Occidental Petroleum 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

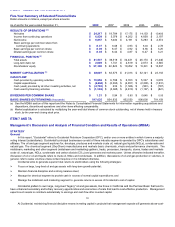

The average New York Mercantile Exchange (NYMEX) domestic natural gas price in 2008 increased approximately 27 percent from

2007. For 2008, NYMEX gas prices averaged $9.01 per Mcf compared with $7.12 per Mcf for 2007, but was $5.62 per Mcf as of December

31, 2008.

Business Review

All sales, production and reserves volumes are net to Occidental unless otherwise specified.

(thousands BOE/day)

In February 2008, Occidental purchased from Plains a 50-percent interest in oil and gas properties in the Permian Basin and western

Colorado for approximately $1.5 billion. In December 2008, Occidental purchased the remainder of Plains' interests in the same assets for

approximately $1.2 billion.

In June 2008, Occidental and its partner signed 30-year agreements (including a potential 5-year extension) with the Libyan National

Oil Company (NOC) to upgrade its existing petroleum contracts in Libya. The new agreements increased Occidental's after-tax economic

returns while allowing NOC and Occidental to design and implement major field redevelopment and exploration programs in the Sirte

Basin. Occidental will contribute 37.5 percent of the development capital. Under these contracts, Occidental will pay $750 million as its share

of a signature bonus. Occidental made its first payment in the amount of $450 million in June 2008. Occidental's remaining annual

payments of $150 million each, are due in each of the next two years.

Occidental conducts its operations in Qatar, Oman, Libya and Yemen and the Dolphin Project under PSCs. Under such contracts,

Occidental receives a share of production and reserves to recover its costs and generally an additional share for profit. In addition,

Occidental's share of production and reserves from THUMS, Tidelands and certain contracts in Colombia are subject to contractual

arrangements similar to a PSC. These contracts do not transfer any right of ownership to Occidental and reserves reported from these

arrangements are based on Occidental’s economic interest as defined in the contracts. Occidental’s share of production and reserves from

these contracts decreases when product prices rise and increases when prices decline. Overall, Occidental’s net economic benefit from these

contracts is greater when product prices are higher.

1. Elk Hills and other interests

2. Long Beach

3. Midcontinent / Rockies

4. Permian Basin

The Permian Basin extends throughout southwest Texas and southeast New Mexico and is one of the largest and most active oil

basins in the United States, with the entire basin accounting for approximately 19 percent of the total United States crude oil production.

Occidental is the largest producer of crude oil in the Permian Basin with an approximate 16-percent net share of the total production.

Occidental also produces and processes natural gas and NGLs in the Permian Basin.

A significant portion of Occidental's Permian Basin interests were obtained through the acquisition of Altura Energy Ltd. in 2000, as

well as the properties obtained from Plains in 2008 and 2006. Occidental's total share of Permian Basin oil and gas production was