Occidental Petroleum 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

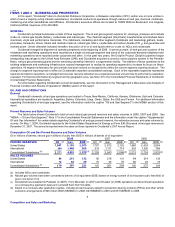

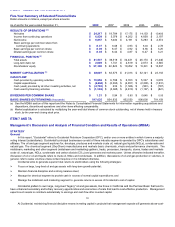

ITEM 6 SELECTED FINANCIAL DATA

Five-Year Summary of Selected Financial Data

Dollar amounts in millions, except per-share amounts

As of and for the years ended December 31, 2008 2007 2006 2005 2004

RESULTS OF OPERATIONS (a)

Net sales $24,217 $18,784 $17,175 $14,153 $10,400

Income from continuing operations $6,839 $5,078 $4,202 $4,838 $2,197

Net income $6,857 $5,400 $4,191 $5,293 $2,574

Basic earnings per common share from

continuing operations $8.37 $6.08 $4.93 $6.00 $2.78

Basic earnings per common share $8.39 $6.47 $4.92 $6.56 $3.25

Diluted earnings per common share $8.35 $6.44 $4.87 $6.47 $3.21

FINANCIAL POSITION (a)

Total assets $41,537 $36,519 $32,431 $26,170 $21,440

Long-term debt, net $2,049 $1,741 $2,619 $2,873 $3,345

Stockholders’ equity $27,300 $22,823 $19,252 $15,091 $10,597

MARKET CAPITALIZATION (b) $48,607 $63,573 $41,013 $32,121 $23,153

CASH FLOW

Cash provided by operating activities $10,652 $6,798 $6,353 $5,337 $3,878

Capital expenditures $(4,664)$(3,360)$(2,857)$(2,200)$(1,631)

Cash (used) provided by all other investing activities, net $(4,793)$232 $(1,526)$(961)$(797)

Cash used by financing activities $(1,382)$(3,045)$(2,819)$(1,187)$(821)

DIVIDENDS PER COMMON SHARE $1.21 $0.94 $0.80 $0.645 $0.55

BASIC SHARES OUTSTANDING (thousands) 817,635 834,932 852,550 806,600 791,159

(a) See the MD&A section of this report and the Notes to Consolidated Financial Statements for information regarding acquisitions and

dispositions, discontinued operations and other items affecting comparability.

(b) Market capitalization is calculated by multiplying the year-end total shares of common stock outstanding, net of shares held in treasury

stock, by the year-end closing stock price.

ITEM 7 AND 7A

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A)

STRATEGY

General

In this report, "Occidental" refers to Occidental Petroleum Corporation (OPC), and/or one or more entities in which it owns a majority

voting interest (subsidiaries). Occidental's principal businesses consist of three industry segments operated by OPC's subsidiaries and

affiliates. The oil and gas segment explores for, develops, produces and markets crude oil, natural gas liquids (NGLs), condensate and

natural gas. The chemical segment (OxyChem) manufactures and markets basic chemicals, vinyls and performance chemicals. The

midstream, marketing and other segment (midstream and marketing) gathers, treats, processes, transports, stores, trades and markets

crude oil, natural gas, NGLs, condensate and carbon dioxide (CO 2) and generates and markets power. Unless otherwise indicated hereafter,

discussion of oil or oil and liquids refers to crude oil, NGLs and condensate. In addition, discussions of oil and gas production or volumes, in

general, refer to sales volumes unless context requires or it is indicated otherwise.

Occidental aims to generate superior total returns to stockholders using the following strategies:

ØFocus on large, long-lived oil and gas assets with long-term growth potential;

ØMaintain financial discipline and a strong balance sheet;

ØManage the chemical segment to provide cash in excess of normal capital expenditures; and

ØManage the midstream and marketing segment to generate returns in excess of Occidental's cost of capital.

Occidental prefers to own large, long-lived "legacy" oil and gas assets, like those in California and the Permian Basin that tend to

have enhanced secondary and tertiary recovery opportunities and economies of scale that lead to cost-effective production. Management

expects such assets to contribute substantially to earnings and cash flow after invested capital.

10

At Occidental, maintaining financial discipline means investing capital in projects that management expects will generate above-cost-