JP Morgan Chase 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320

|

|

77

If you think back 10, 20 or 30 years ago, my

predecessors and I struggled to try to build

a great company, which we hoped would

emerge as an endgame winner. The ultimate

outcome was unclear – and many competitors

did not survive (this is true for most large-

scale consolidating industries). Even for those

of us that did, it was quite a struggle. Today,

it is clear that our company is an endgame

winner – both in the United States and glob-

ally – which is invaluable in any industry. And

while we have had some dicult times since

the financial crisis, the power of the franchise

has shone through. We also know that future

success is not guaranteed – only consistently

good management over a long period of time

can ensure long-term success in any business.

But we certainly are in a very good place.

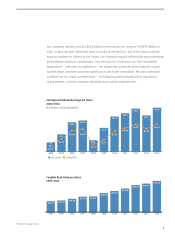

We have delivered good multi-year financial

results (strong margins and returns and

low volatility) and have shown a great

ability to adapt to changes — both from the

marketplace and the regulatory environment

We always compare our margins and returns

with those of our best competitors in each

business. The chart below, which is very

similar to a chart we showed at our Investor

Day, shows some of these numbers for 2014.

We believe that the right discipline is to

compare each of our businesses against its

best competitor. It is a mistake just to look

at the consolidated numbers and compare

them – every company has a dierent mix of

businesses. The chart below also shows how

our businesses compare in terms of margins,

I. WE HAVE AN OUTSTANDING FRANCHISE — OUR

COMPANY HAS EMERGED AS AN ENDGAME WINNER,

BUT WE NEED TO EARN IT EVERY DAY

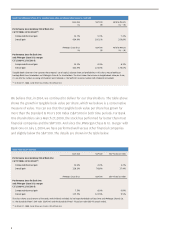

JPMorgan Chase Is in Line with Best-in-Class Peers in Both Eciency and Returns

Eciency Returns

JPM 2014

overhead

ratios

Best-in-class

peer overhead

ratios2 weighted

by JPM

revenue mix

JPM target

overhead

ratios

JPM 2014

ROE

Best-in-class

peer ROTCE4

weighted by

JPM equity mix

JPM target

ROE

Consumer &

Community

Banking

58% 55%

WFC

~50% 18% 16%

WFC

20%

Corporate &

Investment

Bank

62%160%

Citi

55%-60% 13%114%

Citi

13%

Commercial

Banking

39% 38%

PNC

35% 18% 13%

PNC

18%

Asset

Management

71% 69%

UBS WM & BLK

≤70% 23% 27%

BEN

25%+

JPMorgan Chase 60%159%155%+/- 13%313% ~15%3

1 Excludes legal expense

2 Best-in-class overhead ratio represents implied expenses of comparable peer segments weighted by JPMorgan Chase (JPM) revenue: Wells Fargo

Community Banking (WFC), Citi Institutional Clients Group (Citi), PNC Corporate and Institutional Banking (PNC), UBS Wealth Management and

Wealth Management Americas (UBS WM) and BlackRock (BLK), and JPM Corporate segment

3 Represents ROTCE for total JPMorgan Chase. Goodwill is primarily related to the Bank One merger and prior acquisitions and is predominantly

retained by Corporate

4 Best-in-class ROTCE represents implied net income minus preferred stock dividends of comparable peers weighted by JPM tangible common equity:

WFC, Citi, PNC, Franklin Templeton (BEN) and JPM Corporate segment