Kentucky Fried Chicken 2011 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2011 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

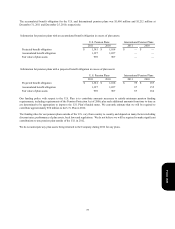

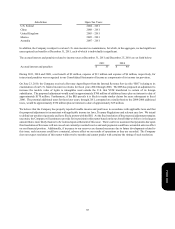

In 2009, this item included out-of-year adjustments which lowered our effective tax rate by 1.6 percentage points.

Change in valuation allowance. This item relates to changes for deferred tax assets generated or utilized during the current year

and changes in our judgment regarding the likelihood of using deferred tax assets that existed at the beginning of the year. The

impact of certain changes may offset items reflected in the ‘Statutory rate differential attributable to foreign operations’ line. The

Company considers all available positive and negative evidence, including the amount of taxable income and periods over which

it must be earned, actual levels of past taxable income and known trends and events or transactions expected to affect future levels

of taxable income.

In 2011, $22 million of net tax expense was driven by $15 million for valuation allowances recorded against deferred tax assets

generated during the current year and $7 million of tax expense resulting from a change in judgment regarding the future use of

certain foreign deferred tax assets that existed at the beginning of the year. These amounts exclude $45 million in valuation

allowance additions related to capital losses recognized as a result of the LJS and A&W divestitures, which are presented within

Net Benefit from LJS and A&W divestitures.

In 2010, the $22 million of net tax expense was driven by $25 million for valuation allowances recorded against deferred tax assets

generated during the current year. This expense was partially offset by a $3 million tax benefit resulting from a change in judgment

regarding the future use of U.S. state deferred tax assets that existed at the beginning of the year.

In 2009, the $9 million net tax benefit was driven by $25 million of benefit resulting from a change in judgment regarding the

future use of foreign deferred tax assets that existed at the beginning of the year. This benefit was partially offset by $16 million

for valuation allowances recorded against deferred tax assets generated during the year.

Net benefit from LJS and A&W divestitures. This item includes a one-time $117 million tax benefit, including approximately $8

million state benefit, recognized on the LJS and A&W divestitures in 2011, partially offset by $45 million of valuation allowance,

including approximately $4 million state expense, related to capital loss carryforwards recognized as a result of the divestitures.

In addition, we recorded $32 million of tax benefits on $86 million of pre-tax losses and other costs, which resulted in $104 million

of total net tax benefits related to the divestitures.

Other. This item primarily includes the impact of permanent differences related to current year earnings and U.S. tax credits.

In 2009, this item was positively impacted by a one-time pre-tax gain of approximately $68 million, with no related income tax

expense, recognized on our acquisition of additional interest in, and consolidation of, the entity that operates KFC in Shanghai,

China. This was partially offset by a pre-tax U.S. goodwill impairment charge of approximately $26 million, with no related

income tax benefit.

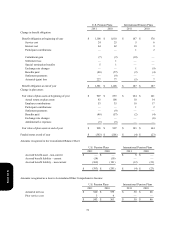

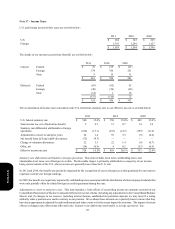

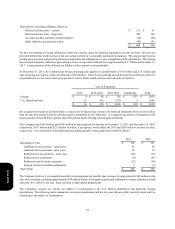

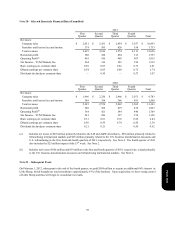

The details of 2011 and 2010 deferred tax assets (liabilities) are set forth below:

Operating losses and tax credit carryforwards

Employee benefits

Share-based compensation

Self-insured casualty claims

Lease-related liabilities

Various liabilities

Deferred income and other

Gross deferred tax assets

Deferred tax asset valuation allowances

Net deferred tax assets

Intangible assets, including goodwill

Property, plant and equipment

Other

Gross deferred tax liabilities

Net deferred tax assets (liabilities)

2011

$ 590

259

106

47

137

72

49

1,260

(368)

$ 892

$(147)

(92)

(53)

$(292)

$ 600

2010

$ 335

171

102

50

166

89

97

1,010

(306)

$ 704

$(211)

(108)

(29)

$(348)

$ 356

Form 10-K