Macy's 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

• We will increase prof it abilit y and return on invest ment.

We are commit t ed t o achieving result s in each of t hese areas in t he year ahead, even

as we cont inue t o build on some of t he more not able successes of t he last year.

2001 Progress

Alt hough our successes t end t o be overshadowed by t he year’s larger issues, t hey are

signif icant because t hey bode well f or t he f ut ure of our department st ore operat ions:

• an abilit y t o cont inue generat ing significant amounts of f ree cash f low f rom our

depart ment st ore operations, despit e pressure on sales – approximat ely $775 million

(aft er capit al expendit ures but bef ore t he acquisit ion of Libert y House), compared

t o approximat ely $600 million in t he prior year;

• an encouraging recovery in t he f ourt h quart er, which enabled us t o exceed revised

sales and EBIT f orecast s;

• year- end invent ories t hat were down about 7% on a same- store basis – a dif f icult

f eat t o achieve, but one t hat posit ions t he company well f or t he year ahead;

• an except ionally st rong privat e brand program t hat consistent ly out perf orms t he

indust ry, and t hat has grown t o represent 16% of Federat ed’s t ot al 2001 sales;

• solid progress in growing our junior’s and young men’s businesses, which

signif icant ly out perf ormed t he rest of t he st ore in t he last year;

• opening of a new protot ype department st ore – Lazarus at East on Cent er

in Columbus, OH – where we are t est ing an array of new service and

merchandising concept s;

• t he acquisit ion of Libert y House, wit h st ores in Hawaii and Guam, and it s virt ually

f lawless int egration int o our Macy’s West division;

• t he eliminat ion of Stern’s and t he conversion of 17 stores int o M acy’s in New York

and New Jersey, which f urt her solidif ied M acy’s posit ioning in t hose market s, and

planned conversions of t wo New Jersey St ern’s st ores t o Bloomingdale’s, slat ed f or

t his year.

In January 2002, we announced our int ent t o dispose of Fingerhut , pref erably

t hrough t he sale of it s operat ions as a going concern, or in t he case of t he Fingerhut

cat alog, by closure of t he business. In t ot al, we expect t o realize approximately $1.1 t o

$1.3 billion of af t er- t ax proceeds, net of one- t ime cost s, over t he next f our years as a

result of t his disposit ion.

Federat ed acquired Fingerhut in 1999 primarily f or it s e- commerce pot ent ial. Knowing

what we do now, we cert ainly would have done t hings dif f erent ly t hree years ago.

Our singular goal

for 2002 is to develop

a more compelling

business proposition

for our customers to

drive sales growth.

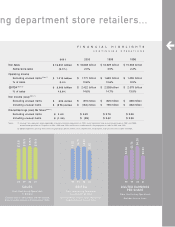

8.4%

98 99 00 01

OPERATING INCOME

From Continuing Operat ions

As a Percent of Sales

(Excludes Unusual It ems)

9.5%

10.6%

10.6%