OG&E 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reflected in the table under Item 2. Properties, approximately 3,850 MWs, or 58.0 percent, are from natural gas generation,

approximately 2,570 MWs, or 38.7 percent, are from coal generation and approximately 221 MWs, or 3.3 percent, are from wind

generation. Though the Company has a higher installed capability of generation from natural gas units, it has been more economical to

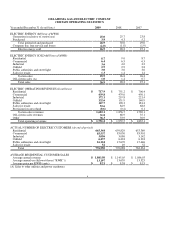

generate electricity for our customers using lower priced coal. Over the last five years, the weighted average cost of fuel used, by

type, per million British thermal unit (“MMBtu”) was as follows:

Year ended December 31 2009 2008 2007 2006 2005

Coal $ 1.65 $ 1.11 $ 1.10 $ 1.10 $ 0.98

Natural Gas $ 4.02 $ 8.40 $ 6.77 $ 7.10 $ 8.76

Weighted Average $ 2.50 $ 3.30 $ 3.13 $ 2.98 $ 3.21

The decrease in the weighted average cost of fuel in 2009 as compared to 2008 was primarily due to decreased natural gas

prices partially offset by increased coal transportation rates in 2009 as discussed in Note 12 of Notes to Financial Statements. The

increase in the weighted average cost of fuel in 2008 as compared to 2007 was primarily due to increased natural gas prices partially

offset by decreased amounts of natural gas being burned. The increase in the weighted average cost of fuel in 2007 as compared to

2006 was primarily due to increased natural gas volumes. The decrease in the weighted average cost of fuel in 2006 as compared to

2005 was primarily due to decreased natural gas prices partially offset by increased amounts of natural gas being burned. A portion of

these fuel costs is included in the base rates to customers and differs for each jurisdiction. The portion of these fuel costs that is not

included in the base rates is recoverable through the Company’s fuel adjustment clauses that are approved by the OCC, the APSC and

the FERC.

Coal

All of the Company’s coal-fired units, with an aggregate capability of approximately 2,570 MWs, are designed to burn low

sulfur western sub-bituminous coal. The Company purchases coal primarily under contracts expiring in years 2010, 2011 and 2015. In

2009, the Company purchased approximately 9.9 million tons of coal from various Wyoming suppliers. The combination of all coal

has a weighted average sulfur content of 0.27 percent and can be burned in these units under existing Federal, state and local

environmental standards (maximum of 1.2 lbs. of sulfur dioxide (“SO2”) per MMBtu) without the addition of SO2 removal

systems. Based upon the average sulfur content and EPA certified emission data, the Company’s coal units have an approximate

emission rate of 0.528 lbs. of SO2 per MMBtu, well within the limitations of the current provisions of the Federal Clean Air Act

discussed in Note 12 of Notes to Financial Statements.

In August 2009, the Company issued an RFP for coal supply purchases for periods from January 2011 through December

2015. The RFP process was completed during the fourth quarter of 2009 and resulted in two new coal contracts expiring in 2015. The

coal supply purchases account for approximately 50 percent of the Company’s projected coal requirements during that timeframe.

Additional coal supplies to fulfill the Company’s remaining 2011 through 2015 coal requirements will be acquired through additional

RFPs.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental

Laws and Regulations” for a discussion of environmental matters which may affect the Company in the future, including its utilization

of coal.

Natural Gas

In August 2009, the Company issued an RFP for gas supply purchases for periods from November 2009 through March

2010. The gas supply purchases from January through March 2010 account for approximately 18 percent of the Company’s projected

2010 natural gas requirements. The RFP process was completed on September 10, 2009. The contracts resulting from this RFP are

tied to various gas price market indices that will expire in 2010. Additional gas supplies to fulfill the Company’s remaining 2010

natural gas requirements will be acquired through additional RFPs in early to mid-2010, along with monthly and daily purchases, all

of which are expected to be made at market prices.

The Company utilizes a natural gas storage facility for storage services that allows the Company to maximize the value of its

generation assets. Storage services are provided by Enogex as part of Enogex’s gas transportation and storage contract with the

Company. At December 31, 2009, the Company had approximately 1.9 million MMBtu’s in natural gas storage valued at

approximately $7.3 million.

10