Macy's 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

reinvent initiatives in a single market,

we will be converting consolidated

Rich’s-Macy’s stores in metro Atlanta to

reinvent formats in 2003.

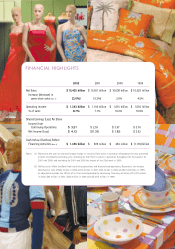

We expect to generate 2003 EPS of $3.05

to $3.25 during the year, including

store-closing costs of $45 million.

Same-store sales for the year currently are

forecasted to be flat to down 1.5 percent,

with the latter half of the year expected to

benefit from a strengthening economy

overall. Cash flow is anticipated to remain

strong in 2003.

Federated plans to open 12 new stores in

2003, and as always, the company will

continue to monitor any under-performing

locations that may be candidates for

future closures. The new stores planned for

2003 openings include: two Bloomingdale’s

in Atlanta, a Bloomingdale’s department

store in the SoHo area of New York City,

and Bloomingdale’s home stores in

downtown Chicago and Oakbrook, IL.

New Rich’s-Macy’s furniture galleries

will open in Atlanta and Augusta, GA.

The Bon Marché will open a new

department store in Redmond, WA, and a

furniture gallery in Tacoma, WA. Macy’s

East will open a new furniture gallery on

Staten Island, and Macy’s West will expand

its presence in Hilo and Maui, HI, with

the addition of two new stores there.

A total of $650 million has been budgeted

for capital expenditures in 2003.

Embracing change

Federated is a company eager to embrace

change, one that seeks and pursues new

ideas, and that leads the way in a crowded

retail field. We are committed to becoming

even more aggressive and creative in

identifying and serving the needs of our

fashion-oriented target customers.

We also will work to ensure that Federated

remains a stable financial performer, with

effective operations and management

continuity. Federated demonstrated this

capacity earlier this year with the long-

planned management transition under

which President Terry Lundgren assumed

CEO responsibilities, while Jim Zimmerman

remains chairman of the board.

While some businesses might fray in times

of challenge, today’s Federated is sewn

from stronger cloth – durable, flexible,

resilient in the face of change. We are

confident in our ability to overcome

obstacles and to find opportunity in doing

so. And we deeply appreciate the support of

our shareholders, customers, employees,

vendor partners and communities as we

continue to improve the department store

for all of the changing tomorrows to come.

Sincerely,

TERRY J. LUNDGREN

PRESIDENT & CHIEF EXECUTIVE OFFICER

James M. Zimmerman

Chairman of the Board

Terry J. Lundgren

President &

Chief Executive Officer

April 16, 2003

JAMES M. ZIMMERMAN

CHAIRMAN OF THE BOARD