JP Morgan Chase 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JPMORGAN CHASE & CO.

Annual Report 2005

Table of contents

-

Page 1

JPMORGAN CHASE & CO. Annual Report 2005 -

Page 2

... businesses, corporations and governments with a full range of banking and asset management products in local markets and through national distribution. The consumer businesses include: Consumer Banking Credit Card Small Business Home Finance Auto Finance Education Finance The commercial banking... -

Page 3

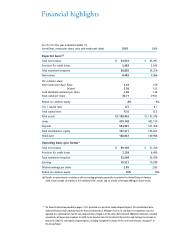

...: Net income per share: Basic Diluted Cash dividends declared per share Book value per share Return on common equity Tier 1 capital ratio Total capital ratio Total assets Loans Deposits Total stockholders' equity Headcount Operating basis (pro forma)* Total net revenue Provision for credit losses... -

Page 4

... to my partner, Jamie Dimon, who I believe will prove to be one of the outstanding CEO s the financial services industry has had in a long time. As Chairman, I look forward to contributing to our growth by leveraging my global relationships and contacts and by helping to further develop strategy. As... -

Page 5

... properly managing our risks? William B. Harrison, Jr., Chairman James Dimon, Chief Executive Officer Let me close with a profound thanks to our shareholders who have had the faith to believe in the potential of this firm. Thanks to our outstanding Board of Directors for their support and wisdom... -

Page 6

... not only accept deposits and provide access to cash, but also sell investments, mortgages, home equity loans, debit and credit cards, and online bill paying services, as well as small business loans, international funds transfers, payroll services, annuities, etc. Our clear "natural product" set is... -

Page 7

...their financial back offices for cash, payroll processing and wire transfer services. This interdependency is cost effective for us and beneficial to our customers. In addition, business accounts often lead to new personal accounts and vice versa. Investment Banking and Commercial Banking. A natural... -

Page 8

.... We cannot afford to waste time justifying mediocrity. Each line of business now assesses its performance in a rigorous and very detailed way. Each compares results to targets in a variety of areas, including sales force productivity, customer service and systems development. It is not enough for... -

Page 9

... heritage Chase branches and over teller workstations. • Providing our retail and wholesale customers with uniform Internet platforms, upgrading loan origination systems and implementing a new mortgage servicing system. • Substantially improving infrastructure, including data centers, networks... -

Page 10

... its deposits, checking accounts and credit cards. Commercial Banking achieved growth in leasing, middle market lending and liability balances. Treasury & Securities Services produced more custody business and had growth in liability balances. Asset & Wealth Management increased the level of assets... -

Page 11

... to open  new branches (this will drive growth in and beyond); adding more retail loan officers; hiring additional private bankers; funding the build-out of our energy and mortgage trading capabilities in the Investment Bank; and investing in state-of-the-art "blink" credit card technology... -

Page 12

... to generate more diversified and consistent returns. For example, we have added energy trading, and increased our activities in mortgage- and asset-backed securities, and principal investing. We have leadership positions in credit markets and in our derivatives franchises, and we will continue to... -

Page 13

... company. Executive Committee members are required to retain % of their stock awards as long as they are with the company. And in general, stock options are awarded on a limited basis. We continually review our benefits programs to assure that they are of value to employees and cost effective... -

Page 14

... cost-effectively provide students in low-income communities with access to a broad range of services, including academic, health and extracurricular activities. In Chicago, we are partnering with the civic community, nonprofit groups and the Chicago Public School system to bring this model to scale... -

Page 15

... in We have come a long way and are well on the road to realizing the vast potential of this company. An enormous amount of work remains, but I am confident that by working together, we will build the best financial services company in the world. James Dimon Chief Executive Officer March 13 -

Page 16

... Acquired Neovest Holdings, Inc., a provider of high-performance trading technology and direct market access services to institutional investors, asset managers and hedge funds. • Strengthened our offerings in fixed income and foreign exchange prime brokerage. 2005 highlights • #2 investment... -

Page 17

... than 11,000 branch salespeople assist customers with checking and savings accounts, mortgage and home equity loans, small business loans, investments and insurance across our 17-state footprint from New York to Arizona. An additional 1,500 mortgage officers provide home loans throughout the country... -

Page 18

... • Develop innovative products and services to create differentiated value for consumers and partners and drive growth in number of cardmembers, outstandings and sales. • Expand the markets we serve to reach a broader base of customers. • Invest in marketing and technology initiatives designed... -

Page 19

...of client and competitor information to drive best practices regarding the coverage model, product delivery and customer service. Direct investment resources and product capability to the highest-potential market sectors. • Outperform our peers in managing credit and operational risk. • Continue... -

Page 20

... Private Equity Fund Services, which provides administration services to global private equity firms and institutional limited partners. • Accomplished  major merger mile- Worldwide Securities Services (WSS) safekeeps, values, clears and services securities and portfolios for investors... -

Page 21

...our client assets are in actively managed portfolios. We have global investment expertise in equities, fixed income, real estate, hedge funds, private equity and liquidity, including both moneymarket instruments and bank deposits. We also provide trust and estate services to ultra-high-net-worth and... -

Page 22

... • Won $75 million New Markets Tax Credit; part of the Community Renewal Tax Relief Act, this program facilitates investment in low-income areas. Used funds to provide capital at favorable terms to low-income communities; will also support the work of community-development financial institutions... -

Page 23

... 63 Credit risk management 75 Market risk management 79 Operational risk management 80 Reputation and fiduciary risk management 80 Private equity risk management 81 Critical accounting estimates used by the Firm 83 Accounting and reporting developments 84 Nonexchange-traded commodity derivative... -

Page 24

...Common shares outstanding Average: Basic Diluted Common shares at period-end Selected ratios Return on common equity ("ROE") Return on assets ("ROA")(a) Tier 1 capital ratio Total capital ratio Tier 1 leverage ratio Selected balance sheet data (period-end) Total assets Securities Loans Deposits Long... -

Page 25

... The Treasury Services ("TS") business provides a variety of cash management products, trade finance and logistics solutions, wholesale card products, and short-term liquidity management tools. The Investor Services ("IS") business provides custody, fund services, securities lending, and performance... -

Page 26

... with the equity method of accounting. Neovest Holdings, Inc. On September 1, 2005, JPMorgan Chase completed its acquisition of Neovest Holdings, Inc., a provider of high-performance trading technology and direct market access. This transaction will enable the Investment Bank to offer a leading... -

Page 27

... for credit losses, which were offset by increased compensation expense. Revenue growth was driven by higher, although volatile, fixed income trading results, stronger equity commissions and improved investment banking fees, all of which benefited from strength in global capital markets activity... -

Page 28

... net losses associated with loan portfolio sale activity. The provision for credit losses benefited from improved credit trends in most consumer lending portfolios and from loan portfolio sales, but was affected negatively by a special provision related to Hurricane Katrina. Card Services operating... -

Page 29

...and data center upgrades. Offsetting the merger savings will be continued investment in distribution enhancements and new product offerings; extensive merger integration activities and upgrading of technology; and expenses related to recent acquisitions, such as the Sears Canada credit card business... -

Page 30

...'s private equity investment results. This change was offset by lower securities gains on the Treasury investment portfolio as a result of lower volumes of securities sold, and lower gains realized on sales due to higher interest rates. Additionally, RFS's Home Finance business reported losses in... -

Page 31

... impact of the Merger and accounting policy conformity charges of $858 million were offset partially by releases in the allowance for credit losses related to the wholesale loan portfolio, primarily due to improved credit quality in the IB, and the sale of the manufactured home loan portfolio in RFS... -

Page 32

... lower reported pre-tax income, a higher level of business tax credits, and changes in the proportion of income subject to federal, state and local taxes, partially offset by purchase accounting adjustments related to leveraged lease transactions. The Merger costs and accounting policy conformity... -

Page 33

... of trading-related revenue, see the IB on pages 36-38 of this Annual Report. In the case of Card Services, operating basis is also referred to as "managed basis," and excludes the impact of credit card securitizations on total net revenue, the provision for credit losses, net charge-offs and loan... -

Page 34

... per share and ratio data) Revenue Investment banking fees Trading revenue(c) Lending & deposit related fees Asset management, administration and commissions Securities/private equity gains Mortgage fees and related income Credit card income Other income Noninterest revenue(c) Net interest income... -

Page 35

... earnings applicable to common stock (a) The Firm uses return on equity less goodwill, a non-GAAP financial measure, to evaluate the operating performance of the Firm. The Firm utilizes this measure to facilitate operating comparisons to competitors. JPMorgan Chase & Co. / 2005 Annual Report 33 -

Page 36

... Finance • Insurance â- JPMorgan is the brand name. Chase is the brand name. Investment Bank Businesses: • Investment banking: - Advisory - Debt and equity underwriting • Market-making and trading: - Fixed income - Equities • Corporate lending Card Services Businesses: • Credit Card... -

Page 37

...except ratios) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset & Wealth Management Corporate Total Operating earnings 2005 $ 3,658 3,427 1,907 1,007 1,037 1,216 (1,731) $ 10,521 2004 $ 2,948 2,199 1,274 608 440 681 61 $ 8,211 Change 24... -

Page 38

... worldwide. The Firm provides a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, and market-making in cash securities and derivative... -

Page 39

... for loan losses to average loans(c) 2.11 Allowance for loan losses to 187 nonperforming loans(f) Nonperforming loans to average loans 1.08 Market risk-average trading and credit portfolio VAR(g)(h)(i) Trading activities: $ 67 $ Fixed income(g) Foreign exchange 23 Equities 34 Commodities and... -

Page 40

... markets. Equities markets includes client and portfolio management revenue related to market-making and proprietary risk-taking across global equity products, including cash instruments, derivatives and convertibles. Credit portfolio revenue includes Net interest income, fees and loan sale activity... -

Page 41

...billion due to the Merger, improved MSR risk management results, higher automobile operating lease income and increased banking fees. These benefits were offset in part by losses on portfolio loan sales in the Home Finance and Auto businesses. The Provision for credit losses totaled $724 million, up... -

Page 42

...risk management activity change over time as market conditions and approach dictate. Home Finance Home Finance is comprised of two key business segments: Prime Production & Servicing and Consumer Real Estate Lending. The Prime Production & Servicing segment includes the operating results associated... -

Page 43

... addition of the Bank One home equity lending business but also reflected growth in retained loan balances and a $95 million net benefit associated with the sale of the $4 billion manufactured home loan portfolio; partially offsetting these increases were lower subprime mortgage securitization gains... -

Page 44

... the Internet. Product offerings include checking and savings accounts, mutual funds and annuities, credit cards, mortgages and home equity loans, and loans for small business customers (customers with annual sales generally less than $10 million). Selected income statement data Year ended December... -

Page 45

... Total loans Core deposits(c) Total deposits Number of: Branches ATMs Personal bankers Personal checking accounts (in thousands)(d) Business checking accounts (in thousands)(d) Active online customers (in thousands) Debit cards issued (in thousands) Overhead ratio Auto & Education Finance 2005 2004... -

Page 46

... operating lease-related assets of $0.4 billion for 2005. Balances prior to January 1, 2005, were insignificant. These are not included in the net charge-off rate. Business metrics - ending balances Invested assets $ 7,767 Policy loans 388 Insurance policy and claims reserves 7,774 Term life sales... -

Page 47

... the credit performance (such as net charge-off rates) of the entire managed credit card portfolio. Operating results exclude the impact of credit card securitizations on revenue, the Provision for credit losses, net charge-offs and receivables. Securitization does not change reported Net income... -

Page 48

... cardmember purchases, balance transfers and cash advance activity. • Net accounts opened - Includes originations, portfolio purchases and sales. • Merchant acquiring business - Represents an entity that processes payments for merchants. JPMorgan Chase is a partner in Chase Paymentech Solutions... -

Page 49

... lending, treasury services, investment banking, and asset and wealth management - and meet its clients' financial needs. three customer segments, Commercial Banking offers several products to the Firm's entire customer base: Chase Business Credit, the #1 asset-based lender for 2005, provides asset... -

Page 50

... loans • Revolving lines of credit • Bridge financing • Asset-based structures • Leases Treasury services includes a broad range of products and services enabling clients to transfer, invest and manage the receipt and disbursement of funds, while providing the related information reporting... -

Page 51

... and the acquisition of Vastera. Leading the product revenue growth was an increase in assets under custody to $11.2 trillion, primarily driven by market value appreciation and new business, along with growth in wholesale card, securities lending, foreign exchange, trust product, trade, clearing and... -

Page 52

... corporate deposit pricing methodology in 2004 and wider deposit spreads. Growth in fees and commissions was driven by a 22% increase in assets under custody to $9.3 trillion as well as new business growth in trade, commercial card, global equity products, securities lending, fund services, clearing... -

Page 53

...'s client assets are in actively managed portfolios. AWM has global investment expertise in equities, fixed income, real estate, hedge funds, private equity and liquidity, including both money market instruments and bank deposits. AWM also provides trust and estate services to ultra-high-net-worth... -

Page 54

... and administration through third-party and direct distribution channels. Private Client Services offers high-net-worth individuals, families and business owners comprehensive wealth management solutions that include financial planning, personal trust, investment and banking products and services... -

Page 55

... and ONE Equity Partners businesses. Treasury manages the structural interest rate risk and investment portfolio for the Firm. The corporate staff units include Central Technology and Operations, Audit, Executive Office, Finance, Human Resources, Marketing & Communications, Office of the General... -

Page 56

...acquisition of ONE Equity Partners as a result of the Merger. Excluding ONE Equity Partners, the portfolio declined as a result of sales of investments, which was consistent with management's intention to reduce over time the capital committed to private equity. Sales of third-party fund investments... -

Page 57

... over the next 12 months and to support the less liquid assets on its balance sheet. Large investor cash positions and increased foreign investor participation in the corporate markets allowed JPMorgan Chase to diversify further its funding across the global markets while lengthening maturities. For... -

Page 58

... Chase results. (b) Additional capital required to meet internal debt and regulatory rating objectives. Credit risk capital Credit risk capital is estimated separately for the wholesale businesses (Investment Bank, Commercial Banking, Treasury & Securities Services and Asset & Wealth Management... -

Page 59

... risk capital Capital is allocated to privately- and publicly-held securities, third-party fund investments and commitments in the Private Equity portfolio to cover the potential loss associated with a decline in equity markets and related asset devaluations. The federal banking regulatory agencies... -

Page 60

... capital level and alternative investment opportunities. In 2005, JPMorgan Chase declared a quarterly cash dividend on its common stock of $0.34 per share. The Firm continues to target a dividend payout ratio of 30-40% of operating earnings over time. Stock repurchases On July 20, 2004, the Board... -

Page 61

...$ 1,867 1,592 1,058 discussion of lending-related commitments and guarantees and the Firm's accounting for them, see Credit risk management on pages 63-72 and Note 27 on pages 124-125 of this Annual Report. Contractual cash obligations In the normal course of business, the Firm enters into various... -

Page 62

... risk, credit risk, market risk, interest rate risk, operational risk, legal and reputation risk, fiduciary risk and private equity risk. As part of the risk management structure, each line of business has a Risk Committee responsible for decisions relating to risk strategy, policies and control... -

Page 63

... about JPMorgan Chase's ability to liquidate assets or use them as collateral for borrowings and take into account credit risk management's historical data on the funding of loan commitments (e.g., commercial paper back-up facilities), liquidity commitments to SPEs, commitments with rating triggers... -

Page 64

... credit spreads remain near historic tight levels as corporate balance sheet cash positions are strong and corporate profits generally healthy. JPMorgan Chase's credit spreads performed in line with peer spreads in 2005. Continued strong foreign investor participation in the global corporate markets... -

Page 65

... provides credit to customers of all sizes, from large corporate clients to loans for the individual consumer. The Firm manages the risk/reward relationship of each portfolio and discourages the retention of loan assets that do not generate a positive return above the cost of risk-adjusted capital... -

Page 66

... except ratios) Total credit portfolio Loans - reported(a) Loans - securitized(b) Total managed loans(c) Derivative receivables(d) Interests in purchased receivables Total managed credit-related assets Lending-related commitments(e) Assets acquired in loan satisfactions Total credit portfolio Credit... -

Page 67

... internal risk ratings and is presented on an S&P-equivalent basis. Wholesale exposure At December 31, 2005 (in billions, except ratios) Loans Derivative receivables Interests in purchased receivables Lending-related commitments Total excluding HFS Held-for-sale(a) Total exposure Credit derivative... -

Page 68

... As of December 31, 2005 (in millions, except ratios) Top 10 industries(a) Banks and finance companies $ Real estate Consumer products Healthcare State and municipal governments(b) Utilities Retail and consumer services(b) Oil and gas Asset managers Securities firms and exchanges All other Total... -

Page 69

...-sale loans are accounted for at lower of cost or fair value, with changes in value recorded in other revenue. • Banks and finance companies: This industry group, primarily consisting of exposure to commercial banks, is the largest segment of the Firm's wholesale credit portfolio. Credit quality... -

Page 70

... into account the effects of legally enforceable master netting agreements) at each of the dates indicated: Notional amounts and derivative receivables marked to market ("MTM") Notional amounts(a) As of December 31, (in billions) Interest rate Foreign exchange Equity Credit derivatives Commodity... -

Page 71

...risk management is essential to controlling the dynamic credit risk in the derivatives portfolio. The Firm risk manages exposure to changes in CVA by entering into credit derivative transactions, as well as interest rate, foreign exchange, equity and commodity derivative transactions. The MTM value... -

Page 72

... both the cost of credit derivative premiums and changes in value due to movement in spreads and credit events; in contrast, the loans and lending-related commitments being risk-managed are accounted for on an accrual basis. Loan interest and fees are generally recognized in Net interest income, and... -

Page 73

... mortgages and home equity loans, credit cards, auto and education financings and loans to small businesses. The domestic consumer portfolio reflects the benefit of diversification from both a product and a geographical perspective. The primary focus is on serving the prime consumer credit market... -

Page 74

... loan and lending-related categories within the consumer portfolio. Retail Financial Services Average RFS loan balances for 2005 were $198 billion. New loans originated in 2005 reflect high credit quality consistent with management's focus on the prime credit market segment. The net charge-off rate... -

Page 75

...the Risk Policy Committee, a subgroup of the Operating Committee, and the Audit Committee of the Board of Directors of the Firm. The allowance is reviewed relative to the risk profile of the Firm's credit portfolio and current economic conditions and is adjusted if, in management's judgment, changes... -

Page 76

...) Investment Bank Commercial Banking Treasury & Securities Services Asset & Wealth Management Corporate Total Wholesale Retail Financial Services Card Services Total Consumer Accounting policy conformity(b) Total provision for credit losses Credit card securitization Accounting policy conformity... -

Page 77

... term investment, mortgage servicing rights, and securities and derivatives used to manage the Firm's asset/liability exposures. Unrealized gains and losses in these positions are generally not reported in Trading revenue. Trading risk Fixed income risk (which includes interest rate risk and credit... -

Page 78

... as the change in value of the mark-tomarket trading portfolios plus any trading-related net interest income, brokerage commissions, underwriting fees or other revenue. The following histogram illustrates the daily market risk-related gains and losses for the IB trading businesses for the year... -

Page 79

...lending rate), pricing strategies on deposits, optionality and changes in product mix. The tests include forecasted balance sheet changes, such as asset sales and securitizations, as well as prepayment and reinvestment behavior. Earnings-at-risk also can result from changes in the slope of the yield... -

Page 80

... reported daily for each trading and nontrading business. Market risk exposure trends, value-at-risk trends, profit and loss changes, and portfolio concentrations are reported weekly. Stress test results are reported monthly to business and senior management. 78 JPMorgan Chase & Co. / 2005 Annual... -

Page 81

... of these reports is to enable management to maintain operational risk at appropriate levels within each line of business, to escalate issues and to provide consistent data aggregation across the Firm's businesses and support areas. Audit alignment Internal Audit utilizes a risk-based program of... -

Page 82

... to managing private equity risk is consistent with the Firm's general risk governance structure. Controls are in place establishing target levels for total and annual investment in order to control the overall size of the portfolio. Industry and geographic concentration limits are in place intended... -

Page 83

... sale. The majority of the Firm's assets reported at fair value are based upon quoted market prices or on internally developed models that utilize independently sourced market parameters, including interest rate yield curves, option volatilities and currency rates. The degree of management... -

Page 84

...reference to prices in highly active and liquid markets. The fair value of other commodities inventory is determined primarily using prices and data derived from less liquid and developing markets where the underlying commodities are traded. Private equity investments The fair value of loans in the... -

Page 85

...of this Annual Report for additional information related to the nature and accounting for goodwill and the carrying values of goodwill by major business segment. Accounting and reporting developments Accounting for income taxes - repatriation of foreign earnings under the American Jobs Creation Act... -

Page 86

...contracts are primarily energy-related contracts. The following table summarizes the changes in fair value for nonexchange-traded commodity derivative contracts for the year ended December 31, 2005: For the year ended December 31, 2005 (in millions) Net fair value of contracts outstanding at January... -

Page 87

... reporting. Internal control over financial reporting is a process designed by, or under the supervision of, the Firm's principal executive, principal operating and principal financial officers, or persons performing similar functions, and effected by JPMorgan Chase's board of directors, management... -

Page 88

... AVENUE • NEW YORK, NY 10017 Report of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of JPMorgan Chase & Co.: We have completed integrated audits of JPMorgan Chase & Co.'s 2005 and 2004 consolidated financial statements and of its internal control over... -

Page 89

...per share data)(a) Revenue Investment banking fees Trading revenue Lending & deposit related fees Asset management, administration and commissions Securities/private equity gains Mortgage fees and related income Credit card income Other income Noninterest revenue Interest income Interest expense Net... -

Page 90

... Loans, net of Allowance for loan losses Private equity investments Accrued interest and accounts receivable Premises and equipment Goodwill Other intangible assets: Mortgage servicing rights Purchased credit card relationships All other intangibles Other assets Total assets Liabilities Deposits... -

Page 91

... stock and options for purchase accounting acquisitions Shares issued and commitments to issue common stock for employee stock-based awards and related tax effects Balance at end of year Retained earnings Balance at beginning of year Net income Cash dividends declared: Preferred stock Common stock... -

Page 92

...of loans Net cash (used) received in business acquisitions or dispositions All other investing activities, net Net cash (used in) provided by investing activities Financing activities Net change in: Deposits Federal funds purchased and securities sold under repurchase agreements Commercial paper and... -

Page 93

... the equity method of accounting. These investments are generally included in Other assets, and the Firm's share of income or loss is included in Other income. For a discussion of private equity investments, see Note 9 on pages 103-105 of this Annual Report. Assets held for clients in an agency or... -

Page 94

... share(a) Fair value of employee stock awards and direct acquisition costs Total purchase price Net assets acquired: Bank One stockholders' equity Bank One goodwill and other intangible assets Subtotal Adjustments to reflect assets acquired at fair value: Loans and leases Private equity investments... -

Page 95

... with the equity method of accounting. Neovest Holdings, Inc. On September 1, 2005, JPMorgan Chase completed its acquisition of Neovest Holdings, Inc., a provider of high-performance trading technology and direct market access. This transaction will enable the Investment Bank to offer a leading... -

Page 96

.... The new company is called JPMorgan Cazenove Holdings. Other acquisitions During 2004, JPMorgan Chase purchased the Electronic Financial Services ("EFS") business from Citigroup and acquired a majority interest in hedge fund manager Highbridge Capital Management ("Highbridge"). Trading assets and... -

Page 97

...") securities). Origination fees and gains or losses on loan sales are recognized in income upon sale. Mortgage servicing fees are recognized over the period the related service is provided, net of amortization. Valuation changes in the mortgage pipeline, warehouse, MSR asset and corresponding risk... -

Page 98

... employee benefit plan assets, a calculated value that recognizes changes in fair value over a five-year period is used to determine the expected return on other postretirement employee benefit plan assets. Unrecognized net actuarial gains and losses and prior service costs associated with... -

Page 99

... business partnership Actual return on plan assets Firm contributions Benefits paid Foreign exchange impact and other Fair value of plan assets at end of year Reconciliation of funded status Funded status Unrecognized amounts:(a) Net transition asset Prior service cost Net actuarial loss 2005... -

Page 100

...plan assets is an average of projected longterm returns for each asset class, selected by reference to the yield on long-term U.K. government bonds and AA-rated long-term corporate bonds, plus an equity risk premium above the risk-free rate. In 2005, the discount rate used in determining the benefit... -

Page 101

... benefit plan, are held in separate accounts with an insurance company and are invested in equity and fixed income index funds. In addition, tax-exempt municipal debt securities, held in a trust, are used to fund the U.S. postretirement benefit plan. As of December 31, 2005, the assets used to fund... -

Page 102

... all outstanding Bank One employee stock-based awards at the merger date, and those awards became exercisable for or based upon JPMorgan Chase common stock. The number of awards converted, and the exercise prices of those awards, was adjusted to take into account the Merger exchange ratio of... -

Page 103

...receive cash payments equivalent to any dividends paid on the underlying common stock during the period the RSU is outstanding. Effective January 2005, the equity portion of the Firm's annual incentive awards were granted primarily in the form of RSUs. JPMorgan Chase & Co. / 2005 Annual Report 101 -

Page 104

... Chase's weighted-average, grant-date fair values for the employee stock-based compensation awards granted, and the assumptions used to value stock options and SARs under the Black-Scholes valuation model: Year ended December 31,(a) 2005 2004 2003 Net income as reported $ 8,483 Add: Employee stock... -

Page 105

...or in anticipation of changes in market conditions, or as part of the Firm's management of its structural interest rate risk. AFS securities are carried at fair value on the Consolidated balance sheets. Unrealized gains and losses after SFAS 133 valuation adjustments are reported as net increases or... -

Page 106

... losses aged greater than 12 months have a market value at December 31, 2005, that is within 4% of their amortized cost basis. In calculating the effective yield for mortgage-backed securities ("MBS") and collateralized mortgage obligations ("CMO"), JPMorgan Chase includes the effect of principal... -

Page 107

... public companies, changes in market outlook and the third-party financing environment over time. The Valuation Control Group within the Finance area is responsible for reviewing the accuracy of the carrying values of private investments held by Private Equity. Private Equity also holds publicly... -

Page 108

...at the principal amount outstanding, net of the Allowance for loan losses, unearned income and any net deferred loan fees. Loans held for sale are carried at the lower of cost or fair value, with valuation changes recorded in noninterest revenue. Loans are classified as "trading" where positions are... -

Page 109

... sale, principally mortgage-related: Year ended December 31, (in millions)(a) Net gains on sales of loans held for sale Lower of cost or fair value adjustments 2005 $ 596 (332) 2004 $ 368 39 2003 $ 933 26 The formula-based component covers performing wholesale and consumer loans and is the product... -

Page 110

... by security certificates. The Firm's undivided interests are carried at historical cost and are classified in Loans. Retained interests from wholesale activities are reflected as trading assets. JPMorgan Chase retains servicing responsibilities for all residential mortgage, credit card and... -

Page 111

...auto securitization gain of $9 million does not include the write-down of loans transferred to held-for-sale in 2005 and risk management activities intended to protect the economic value of the loans while held-for-sale. (d) Expected credit losses for prime residential mortgage and certain wholesale... -

Page 112

... to credit card securitizations due to their revolving structure. (b) 2004 results include six months of the combined Firm's results and six months of heritage JPMorgan Chase results. 2003 reflects the results of heritage JPMorgan Chase only. (c) 2005 securitizations consist of prime-mortgage... -

Page 113

... asset-backed securities business, helping meet customers' financing needs by providing access to the commercial paper markets through VIEs known as multi-seller conduits. These entities are separate bankruptcy-remote corporations in the business of purchasing interests in, and making loans secured... -

Page 114

... disruptions in the commercial paper market. Deal-specific credit enhancement that supports the commercial paper issued by the conduits is generally structured to cover a multiple of historical losses expected on the pool of assets and is provided primarily by customers (i.e., sellers) or other... -

Page 115

... of this Annual Report. (b) The decline in balance is primarily attributable to the sale of the Firm's interest in a structured investment vehicle's capital notes and resulting deconsolidation of this vehicle in 2005. (c) Includes the fair value of securities and derivatives. Interests in purchased... -

Page 116

...984 Commercial Banking 2,651 Treasury & Securities Services 2,062 Asset & Wealth Management 7,025 Corporate (Private Equity) 377 Total goodwill $ 43,621 $ 34,160 Mortgage servicing rights JPMorgan Chase recognizes as intangible assets mortgage servicing rights, which represent the right to perform... -

Page 117

... recorded in Mortgage fees and related income. Certain AFS securities purchased by the Firm to manage structural interest rate risk were designated in 2005 as risk management instruments of MSRs. At December 31, 2005 and 2004, the unrealized loss on AFS securities used to manage the risk exposure of... -

Page 118

... immaterial asset retirement obligations related to asbestos remediation under SFAS 143 and FIN 47 in those cases where it has sufficient information to estimate the obligations' fair value. JPMorgan Chase capitalizes certain costs associated with the acquisition or development of internal-use... -

Page 119

... interest debentures held by trusts that issued guaranteed capital debt securities." The Firm also records the common capital securities issued by the issuer trusts in Other assets in its Consolidated balance sheets at December 31, 2005 and 2004. JPMorgan Chase & Co. / 2005 Annual Report 117 -

Page 120

... H cumulative(a) Fixed/adjustable rate, noncumulative Total preferred stock Earliest redemption date 3/31/2006 - (a) Represented by depositary shares. (b) Redemption price includes amount shown in the table plus any accrued but unpaid dividends. 118 JPMorgan Chase & Co. / 2005 Annual Report -

Page 121

...treasury) by JPMorgan Chase during 2005, 2004 and 2003 were as follows: December 31,(a) (in millions) Issued - balance at January 1 Newly issued: Employee benefits and compensation plans Employee stock purchase plans Purchase accounting acquisitions and other Total newly issued Cancelled shares 2005... -

Page 122

... and losses on AFS securities, SFAS 133 hedge transactions and certain tax benefits associated with the Firm's employee stock plans. The tax effect of these items is recorded directly in Stockholders' equity. Stockholders' equity increased by $425 million, $431 million and $898 million in 2005, 2004... -

Page 123

... on cash and intercompany funds transfers JPMorgan Chase Bank's business is subject to examination and regulation by the Office of the Comptroller of the Currency ("OCC"). The Bank is a member of the Federal Reserve System and its deposits are insured by the Federal Deposit Insurance Corporation... -

Page 124

...intangible assets, investments in subsidiaries and the total adjusted carrying value of nonfinancial equity investments that are subject to deductions from Tier 1 capital. (e) Represents requirements for bank subsidiaries pursuant to regulations issued under the Federal Deposit Insurance Corporation... -

Page 125

...used to manage the credit risk of loans and commitments because of the difficulties in qualifying such contracts as hedges under SFAS 133. Similarly, the Firm does not apply hedge accounting to certain interest rate derivatives used as economic hedges. JPMorgan Chase & Co. / 2005 Annual Report 123 -

Page 126

...and financial guarantees are conditional lending commitments issued by JPMorgan Chase to guarantee the performance of a customer to a third party under certain arrangements, such as commercial paper facilities, bond financings, acquisition financings, trade and similar transactions. Approximately 58... -

Page 127

... protect the customer against the risk of loss if the third party fails to return the securities. To support these indemnification agreements, the Firm obtains from the third party cash or other highly liquid collateral with a market value exceeding 100% of the value of the loaned securities. If the... -

Page 128

... 2005 December 31, (in billions) Wholesale-related: Banks and finance companies Real estate Consumer products Healthcare State and municipal governments All other wholesale Total wholesale-related Consumer-related: Home finance Auto & education finance Consumer & small business and other Credit card... -

Page 129

... loans are current rates offered by commercial banks. For consumer real estate, secondary market yields for comparable mortgage-backed securities, adjusted for risk, are used. • Fair value for credit card receivables is based upon discounted expected cash flows. The discount rates used for credit... -

Page 130

... to prices in highly active and liquid markets. The fair value for other commodities inventory is determined primarily using pricing and other data derived from less liquid and developing markets where the underlying commodities are traded. This caption also includes private equity investments and... -

Page 131

...six months of heritage JPMorgan Chase results. 2003 reflects the results of heritage JPMorgan Chase only. (b) Revenue is composed of Net interest income and noninterest revenue. (c) Expense is composed of Noninterest expense and Provision for credit losses. JPMorgan Chase & Co. / 2005 Annual Report... -

Page 132

... business structure of the combined Firm. Treasury was transferred from the Investment Bank into Corporate. The segment formerly known as Chase Financial Services had been comprised of Chase Home Finance, Chase Cardmember Services, Chase Auto Finance, Chase Regional Banking and Chase Middle Market... -

Page 133

...to the lines of business for 2005 and 2004 were as follows (there were no merger costs in 2003): Year ended December 31, (in millions)(b) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset & Wealth Management Services Corporate . 2005 $ 32... -

Page 134

..., net 34 Available-for-sale securities: Purchases (215) Proceeds from sales and maturities 124 Cash received in business acquisitions - Net cash (used in) provided by investing activities Financing activities Net cash change in borrowings from subsidiaries(b) Net cash change in other borrowed funds... -

Page 135

... stockholders' equity Credit quality metrics Allowance for credit losses Nonperforming assets(c) Allowance for loan losses to total loans(d) Net charge-offs Net charge-off rate(a)(d) Wholesale net charge-off (recovery) rate(a)(d) Managed Card net charge-off rate(a) Headcount Share price(e) High Low... -

Page 136

... JPMorgan Chase's internal risk assessment system. "Investment-grade" generally represents a risk profile similar to a rating of a BBB-/Baa3 or better, as defined by independent rating agencies. Mark-to-market exposure: A measure, at a point in time, of the value of a derivative or foreign exchange... -

Page 137

... to develop new products and services; acceptance of new products and services and the ability of the Firm to increase market share; ability of the Firm to control expenses; competitive pressures; changes in laws and regulatory requirements; changes in applicable accounting policies; costs, outcomes... -

Page 138

... of the Board of Directors Koç Holding A.S. Ç Istanbul, Turkey Michael A. Chaney Chairman National Australia Bank Limited Perth, Australia James Dimon Chief Executive Officer JPMorgan Chase & Co. New York, New York William S. Stavropoulos Chairman of the Board The Dow Chemical Company Midland... -

Page 139

...Joe Myer Executive Director NCALL Research Dover, DE Shirley Stancato President/CEO New Detroit, Inc. Detroit, MI James Klein Executive Director Ohio Community Development Finance Fund Columbus, OH Sarah Gerecke CEO Neighborhood Housing Services of NYC New York, NY Jeremy Nowak President/CEO The... -

Page 140

... A. Toben Executive Vice President and Chief Financial Officer Verizon Communications Richard J. Bressler Managing Director and Head of the Strategic Resources Group Thomas H. Lee Partners, LP John B. Hess Chairman of the Board and Chief Executive Officer Amerada Hess Corporation Lewis Ranieri... -

Page 141

... business activity, including liquidity risk, credit risk, market risk, interest rate risk, operational risk, legal and reputation risk, fiduciary risk and private equity risk. Each line of business has a risk committee responsible for decisions relating to risk strategy, policies and control. Where... -

Page 142

... & Management Development Committee 3. Corporate Governance & Nominating Committee 4. Public Responsibility Committee 5. Risk Policy Committee Executive Committee (*denotes member of Operating Committee) James Dimon* Chief Executive Officer Michael K. Clark Institutional Trust & Investor Services... -

Page 143

...Co. Corporate headquarters 270 Park Avenue New York, New York 10017-2070 Telephone: 212-270-6000 http://www.jpmorganchase.com Principal subsidiaries JPMorgan Chase Bank, National Association Chase Bank USA, National Association J.P. Morgan Securities Inc. Annual report on Form 10-K The Annual Report... -

Page 144

JPMorgan Chase & Co. www.jpmorganchase.com