North Face 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|

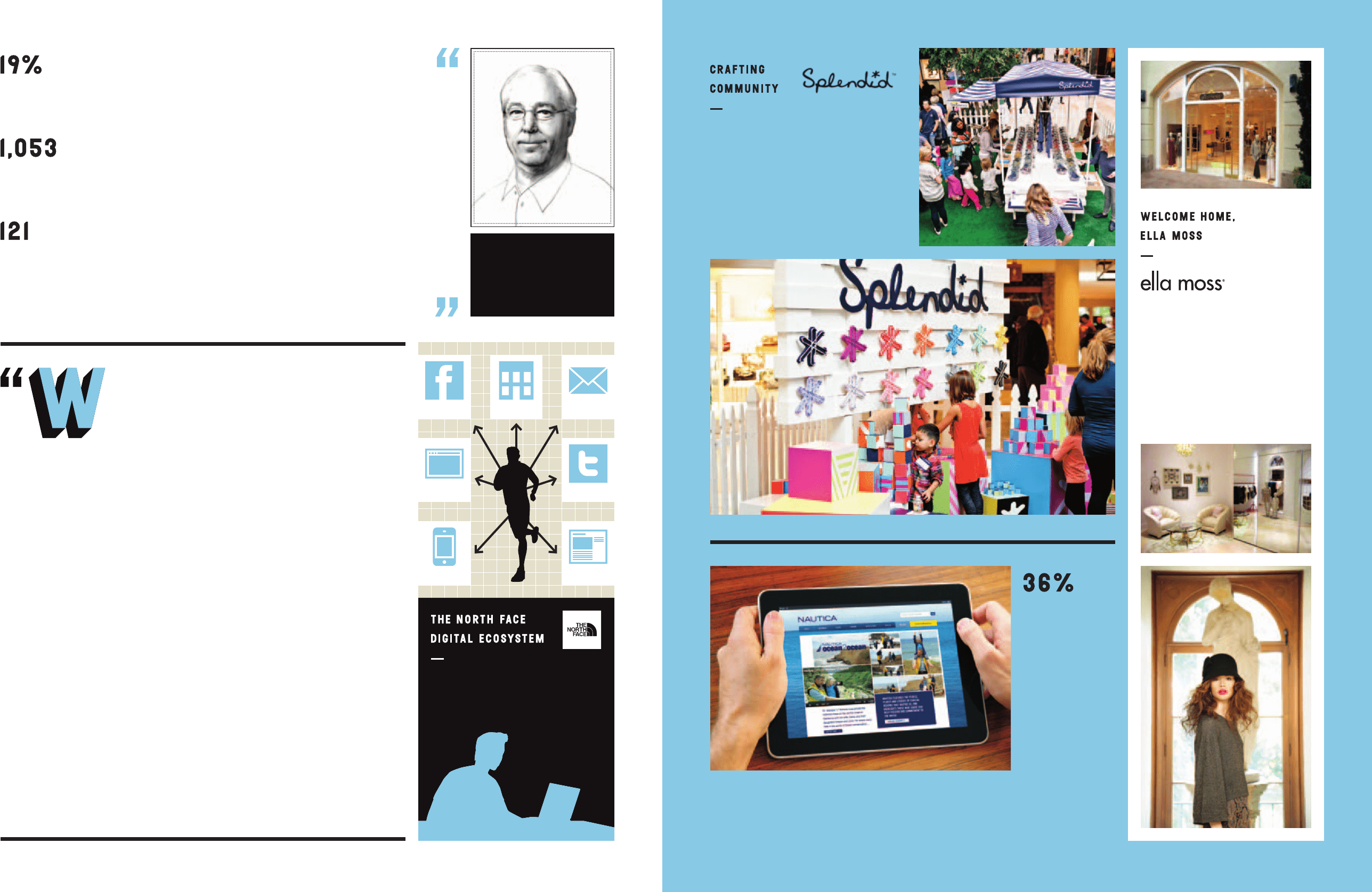

The first freestanding, owned Ella Moss®

retail store opened in Newport Beach,

California’s Fashion Island shopping center.

The 1,400-square-foot store features a

whimsical atmosphere designed to feel

like a girl’s dream closet, and gives

consumers the opportunity to shop all of

the brand’s feminine, playful collections:

Ella Moss, Ella Moss Girl and Little Ella.

e increase in VF’s

e-commerce revenues

in , excluding

Timberland

The Splendid ® brand’s “Crafting Community” pop-up

experience brought the everyday joy of handmade

crafts to new store openings in California and the

southwest U.S. At this “hands-on” event, consumers

get to experience the brand through crafting

workshops that use its famously soft fabrics to

create colorful bracelets, belts, necklaces, custom

scarves and even gardens.

e are making

signicant invest-

ments to become

leaders in connecting

our brands to their

consumers through

communications and commerce, both online and

in our owned stores,” says Gannaway. “e single

most important development impacting our brands’

direct-to-consumer business is the emergence of

the digital space and its impact on how consumers

connect with retailers, brands and each other.”

at video seamlessly blending storytelling

with sales is part of what e North Face calls

its “Digital Ecosystem,” a content distribution

platform that automatically pushes content out

to multiple media sources. You can see that ultra-

runners video (and countless others) on the brand’s

website, in a retail store, on a CRM e-mail, at a

dealer website, on an athlete’s personal blog, on

a social network such as Facebook ® or Twitter®,

or even through one of the brand’s apps. “We are

building towards true omni-channel connectivity,”

says Gannaway. “We’re putting consumers in the

center and making it easy for them to shop our

brands through any media they choose.” e

diversity of media also encourages a good balance

between organic content created by athletes and

product innovation messages created by the

brand itself. Other VF brands are applying this

consumer-centric approach in dierent ways. For

example, the Vans® brand takes a broader, more

decentralized approach built on its four cultural

pillars of art, music, action sports and street culture.

“We know that consumers want to interact with

the Vans® brand in a variety of dierent ways,”

says Steve Rendle, VF Vice President and Group

President—Outdoor & Action Sports Americas.

“Skateboarders want skateboarding. Punk rockers

want punk rock. Artists want art. We build for

each constituency, binding them all together under

a single umbrella of creative self-expression.” e

brand operates a network of dierent websites,

and numerous other programs and events built

for specic activities and interests.

e strategy is working. All VF brands in North

America had strong, double-digit e-commerce

growth in , with the Nautica®, For All

Mankind ®, Wrangler®, e North Face® and Vans®

brands performing exceptionally well. European

e-commerce sales grew by over as regional

e-commerce rollouts for the Kipling®, Napapijri ®,

Eastpak®, e North Face ® and for all Mankind ®

brands continued. e rst website for the Vans®

brand in Asia was launched in . While

still a small percentage of VF’s total revenues,

e-commerce is VF’s fastest growing channel, and

Gannaway believes there’s much more to come,

given the current momentum, additional regional

rollouts and increased knowledge-sharing among

the brands. “We share our expertise across brands

and geographies through our Direct-to-Consumer

Councils that identify and develop best practices

for adaptation by other brands,” says Gannaway.

“Each key region also has its own DTC Council,

which works with our DTC leadership team to

ensure best practice adaptation across regions and

a consistent approach to planning and reporting.”

—

Vice President—

VF Direct/

Customer Teams

We’re putting

consumers in

the center and

making it easy

for them to

shop our brands

through any

media they choose.

With the press of a button at its headquarters

in San Leandro, California, The North Face

can instantly share the best of its expedition

footage from around the globe with consumers

through a wide variety of digital touchpoints.

This centralized approach to content distribution

drives consistency in messaging to the global

regions, and allows the brand to link unique

content to product innovation messaging

as it hits thenorthface.com homepage, store

windows and traditional media outlets.

Twitter

Blogs

Facebook

Websites

Apps

|

Retail E-mail

VF’s revenues from its

direct-to-consumer

businesses

e number of owned retail

stores, exceeding , for

the rst time in VF’s history

New stores

opened in