North Face 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with investing in supply chain capabilities

that reduce cost and provide speed, exibility,

value and service.

+ Win with Winning Customers, by leveraging

consumer knowledge and global brand

expertise to grow our market shares and to

help our retail customers win with our global

and exclusive brands.

+ Lead in Innovation, fostering a global culture

of innovation across brands and functions,

supported by new processes, new skills and

talent, as well as new collaborative networks to

accelerate the pace of breakthrough product

introductions. You can read more about our

Innovation agenda on page .

e power of the VF portfolio—diversied, global

and growing—has never been more evident. We

enter with condence that brands will continue

their momentum, with conviction in our ability to

execute our plans, and with a great deal of excite-

ment about the many opportunities that lie ahead.

.

—

Chairman, President &

Chief Executive Ocer

to consumers’ needs and aspirations. Steve

Rendle, Vice President and Group President

—Outdoor & Action Sports Americas, and

Scott Baxter, Vice President and Group

President—Jeanswear Americas and Imagewear,

provide their perspectives on what it takes to

build strong brands beginning on page .

+ Go Global, by growing in both established and

emerging markets, with our eorts concentrated

in Europe, China, India, Brazil and Mexico,

with a goal of of total VF revenues from

international markets by . In , interna-

tional revenues were of total revenues, up

from in . Karl Heinz Salzburger, Vice

President and Group President—International,

discusses our international strategies in more

detail on page .

+ Serve Consumers Directly, growing direct-to-

consumer revenues to of total revenues by

adding branded retail stores and building stronger

consumer relationships through our websites

and social media. In , direct-to-consumer

revenues grew to of total revenues from

in . Mike Gannaway, Vice President—VF

Direct/Customer Teams, provides a deeper look

at our direct-to-consumer business on page .

+ Enable VF’s Future, through investing in our

people’s professional development with training,

tools and development opportunities, along

businesses, as our work to evolve Nautica®

products to a dierentiated, performance-based

positioning around water continues to pay o.

And our Kipling® brand is a fast-growing

and very protable success story in the U.S.

Healthy growth was also achieved by our Contem-

porary Brands coalition, where revenues rose by

in . Our For All Mankind ®, Splendid ®, Ella

Moss® and John Varvatos® brands all achieved

higher revenues during the year. Building these

brands’ direct-to-consumer businesses, including

new stores and e-commerce, continues to be an

important component of our growth plans, and

during the year direct-to-consumer revenues

for Contemporary Brands grew over .

A Roadmap for Growth

In early we updated our ve-year nancial

goals and strategic growth drivers. Simply stated,

we intend to deliver billion in revenue growth

and in earnings per share growth over the

next ve years. More specically, our goals are to

increase revenues and earnings per share by

and annually, respectively—goals which we

surpassed in .

Key to our success has been our focus on VF’s

core Growth Drivers, which now consist of:

+ Build Lifestyle Brands, by emphasizing activity-

based lifestyle brands that speak authentically

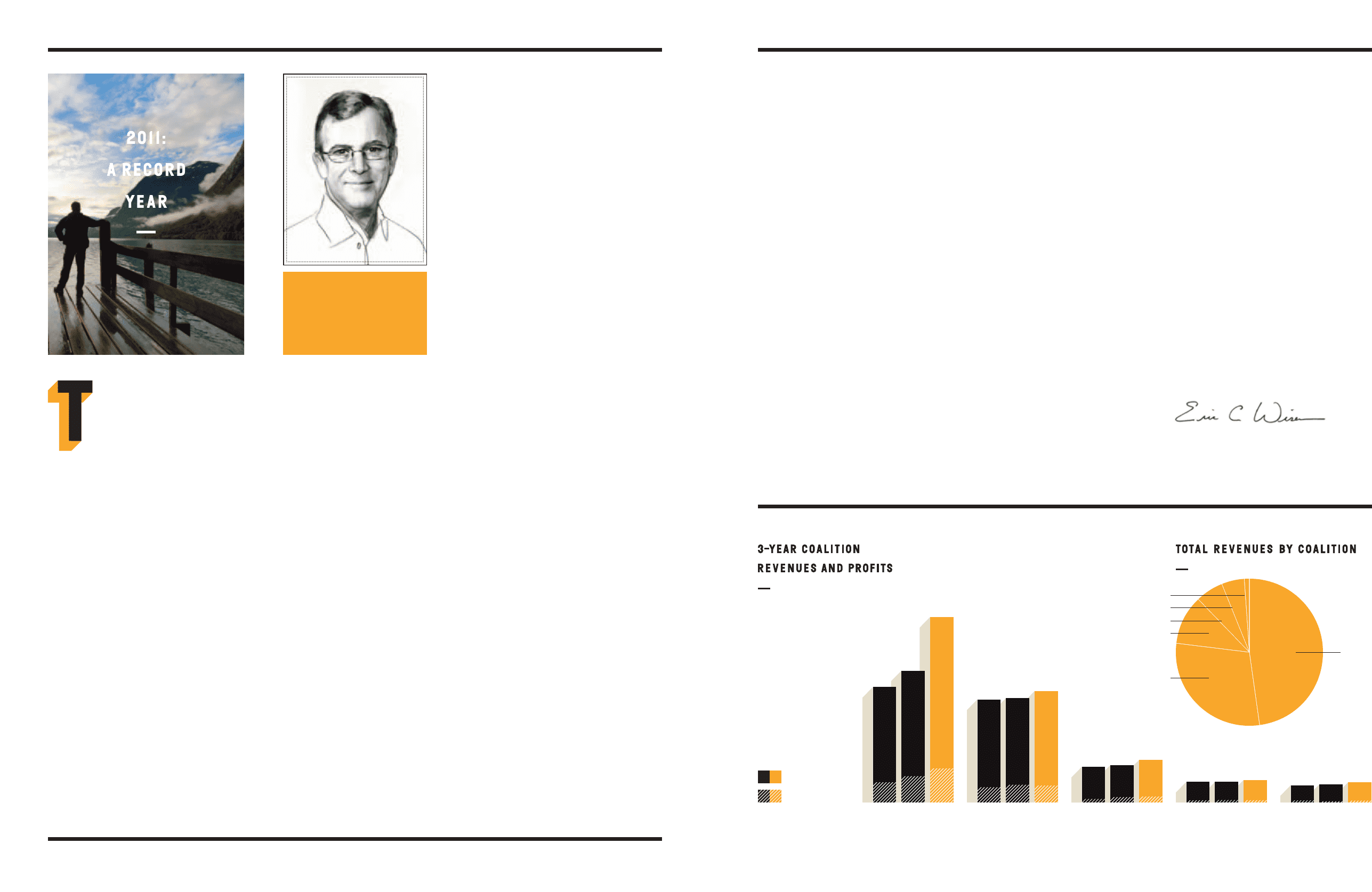

1009 11

Outdoor & Action Sports

1009 11

Jeanswear

1009 11

Imagewear

1009 11

Sportswear

1009 11

Contemporary Brands

$637

$493

$828

$3,205

$2,806

$4,562

$432

$371 $413

$2,538

$2,522

$2,732

$87 $111 $146

$909

$865 $1,025

$52$52 $56

$498$498 $544

$14

$51 $36

$439

$418 $485

Revenues

Profits

Dollars

in Millions

|

Outdoor

& Action

Sports29%

11%

Other

Contemporary Brands

Sportswear

1%

5%

48%

Imagewear

Jeanswear

6%

his was a year of records: record

revenues, record earnings and

record cash ow from operations.

e acquisition of e Timberland

Company for . billion also

marked a record for us, as the

largest acquisition in our company’s history. e

addition of two strong, authentic outdoor brands

—Timberland ® and Smartwool ®—demonstrates

our commitment to building the most powerful

portfolio of outdoor brands in the world.

VF’s total revenues in reached . billion,

up from the prior year. e Timberland

acquisition added more than million

to revenues. On an organic basis, excluding

Timberland, revenues grew by more than billion,

or , with solid growth across our Outdoor &

Action Sports, Jeanswear, Imagewear, Sportswear

and Contemporary Brands coalitions.

Earnings per share rose to ., an increase of

over earnings per share of . (excluding

a noncash impairment charge) in . For the

second consecutive year, cash ow from operations

exceeded billion. Our dividend remains a priority

for our use of cash ow, and marked the th

consecutive year of higher dividend payments

to shareholders.

We are very pleased that our shareholders have

been rewarded for our success. In , VF’s

stock price increased —hitting record highs

—versus at performance for the S&P Index.

Strong Brands Positioned

for Strong Growth

VF’s business model is designed to deliver

consistent, sustainable growth. e diversity of

our portfolio ensures we have strong brands in

place to engage consumers wherever they live,

work or shop. We rely on consumer insights to

guide our brand-building eorts, enabling us to

craft authentic brand experiences and build deep

connections with consumers around the world.

e performance of our coalitions in is a

testament to the power of our brands and the

talent of our teams.

In Outdoor & Action Sports, the momentum

continued in , with revenues rising by .

Our results benetted tremendously from the

Timberland acquisition, but we were just as

excited about the organic growth in revenues

achieved during the year. e North Face® and

Vans® brands had record years, with revenues for

each growing by more than . And for the

rst time in the brand’s history, Vans® revenues

surpassed the billion mark. We also saw

double-digit growth in our Kipling®, Napapijri®,

lucy®, Reef ® and Eastpak ® brands.

Jeanswear revenues rose in , with growth

both domestically and internationally. In the U.S.,

success in both our Lee® and Wrangler® brands

was driven by new product innovations, such as

the Lee Classic Fit and Premium Select lines.

e Lee® and Wrangler® businesses in the U.S.

each continued to gain market share in their

respective channels of distribution, and today are as

well-positioned for future growth as they have ever

been. Internationally, Jeanswear growth was fueled

by rapid expansion in Asia and strong growth in

South America, Mexico and Canada. Higher

product costs aected Jeanswear’s protability in

, but are beginning to subside, pointing to a

year of both top and bottom line growth in .

Revenues in our Imagewear business also exceeded

billion for the rst time in , with strength

in both the Image and Licensed Sports Group

businesses. Our protective apparel business,

powered by the Bulwark® brand, drove our

Image business up nearly in revenues for

the year. Our Licensed Sports Group business

benetted from strong growth in both Major

League Baseball and National Football League

fanwear and a growing women’s business.

Growth in our Nautica® and Kipling® (U.S.)

businesses drove growth in Sportswear

revenues in . e Nautica® brand enjoyed

gains in its sportswear, licensed and outlet

Timberland:

A Transformational Acquisition

With approximately . billion in expected annual

revenues, Timberland marks a new chapter for

VF. In , for the rst time, our Outdoor &

Action Sports coalition will account for more than

half of VF’s total revenues, up from in .

We’re targeting a annual revenue growth

rate for Timberland, or million in revenue

growth over the next ve years. Key initiatives

include developing and launching Timberland ®

apparel in the U.S.; building on the momentum

of the Timberland ® Earthkeepers® collection

of environmentally conscious products in both

footwear and apparel; continuing to grow the

core Timberland ® and Smartwool ® businesses

globally, leveraging our well-established

international platforms in Europe and China; and

driving growth and enhanced protability across

Timberland’s direct-to-consumer touchpoints,

including retail stores and e-commerce.

Timberland is a recognized leader in sustainability

—and our brands will benet from Timberland’s

long experience and track record of environmental

responsibility. Our two largest outdoor brands,

Timberland ® and e North Face®, are both

passionately committed to embedding sustain-

ability across their products and operations. As

authentic outdoor brands, they understand the

importance of getting consumers outside to

enjoy and appreciate the environment—and

to protect and conserve it for future generations.

|

.

—

Chairman,

President &

Chief Executive Ocer

his was a year of records: record

revenues, record earnings and

record cash ow from operations.

e acquisition of e Timberland

Company for . billion also

marked a record for us, as the

largest acquisition in our company’s history. e

addition of two strong, authentic outdoor brands

—Timberland ® and Smartwool ®—demonstrates

our commitment to building the most powerful

portfolio of outdoor brands in the world.

VF’s total revenues in reached . billion,

up from the prior year. e Timberland

acquisition added more than million

to revenues. On an organic basis, excluding

Timberland, revenues grew by more than billion,

or , with solid growth across our Outdoor &

Action Sports, Jeanswear, Imagewear, Sportswear

and Contemporary Brands coalitions.

Earnings per share rose to ., an increase of

over earnings per share of . (excluding

a noncash impairment charge) in . For the

second consecutive year, cash ow from operations

exceeded billion. Our dividend remains a priority

for our use of cash ow, and marked the th

consecutive year of higher dividend payments

to shareholders.

We are very pleased that our shareholders have

been rewarded for our success. In , VF’s

stock price increased —hitting record highs

—versus at performance for the S&P Index.

Strong Brands Positioned

for Strong Growth

VF’s business model is designed to deliver

consistent, sustainable growth. e diversity of

our portfolio ensures we have strong brands in

place to engage consumers wherever they live,

work or shop. We rely on consumer insights to

guide our brand-building eorts, enabling us to

craft authentic brand experiences and build deep

connections with consumers around the world.

e performance of our coalitions in is a

testament to the power of our brands and the

talent of our teams.

In Outdoor & Action Sports, the momentum

continued in , with revenues rising by .

Our results benetted tremendously from the

Timberland acquisition, but we were just as

excited about the organic growth in revenues

achieved during the year. e North Face® and

Vans® brands had record years, with revenues for

each growing by more than . And for the

rst time in the brand’s history, Vans® revenues

surpassed the billion mark. We also saw

double-digit growth in our Kipling®, Napapijri®,

lucy®, Reef ® and Eastpak ® brands.

Jeanswear revenues rose in , with growth

both domestically and internationally. In the U.S.,

success in both our Lee® and Wrangler® brands

was driven by new product innovations, such as

the Lee Classic Fit and Premium Select lines.

e Lee® and Wrangler® businesses in the U.S.

each continued to gain market share in their

respective channels of distribution, and today are as

well-positioned for future growth as they have ever

been. Internationally, Jeanswear growth was fueled

by rapid expansion in Asia and strong growth in

South America, Mexico and Canada. Higher

product costs aected Jeanswear’s protability in

, but are beginning to subside, pointing to a

year of both top and bottom line growth in .

Revenues in our Imagewear business also exceeded

billion for the rst time in , with strength

in both the Image and Licensed Sports Group

businesses. Our protective apparel business,

powered by the Bulwark® brand, drove our

Image business up nearly in revenues for

the year. Our Licensed Sports Group business

benetted from strong growth in both Major

League Baseball and National Football League

fanwear and a growing women’s business.

Growth in our Nautica® and Kipling® (U.S.)

businesses drove growth in Sportswear

revenues in . e Nautica® brand enjoyed

gains in its sportswear, licensed and outlet

Timberland:

A Transformational Acquisition

With approximately . billion in expected annual

revenues, Timberland marks a new chapter for

VF. In , for the rst time, our Outdoor &

Action Sports coalition will account for more than

half of VF’s total revenues, up from in .

We’re targeting a annual revenue growth

rate for Timberland, or million in revenue

growth over the next ve years. Key initiatives

include developing and launching Timberland ®

apparel in the U.S.; building on the momentum

of the Timberland ® Earthkeepers® collection

of environmentally conscious products in both

footwear and apparel; continuing to grow the

core Timberland ® and Smartwool ® businesses

globally, leveraging our well-established

international platforms in Europe and China; and

driving growth and enhanced protability across

Timberland’s direct-to-consumer touchpoints,

including retail stores and e-commerce.

Timberland is a recognized leader in sustainability

—and our brands will benet from Timberland’s

long experience and track record of environmental

responsibility. Our two largest outdoor brands,

Timberland ® and e North Face®, are both

passionately committed to embedding sustain-

ability across their products and operations. As

authentic outdoor brands, they understand the

importance of getting consumers outside to

enjoy and appreciate the environment—and

to protect and conserve it for future generations.

|

.

—

Chairman,

President &

Chief Executive Ocer