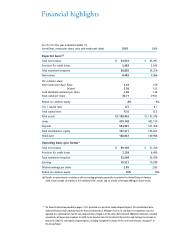

JP Morgan Chase 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

•Completing the largest credit card conversion in history.

This effort combined over million heritage Chase and

Bank One accounts onto a single platform and provided

us with a single best-in-class system to better serve our

customers (and at a lower cost).

•Integrating and upgrading all of our businesses in

Texas – in terms of products, brand, systems and

operations – where we have , employees serving

million customers.

•Converting all U.S. dollar clearing to one platform glob-

ally, an operation that processes an average of $.tril-

lion daily for , clients worldwide.

•Executing the largest merger of mutual fund families in

U.S. history,affecting .million fund shareholders.

•Completing the first and second construction phases of

our new Global Services Center in Bangalore, India, and

hiring , employees to meet increased demand and

deliver more services from India.

•Migrating much of the company’s production, disaster

recovery, and development and test systems into a new

data center. The move increases our data storage capabil-

ity,enhances our resiliency,reduces infrastructure points

of failure and lowers overall cost to the firm.

Over this next year, we will continue to massively

upgrade and streamline our systems and operations.

Highlights include:

•Converting and upgrading all of our operations in the

New York tri-state market, beginning in the second

quarter. This will be one of the most visible bank con-

versions in our industry and will have an impact on all

of our businesses – specifically, .million deposit

accounts representing over $ billion, and involves

more than heritage Chase branches and over ,

teller workstations.

•Providing our retail and wholesale customers with uni-

form Internet platforms, upgrading loan origination sys-

tems and implementing a new mortgage servicing system.

•Substantially improving infrastructure, including data

centers, networks and financial management systems.

We cannot build a great company unless we are unrelenting

in our efforts to be a lean and efficient company. This must

become a permanent part of our mindset.

Remove barriers to success

As I mentioned before, excessive bureaucracy is lethal. It

slows us down, distracts us from our clients and demoralizes

good employees. We must act with more openness, passion

and urgency. The process of busting bureaucracy never ends,

but what is different now is that our employees are engaged

in challenging the system and solving the problems.

Wecontinue to attack bureaucracy and improve all aspects

of our management practices, including:

•Accountability and decision making: Central to the changes

we have undertaken is the realignment of corporate staff.

Now embedded in the businesses are many of the staff

functions – like finance and systems – that used to be

concentrated at the corporate level. The realignment gives

our businesses greater ability to manage their support

functions. For staff, better access to the businesses they

support provides them with more knowledge and control.

The restructuring will lead to better accountability,

transparency and reporting, which in turn will improve

execution and overall corporate risk management.

•Management information and discipline: It is hard to act

on the truth if you do not know what it is. We want

managers to have the tools and information to run their

businesses as if they owned them. With this goal in

mind, we now produce thousands of increasingly accu-

rate reports that provide managers with specific informa-

tion on their performance. In addition, we give them

tools to proactively eliminate waste and manage their

resources. Better reporting has dramatically improved

the effectiveness of our business review meetings.

Without this information, these meetings are often a

waste of time. They now are convened at many levels of

the company and focus on where we are and need to be,

relative to our own benchmarks and the best performers