Jack In The Box 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

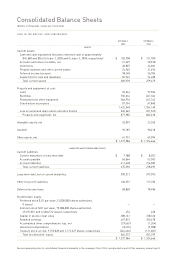

Consolidated Statements of Cash Flows

(Dollars in thousands)

JACK IN THE BOX INC. AND SUBSIDIARIES

FISCAL YEAR

2005 2004 2003

Cash flows from operating activities:

Net earnings $ 91,537 $ 74,684 $ 70,084

Non-cash items included in operations:

Depreciation and amortization 86,156 84,446 76,105

Deferred finance cost amortization 982 1,456 2,849

Deferred income taxes, excluding the effect of the

Qdoba acquisition in 2003 (3,237) 4,023 13,734

Amortization of unearned compensation expense 1,396 584 497

Loss on early retirement of debt — 9,180 —

Impairment charges and other 3,565 933 —

Tax benefit associated with exercise of stock options 9,771 2,867 188

Pension contributions (23,506) (31,214) (5,416)

Gains on the sale of company-operated restaurants (23,334) (17,918) (26,562)

Changes in assets and liabilities, excluding the effect of

the Qdoba acquisition in 2003:

Decrease (increase) in receivables 162 (6,720) (624)

Increase in inventories (5,964) (2,344) (1,573)

Decrease (increase) in prepaid expenses and other

current assets (4,935) (637) 897

Increase (decrease) in accounts payable 2,561 2,695 (9,890)

Increase in other liabilities 19,052 47,616 27,523

Cash flows provided by operating activities 154,206 169,651 147,812

Cash flows from investing activities:

Purchase of property and equipment (123,109) (120,065) (111,872)

Purchase of Qdoba, net of $2,856 cash acquired — — (42,606)

Proceeds from the sale of property and equipment 12,521 10,671 27,198

Proceeds from the sale of company-operated restaurants 33,210 21,486 3,740

Proceeds from (purchase of) assets held for sale

and leaseback, net (21,000) 11,269 (22,642)

Collections on notes receivable 895 21,911 20,092

Purchase of investments and change in cash

surrender value, net (10,411) (9,283) (6,760)

Other (2,944) 16,768 (401)

Cash flows used in investing activities (110,838) (47,243) (133,251)

Cash flows from financing activities:

Borrowings under revolving bank loans — 45,000 510,500

Principal payments under revolving bank loans — (45,000) (544,500)

Proceeds from issuance of debt — 275,000 151,450

Principal payments on debt (8,205) (282,772) (57,632)

Debt issuance and debt repayment costs (343) (7,103) (7,843)

Repurchase of common stock (92,861) (7,138) (50,157)

Proceeds from issuance of common stock 30,049 8,943 363

Cash flows provided by (used in) financing activities (71,360) (13,070) 2,181

Net increase (decrease) in cash and cash equivalents $ (27,992) $ 109,338 $ 16,742

See accompanying notes to consolidated financial statements in the company’s Form 10-K, incorporated as part of this summary annual report.