National Grid 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

03 Summary Operating

and Financial Review

19National Grid plc Annual Review 2008/09

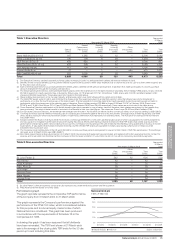

Net pension and other post-retirement obligations

At 31 March 2009, we had a net pension and other post-retirement

obligations deficit of £2.8 billion (2008: £0.9 billion), consisting of

plan assets of £15.5 billion (2008: £17.3 billion) offset by plan

liabilities of £18.3 billion (2008: £18.2 billion). The principal movements

in our net pensions obligation during the year arose as a result of

actuarial losses on the value of plan assets reflecting the significant

decline in global share indices. This was partially offset by actuarial

gains on plan liabilities, primarily as a consequence of using higher

discount rates.

In addition to ongoing employer contributions, we have agreed to

make additional deficit contributions to our UK pension schemes

expected to total £149 million in 2009/10, with the remaining deficit

payable over the period up to 2017. In accordance with our funding

policy for US pension and other post-retirement benefit plans, we

expect to contribute approximately £445 million during 2009/10.

Treasury policy

Funding and treasury risk management for National Grid is

carried out by the Treasury function under policies and guidelines

approved by the Board. The Finance Committee of the Board is

responsible for the regular review and monitoring of treasury

activity and for the approval of specific transactions, the authority

for which may be delegated. The primary objective of the Treasury

function is to manage the funding and liquidity requirements of

National Grid. A secondary objective is to manage the associated

financial risks (in the form of interest rate risk and foreign exchange

risk) to within acceptable boundaries. Our policies over the

management of funding and liquidity and the main risks arising

from our financing activities, including the use of financial

derivatives, are agreed and reviewed by the Board and the

Finance Committee. The Treasury function is not operated as

a profit centre. Debt and treasury positions are managed in a

non-speculative manner, such that all transactions in financial

instruments or products are matched to an underlying current

or anticipated business requirement.

Commodity derivatives entered into in respect of gas and

electricity commodities are controlled by policy guidelines

set by the Finance Committee and energy procurement

risk management committee.

Going concern

Having made enquiries, the Directors consider that the

Company and its subsidiary undertakings have adequate

resources to continue in business for the foreseeable future

and that it is therefore appropriate to adopt the going

concern basis in preparing the consolidated and individual

financial statements of the Company.

Discontinued operations

During 2008/09 discontinued operations included the Ravenswood

generation station, which was sold on 26 August 2008, KeySpan

Communications, which was sold on 25 July 2008, and the

KeySpan engineering companies, one of which was sold on

11 July 2008. Subsequent to the year end, two further engineering

companies were sold.

Dividends

The total ordinary dividend for 2008/09 (including the proposed

final dividend of 23.00 pence) amounts to 35.64 pence per

ordinary share, which equates to approximately £867 million.

This represents an increase of 8% over the previous year’s

total ordinary dividend per share of 33.00 pence (£831 million).

The above amounts exclude the £597 million returned in

2008/09 on repurchasing shares (2007/08: £1,516 million).

The proposed final dividend to shareholders for 2008/09 of

23.00 pence per share, amounting to approximately £560 million

(assuming all amounts settled in cash), will be reported in the

financial statements for the year ending 31 March 2010. This year,

we are offering shareholders the option of a scrip dividend (subject

to shareholder approval). Under this scheme, shareholders can opt

to receive the final dividend in new ordinary shares rather than cash.

Dividend policy

Our target is to increase dividends by 8% each year until

31 March 2012.

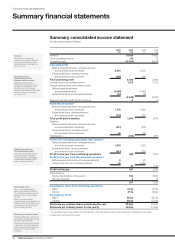

Cash flow

Cash generated from continuing operations was £3,564 million in

2008/09, compared with £3,265 million in 2007/08. This includes

net cash inflows for continuing operations relating to exceptional

items and stranded cost recoveries of £228 million and £146 million

in 2008/09 and 2007/08 respectively. After reflecting cash flows

relating to discontinued operations and tax paid, net cash inflow

from operating activities was £3,413 million, compared with

£3,165 million in 2007/08.

Cash outflows from investing activities were £1,998 million in

2008/09 compared with an outflow of £3,023 million in 2007/08.

This reflected £73 million spend on the acquisition of subsidiaries

and other investments in 2008/09 (2007/08: £3,528 million spent,

primarily relating to the KeySpan acquisition), purchases of

property, plant and equipment of £3,107 million in 2008/09

(2007/08: £2,832 million), partially offset by net sales of financial

investments of £99 million (2007/08: net sales of £45 million), cash

inflows from discontinued operations of £1,049 million (2007/08:

inflows of £3,050 million), and other cash inflows of £34 million

(2007/08: inflows of £242 million).

Net cash used in financing activities of £877 million in 2008/09

compared with £1,592 million used in 2007/08. This included

£627 million in 2008/09 and £1,498 million outflows in 2007/08 with

respect to share repurchases. It also included £4,892 million raised

from loans received compared with £1,568 million in 2007/08.

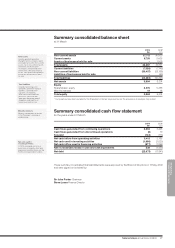

Net debt

Net debt increased by £5.1 billion from £17.6 billion at 31 March

2008 to £22.7 billion at 31 March 2009, primarily as a result of the

foreign exchange impact due to the strengthening of the US dollar

and the funding of our capital expenditure programme, partially

offset by cash inflows from operations and disposal proceeds.