Navy Federal Credit Union 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report from the Chairman and President

The year of 2007 was

one of incredible growth

at Navy Federal. Our

ongoing member service initia-

tives resulted in many records

being set and goals exceeded.

We delivered, and then some,

on our promises.

One key focus this year was

to improve member access by

expanding Navy Federal’s

branch and ATM networks and

by improving a member’s

experience when he or she

calls us. In terms of expansion,

we delivered 34 new branches,

surpassing the 31 we promised

in last year’s annual report, and

we installed 52 ATMs instead

of the promised 34.

Complementing branch

growth was the further exten-

sion of branch hours at more

locations, including adding

Saturdays and even Sundays in

some areas. We’ll continue to

evaluate service hours at

remaining locations in 2008.

We hired 2,800 employees

throughout 2007, many of

whom were needed for our

new branches and to

increase our call-handling

capabilities. Three million

more calls were handled this

year than in 2006, and wait

time was dramatically reduced.

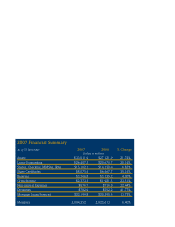

Our excellent financial

performance for the year takes

on even greater significance in

light of our expansion efforts.

Assets grew by 22% to reach

$33.0 billion, and membership

increased 6% to over three

million. Total loans increased

28% to $26.5 billion, and

savings increased by 16% to

$24.0 billion. And while we’re

not immune to the economy,

we’re pleased to report that we

processed 26% more mortgages

than in 2006. Our healthy

mortgage program reflects our

policy of not making sub-prime

loans and of guiding members

to mortgages that best meet

their needs.

Other key accomplishments

from 2007 include:

•We were top rated as a

credit card issuer for overall

member satisfaction by a leading

consumer magazine. We also

received top marks in a separate

independent study for being

one of the safest card issuers for

fraud prevention and resolution.

“We delivered,

and then some,

on our promises.

”

2Navy Federal

(Left to right)

John A. Lockard, Chairman

Cutler Dawson, President & CEO