Intel 1995 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1995 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Information By Quarter

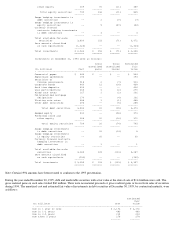

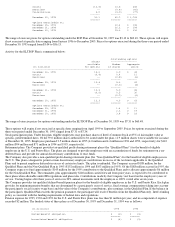

(In millions--except per share data)

(Unaudited)

(A) Intel plans to continue its dividend program. However, dividends are dependent on future earnings, capital requirements and financial

condition.

(B) Intel's Common Stock (symbol INTC) and 1998 Step-Up Warrants (symbol INTCW)

trade on The Nasdaq Stock Market and are quoted in the Wall Street Journal and other newspapers. Intel's Common Stock also trades on the

Zurich, Basel and Geneva, Switzerland exchanges. At December 30, 1995, there were approximately 69,400 holders of Common Stock. All

stock and warrant prices are closing prices per The Nasdaq Stock Market.

(C) Net income for the fourth quarter of 1994 was impacted by a $475 million pretax charge to revenue and cost of sales to cover replacement

and other costs associated with a divide problem in the floating point unit of the Company's Pentium processor.

GRAPHICS APPENDIX LIST*

* In this Appendix, the following descriptions of graphs on pages 28 and 29 of the Company's 1995 Annual Report to Stockholders that are

omitted from the EDGAR text are more specific with respect to the actual amounts and percentages than can be determined from the graphs

themselves.

The Company submits such more specific descriptions only for the purpose of complying with EDGAR requirements for transmitting this

Annual Report on Form 10-K; such more specific descriptions are not intended in any way to provide information that is additional to that

otherwise provided in the 1995 Annual Report to Stockholders.

1995 for quarter ended December 30 September 30 July 1 April 1

- -------------------------------------------------------------------------------

Net revenues $ 4,580 $ 4,171 $ 3,894 $ 3,557

Cost of sales $ 2,389 $ 2,008 $ 1,805 $ 1,609

Net income $ 867 $ 931 $ 879 $ 889

Earnings per share $ .98 $ 1.05 $ .99 $ 1.02

Dividends per share(A)

Declared $ .04 $ .04 $ .04 $ .03

Paid $ .04 $ .04 $ .03 $ .03

Market price range Common

Stock(B) High $ 72.88 $ 76.44 $ 65.63 $ 44.25

Low $ 56.75 $ 58.63 $ 42.75 $ 31.81

Market price range Step-Up

Warrants(B) High $ 39.00 $ 43.63 $ 31.88 $ 11.91

Low $ 26.75 $ 30.44 $ 11.31 $ 6.97

(In millions-except per share data)

1994 for quarter ended December 31 October 1 July 2 April 2

- -------------------------------------------------------------------------------

Net revenues $ 3,228 $ 2,863 $ 2,770 $ 2,660

Cost of sales $ 2,023 $ 1,273 $ 1,156 $ 1,124

Net income $ 372(C) $ 659 $ 640 $ 617

Earnings per share $ .43 $ .76 $ .73 $ .70

Dividends per share(A)

Declared $ .03 $ .03 $ .03 $ .025

Paid $ .03 $ .03 $ .025 $ .025

Market price range Common

Stock(B) High $ 33.06 $ 33.63 $ 35.31 $ 36.13

Low $ 28.91 $ 28.25 $ 28.75 $ 30.63

Market price range Step-Up

Warrants(B) High $ 7.50 $ 8.00 $ 9.22 $ 9.75

Low $ 6.16 $ 6.50 $ 6.50 $ 7.56

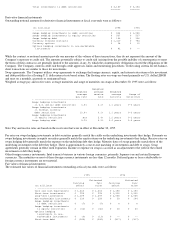

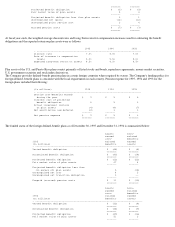

REVENUES AND INCOME

(Dollars in billions) 1993 1994 1995

------ ------ ------

Net revenues 8.782 11.521 16.202

Net income 2.295 2.288 3.566

COSTS AND EXPENSES

(Percent of revenues) 1993 1994 1995

------ ------ ------

Cost of sales 37% 48% 48%

R&D 11% 10% 8%

Marketing and G&A 13% 13% 11%

OTHER INCOME AND EXPENSE

(Dollars in millions) 1993 1994 1995

------ ------ ------

Interest and other income 188 273 415