Navy Federal Credit Union 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

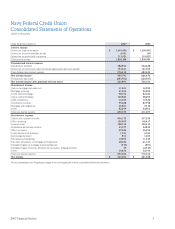

Navy Federal Credit Union

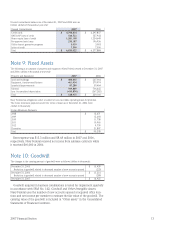

Consolidated Statements of Operations

(dollars in thousands)

2007 Financial Section 3

Years Ended December 31 2007 2006

Interest income

Interest on loans to members $ 1,661,456 $ 1,290,002

Interest on securities available-for-sale 6,931 169

Interest on securities held-to-maturity 213,921 219,822

Total interest income 1,882,308 1,509,993

Dividend and interest expense

Dividends to members 782,894 552,228

Interest on securities sold under repurchase agreements and notes payable 193,621 131,095

Total dividend and interest expense 976,515 683,323

Net interest income 905,793 826,670

Provision for loan losses (283,902) (120,567)

Net interest income after provision for loan losses 621,891 706,103

Non-interest income

Gain on mortgage loan sales, net 11,561 12,992

Mortgage servicing 51,293 50,292

Credit card interchange 98,196 82,323

Check card interchange 109,882 98,695

ATM convenience 16,457 17,522

Overdrawn check fee 95,428 87,758

Mortgage loan origination 25,861 7,312

Other 82,299 54,603

Total non-interest income 490,977 411,497

Non-interest expense

Salaries and employee benefits 436,172 337,220

Office operating 120,992 118,417

Loan servicing 128,316 120,213

Professional and outside services 53,377 34,832

Office occupancy 47,546 36,572

Loan protection life insurance 1,931 3,741

Life savings insurance 851 1,465

Education and marketing 19,809 11,639

Fair value adjustment of mortgage servicing assets 28,252 21,147

Unrealized (gain) on mortgage loans awaiting sale (537) (891)

Unrealized (gain)/loss from derivative and economic hedging activities 79 (2,537)

Other 39,874 34,194

Total non-interest expense 876,662 716,012

Net income $ 236,206 $ 401,588

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.