Microsoft 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Product Warranty

We provide for the estimated costs of fulfilling our obligations under hardware and software warranties at the time the

related revenue is recognized. For hardware warranties, we estimate the costs based on historical and projected product

failure rates, historical and projected repair costs, and knowledge of specific product failures (if any). The specific

hardware warranty terms and conditions vary depending upon the product sold and the country in which we do business,

but generally include parts and labor over a period generally ranging from 90 days to three years. For software warranties,

we estimate the costs to provide bug fixes, such as security patches, over the estimated life of the software. We regularly

reevaluate our estimates to assess the adequacy of the recorded warranty liabilities and adjust the amounts as

necessary.

Research and Development

Research and development expenses include payroll, employee benefits, stock-based compensation expense, and other

headcount-related expenses associated with product development. Research and development expenses also include

third-party development and programming costs, localization costs incurred to translate software for international markets,

and the amortization of purchased software code and services content. Such costs related to software development are

included in research and development expense until the point that technological feasibility is reached, which for our

software products, is generally shortly before the products are released to manufacturing. Once technological feasibility is

reached, such costs are capitalized and amortized to cost of revenue over the estimated lives of the products.

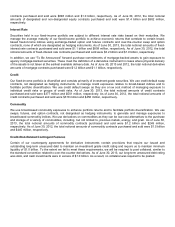

Sales and Marketing

Sales and marketing expenses include payroll, employee benefits, stock-based compensation expense, and other

headcount-related expenses associated with sales and marketing personnel, and the costs of advertising, promotions,

trade shows, seminars, and other programs. Advertising costs are expensed as incurred. Advertising expense was $2.6

billion, $1.6 billion, and $1.9 billion in fiscal years 2013, 2012, and 2011, respectively.

Stock-Based Compensation

We measure stock-based compensation cost at the grant date based on the fair value of the award and recognize it as

expense, net of estimated forfeitures, over the vesting or service period, as applicable, of the stock award (generally four

to five years) using the straight-line method.

Employee Stock Purchase Plan

Shares of our common stock may be purchased by employees at three-month intervals at 90% of the fair market value of

the stock on the last day of each three-month period. Compensation expense for the employee stock purchase plan is

measured as the discount the employee is entitled to upon purchase and is recognized in the period of purchase.

Income Taxes

Income tax expense includes U.S. and international income taxes, the provision for U.S. taxes on undistributed earnings

of international subsidiaries not deemed to be permanently invested, and interest and penalties on uncertain tax positions.

Certain income and expenses are not reported in tax returns and financial statements in the same year. The tax effect of

such temporary differences is reported as deferred income taxes. Deferred tax assets are reported net of a valuation

allowance when it is more likely than not that a tax benefit will not be realized. The deferred income taxes are classified as

current or long-term based on the classification of the related asset or liability.