Jack In The Box 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

other leases range from approximately one year to 48 years, including optional renewal periods. At September 27, 2009, our restaurant

leases had initial terms expiring as follows:

2010 - 2014 169 332

2015 - 2019 137 561

2020 - 2024 190 383

2025 and later 144 62

Our principal executive offices are located in San Diego, California in an owned facility of approximately 150,000 square feet. We

also own our 70,000 square foot Innovation Center and approximately four acres of undeveloped land directly adjacent to it. Qdoba’s

corporate support center is located in a leased facility in Wheat Ridge, Colorado. We also lease seven distribution centers, with remaining

terms ranging from eight to 16 years, including optional renewal periods.

Certain of our personal property is pledged as collateral under our credit agreement and certain of our real property may be pledged

as collateral in the event of a ratings downgrade as defined in the credit agreement.

The Company is subject to normal and routine litigation. In the opinion of management, based in part on the advice of legal counsel,

the ultimate liability from all pending legal proceedings, asserted legal claims and known potential legal claims should not materially

affect our operating results, financial position or liquidity.

The Company did not submit any matter during the fourth quarter of fiscal 2009 to a vote of its stockholders, through the

solicitation of proxies or otherwise.

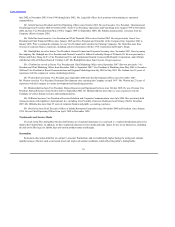

Market Information. The following table sets forth the high and low sales prices for our common stock during the fiscal quarters

indicated, as reported on the New York Stock Exchange and NASDAQ — Composite Transactions:

High $ 23.87 $ 28.35 $ 25.78 $ 23.09

Low 19.87 21.82 16.59 11.82

High $ 30.35 $ 28.27 $ 29.89 $ 35.13

Low 17.79 21.49 22.57 22.68

Dividends. We did not pay any cash or other dividends during the last two fiscal years and do not anticipate paying dividends in

the foreseeable future. Our credit agreement provides for $50.0 million for the potential payment of cash dividends.

Stock Repurchases. In November 2007, the Board approved a program to repurchase up to $200.0 million in shares of our

common stock over three years expiring November 9, 2010. As of September 27, 2009, the aggregate

17