JP Morgan Chase 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

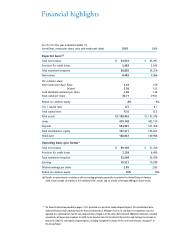

Financial highlights

*The financial information provided on pages 2-20 is presented on a pro forma combined-operating basis. The unaudited pro forma

combined historical results represent how the financial information of JPMorgan Chase & Co. and Bank One Corporation may have

appeared on a combined basis had the two companies been merged as of the earliest date indicated. Additional information, including

reconciliation of the pro forma numbers to GAAP, can be found on Form 8-K furnished to the Securities and Exchange Commission on

January 18, 2006. For a description of operating basis, including management’s reasons for its use of such measures, see page 31 of

this Annual Report.

As of or for the year ended December 31,

(in millions, except per share, ratio and headcount data) 2005 2004

Reported basis(a)

Total net revenue $54,533 $43,097

Provision for credit losses 3,483 2,544

Total noninterest expense 38,835 34,359

Net income 8,483 4,466

Per common share:

Net income per share: Basic 2.43 1.59

Diluted 2.38 1.55

Cash dividends declared per share 1.36 1.36

Book value per share 30.71 29.61

Return on common equity 8% 6%

Tier 1 capital ratio 8.5 8.7

Total capital ratio 12.0 12.2

Total assets $1,198,942 $1,157,248

Loans 419,148 402,114

Deposits 554,991 521,456

Total stockholders’ equity 107,211 105,653

Headcount 168,847 160,968

Operating basis (pro forma)*

Total net revenue $59,149 $57,760

Provision for credit losses 7,259 6,490

Total noninterest expense 35,549 35,439

Earnings 10,521 10,289

Diluted earnings per share 2.95 2.85

Return on common equity 10% 10%

(a) Results are presented in accordance with accounting principles generally accepted in the United States of America.

2004 results include six months of the combined Firm’s results and six month of heritage JPMorgan Chase results.