Kentucky Fried Chicken 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

operating activities to continue in the foreseeable future. However, unforeseen downturns in our business could adversely impact

our cash flows from operations from the levels historically realized.

In the event our cash flows are negatively impacted by business downturns, we believe we have the ability to temporarily reduce

our discretionary spending without significant impact to our long-term business prospects. Our discretionary spending includes

capital spending for new restaurants, acquisitions of restaurants from franchisees, repurchases of shares of our Common Stock

and dividends paid to our shareholders. Additionally, as of December 31, 2011 we had approximately $1.1 billion in unused

capacity under our revolving credit facilities that expire in November 2012, primarily related to a domestic facility. We are in the

process of renewing these facilities.

China and YRI represented more than 70% of the Company’s operating profit in 2011 (excluding Corporate and unallocated

income and expenses) and both generate a significant amount of positive cash flows that we have historically used to fund our

international development. To the extent we have needed to repatriate international cash to fund our U.S. discretionary cash

spending, including share repurchases, dividends and debt repayments, we have historically been able to do so in a tax-efficient

manner. If we experience an unforeseen decrease in our cash flows from our U.S. business or are unable to refinance future U.S.

debt maturities we may be required to repatriate future international earnings at tax rates higher than we have historically

experienced.

We currently have investment-grade ratings from Standard & Poor’s Rating Services (BBB-) and Moody’s Investors Service

(Baa3). While we do not anticipate a downgrade in our credit rating, a downgrade would increase the Company’s current borrowing

costs and could impact the Company’s ability to access the credit markets cost-effectively if necessary. Based on the amount and

composition of our debt at December 31, 2011, which included no borrowings outstanding under our credit facilities, our interest

expense would not materially increase on a full-year basis should we receive a one-level downgrade in our ratings.

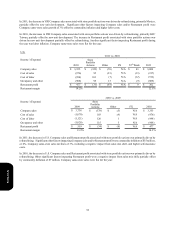

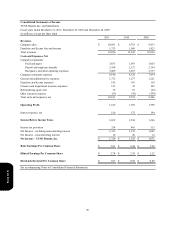

Discretionary Spending

During 2011, we invested $940 million in capital spending, including approximately $405 million in China, $256 million in YRI

and $279 million in the U.S. For 2012, we estimate capital spending will be approximately $1 billion.

During the year ended December 31, 2011 we repurchased shares for $752 million, which includes the effect of $19 million in

share repurchases with trade dates prior to the 2010 fiscal year end but cash settlement dates subsequent to the 2010 fiscal year. In

January 2011, our Board of Directors authorized share repurchases through July 2012 of up to $750 million (excluding applicable

transaction fees) of our outstanding Common Stock, and on November 18, 2011, our Board of Directors authorized additional

share repurchases through May 2013 of up to $750 million (excluding applicable transaction fees) of our outstanding Common

Stock. At December 31, 2011, we had remaining capacity to repurchase up to approximately $938 million of outstanding Common

Stock (excluding applicable transaction fees) under these authorizations. Shares are repurchased opportunistically as part of our

regular capital structure decisions.

During the year ended December 31, 2011, we paid cash dividends of $481 million. Additionally, on November 18, 2011 our

Board of Directors approved cash dividends of $0.285 per share of Common Stock to be distributed on February 3, 2012 to

shareholders of record at the close of business on January 13, 2012. The Company is targeting an ongoing annual dividend payout

ratio of 35% to 40% of net income.

In connection with the proposal to acquire an additional 66% of Little Sheep, we placed $300 million in escrow to demonstrate

availability of funds to acquire additional shares in this business. The funds placed in escrow were restricted to the pending

acquisition of Little Sheep and are separately presented in our Consolidated Balance Sheet as of December 31, 2011 and in our

Consolidated Statement of Cash Flows for the year ended December 31, 2011. In February 2012, the funds were released from

escrow upon our acquisition of Little Sheep. See Notes 4 and 21 for details.

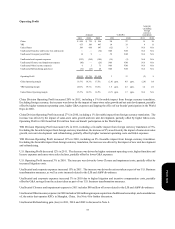

Borrowing Capacity

Our primary bank credit agreement comprises a $1.15 billion syndicated senior unsecured revolving credit facility (the “Credit

Facility”) which matures in November 2012 and includes 24 participating banks with commitments ranging from $20 million to

$93 million. We believe the syndication reduces our dependency on any one bank.

Under the terms of the Credit Facility, we may borrow up to the maximum borrowing limit, less outstanding letters of credit or

banker’s acceptances, where applicable. At December 31, 2011, our unused Credit Facility totaled $727 million net of outstanding

letters of credit of $423 million. There were no borrowings outstanding under the Credit Facility at December 31, 2011. The

interest rate for borrowings under the Credit Facility ranges from 0.25% to 1.25% over the London Interbank Offered Rate

Form 10-K