Nucor 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Nucor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

TO OUR STOCKHOLDERS

Fellow Stockholders:

I want to thank everyone on our teams at Nucor and our Harris Steel and David J.

Joseph (DJJ) operations for their excellent work in an economic environment that

remained extremely challenging in 2011. Together, we have continued to deliver on our

goal of Taking Care of Our Customers, which include our fellow teammates, the people

who buy and use our products, and you, our stockholders, who trust us to make the

most valuable use of your capital. We have done this by working and succeeding at being

the Safest, Highest Quality, Lowest Cost, Most Productive and Most Profitable steel and

steel products company.

The hard work of the Nucor team — along with our strong financial position and our

business model with its flexibility, diversification and sustainability — drove us to

improved results in 2011.

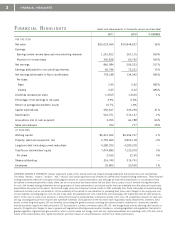

Financial Highlights

Earnings increased more than fivefold in 2011 to $778.2 million, or $2.45 per diluted share, compared with $134.1 million, or $0.42 per

diluted share, in 2010. Earnings remain significantly lower than they were during the five-year cyclical peak that ended in 2008.

Consolidated net sales increased 26% to $20.02 billion, compared with $15.84 billion in 2010. Average sales price per ton increased 21%,

while total tons shipped to outside customers increased 5%. The average scrap and scrap substitute cost per ton used increased 25%

to $439 from $351. Overall operating rates at our steel mills increased to 74% from 70%, which is still well under the pre-recession 91%

utilization rate for the first nine months of 2008.

In 2012, we expect to see continued growth in sales and earnings for Nucor, albeit in a slow-growth U.S. economy with a challenging

regulatory and business environment. Uncertainties in Europe’s financial sector, and its potential to impact the banks in other regions of the

world like the USA, will continue to weigh on global and domestic growth.

In December 2011, the board of directors authorized an increase to the regular quarterly cash dividend on our common stock to $0.365

per share from $0.3625 per share, continuing our record of increasing the base cash dividend every year since 1973, when Nucor began

paying cash dividends. Through the end of 2011,

Nucor has made 154 consecutive quarterly cash

dividend payments.

Growing Stronger in Tough Times

The nation’s economy continued to stumble in

2011, making this one of the longest and deepest

slumps in several generations. At year end, the U-6 unemployment rate, which includes people who have given up looking for

work or are underemployed, stood at 15.2%. That’s down from its peak in late 2010 but roughly double the rate in 2007. Adding

college graduates in low skill positions that do not utilize their education, the unemployment rate is likely closer to 18%.

The U.S. monthly trade deficit widened to over $50 billion over the summer, its highest level in more than 2.5 years, though it narrowed

somewhat later in the year. GDP growth was an anemic rate of under 2%. Nonresidential construction spending remained at 2010’s

depressed levels.

Daniel R. DiMicco

Chairman and

Chief Executive Officer

IN 2012, WE EXPECT TO SEE CONTINUED GROWTH IN SALES AND

EARNINGS FOR NUCOR, ALBEIT IN A SLOW-GROWTH U.S. ECONOMY WITH A

CHALLENGING REGULATORY AND BUSINESS ENVIRONMENT.

EARNINGS INCREASED MORE THAN FIVEFOLD IN 2011 TO $778.2 MILLION,

OR $2.45 PER DILUTED SHARE, COMPARED WITH $134.1 MILLION, OR $0.42

PER DILUTED SHARE, IN 2010.