Omron 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4. Future Goals

■

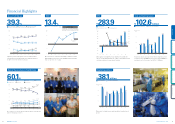

Three-Year Total Shareholder Return Comparison*2

*2 Three-year stock trend after dividend adjustments

(March 30, 2012 = 100)

Source: Internal data; Bloomberg

2012

/3/30

2015/3/

31

2012/6/30

2013/6/30

2012/9/30

2012/12/31

2013/9/30

2013/12/31

2013/3/31

2014/6/30

2014/9/30

2014/12/31

2014/3/31

50

100

150

200

250

300

350 TSR (Annual Rate)

Omron 47%

TOPIX Electric Appliances 24%

5. Building a Better Governance Structure

“We moved our plan for EARTH-1 STAGE

goals forward by 12 months”

■

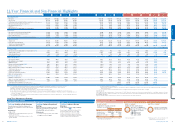

FY2015 Management Indicators

*3 Published April 24, 2014

FY

2014

Actual FY

2015

Plan EARTH-

1

STAGE Goals (FY

2016

)*

3

Net sales (¥ billion) 847.3900 > 900

Gross profit margin 39.3%39.6%> 40%

Operating income margin 10.2%10.0%> 10%

ROIC 13.4%> 13%approx. 13%

ROE 13.5%> 13%approx. 13%

EPS (¥) 283.9306.1approx. 290

USD rate (¥) 110.0

115.0

100.0

EUR rate (¥) 138.7

130.0

135.0

We have set fiscal 2015 targets for net sales

and operating income of ¥900 billion and ¥90

billion, moving our EARTH-1 STAGE goals up

by 12 months. We project earnings per share

to exceed our interim goal of ¥306 per share.

Similarly, we have set a target for dividend

payout ratio of 30% for fiscal 2015, 12 months

ahead of our original plan.

During fiscal 2015, we plan to work even

harder on our self-driven growth engine and

numerical targets:

(1) Achieve EARTH-1 STAGE goals one year

We believe that Omron can help solve social

issues through technology and innovation. This

is one reason why we established the new

position of chief technology officer (CTO) in April

2015. The mission of Omron’s CTO is to (1)

strengthen our core technologies, (2) promote

open innovation by working with outside entities,

and (3) develop new technologies looking toward

fiscal 2020 and beyond.

Kiichiro Miyata, formerly president of Omron

Healthcare, is serving as our CTO. Together with

CFO Yoshinori Suzuki—himself an experienced

corporate leader—and I as CEO, we plan to

guide the Omron Group as a unified team.

The business environment changes

dynamically and on a global scale. Geopolitical

risk, labor health and safety, procurement risk,

employee safety, and other business issues

are becoming more complex. So, with the

many new and evolving issues we face, we

have decided to place risk management and

legal affairs directly under the office of the

president to assure that proper attention is

given to these matters.

We published the new

Omron Corporate

Governance Policies

in response to the

June 2015 enactment of

Japan’s Corporate

Governance Code

. As a company, we

continue to observe and improve our stance

regarding governance as a good corporate

citizen should.

We want Omron to be a company valued and

appreciated by the people of the world. To do

this, we must build a strong corporate culture

that combines growth, profits, and the ability to

respond to change. Our long-term management

vision looks ahead to the year 2020 and far

beyond. For Omron to be a company valued by

the people of the world, we must continue to

endeavor. I ask you for your continued support

as we pursue this vision.

earlier than planned

(2) Sustain efforts toward higher profitability

(GP%)

(3) Increase sales and profits in all business

segments

Our goals for VG2020 (fiscal 2020) are

net sales of over ¥1 trillion and an operating

income margin of 15%. Ongoing investment

will be key in accomplishing these goals.

We will increase the size of our growth

investments, primarily in our Industrial

Automation Business and Healthcare

Business. We also plan to increase capital

investment in our Backlights Business, where

the market is growing at a tremendous clip.

Omron builds a self-driven growth structure

not affected by the ups and downs of external

market changes.

reported strong results, driving overall

performance to reach net sales of ¥847.3

billion and operating income of ¥86.6 billion.

Operating income margin came in at 10.2%,

surpassing the 10% level for the first time

in 25 years. We are steadily building a more

self-driven growth structure, particularly in

our Industrial Automation Business. At the

same time, we are building more earnings

capacity, creating a stronger portfolio of

businesses. ROIC jumped 2.1 points over the

prior fiscal year, reaching 13.4%.

In terms of shareholder value, we made

a significant repurchase of shares for the

first time in six years. During fiscal 2014, we

purchased 2.82 million shares, after which we

retired a total of 9.72 million shares including

treasury stock. Our dividends were a record

¥71 per share.

Total shareholder return (TSR) compared to

fiscal 2013 was up 29%. Over the past three

years, our TSR has been 47%, outperforming

the TOPIX average of 24% for the electric

appliances sector.

26 OMRON Corporation Integrated Report 2015 27

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section