

0.92.5

7.86.57.0

8.8

0

20

10

40

30

50

1408 09 10 11 12 13

39.339.3

23.4

34.8

34.8

26.225.4

23.023.523.4

6.85.7

7.77.2

6.76.76.2

23.5

35.1

35.1

37.5

37.536.836.837.137.138.5

38.5

(%)

FY

Significant growth in IAB segment revenues and profits drive

earnings improvement. Operating income margin breaks above

the

10% level for the first time in 25 years.

39.3

%

Selling, general and administrative expenses ratio (excluding R&D expenses)

R&D expenses ratio Operating income margin

Gross profit margin

(%)

We continue to see revenue growth in Greater China, Southeast Asia,

and other emerging economies.

60.1

%

Greater China

Japan

Asia Pacific

EuropeAmericas

Direct Exports

Overseas Total

0

40

50

30

20

10

60

1408 09 10 11 12 13

49.7

50.3 49.3

51.4

48.647.8

52.251.1

48.9

44.6

55.4

39.9

60.1

50.7

FY

12.8

12.0

6.4

2.01.91.61.8

2.07.6

1.6

16.414.8

11.7 12.0

15.7

8.1

13.7

12.1

16.3

8.5

13.5

16.3

8.4

12.413.1

18.4

1.5

9.3

21.4

9.8

12.8

14.6

14.7

¥38.1

billion

Omron plans to steadily increase capital expenditures toward sustained

growth.

0

20

30

10

40

1408 09 10 11 12 13

28.3

38.1

36.8

33.5

27.0

19.5

23.2 23.0

28.3

22.6

28.3

22.5

25.1

33.7

FY

(Billions of yen)

Depreciation and amortization

Capital expenditures

Integrated Report 2015 15

14 OMRON Corporation

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section