Intel 1995 Annual Report Download - page 26

Download and view the complete annual report

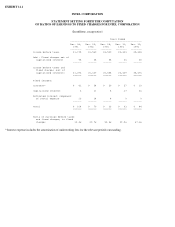

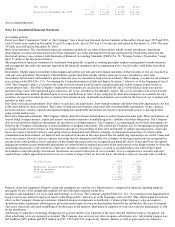

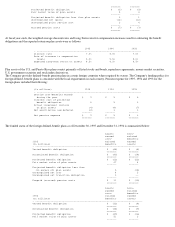

Please find page 26 of the 1995 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial

reporting purposes and the amounts used for income tax purposes.

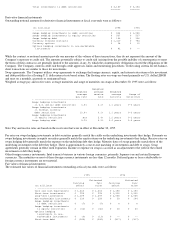

Significant components of the Company's deferred tax assets and liabilities at fiscal year-ends were as follows:

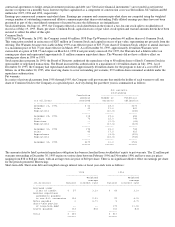

U.S. income taxes were not provided for on a cumulative total of approximately $615 million of undistributed earnings for certain non-U.S.

subsidiaries. The Company intends to reinvest these earnings indefinitely in operations outside the United States.

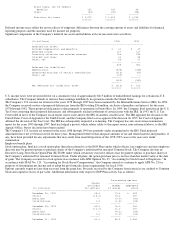

The Company's U.S. income tax returns for the years 1978 through 1987 have been examined by the Internal Revenue Service (IRS). In 1989,

the Company received a notice of proposed deficiencies from the IRS totaling $36 million, exclusive of penalties and interest, for the years

1978 through 1982. These proposed deficiencies relate primarily to operations in Puerto Rico. In 1989, the Company filed a petition in the U.S.

Tax Court contesting these proposed deficiencies and subsequently reached settlement of certain issues with the IRS. In 1993, the U.S. Tax

Court ruled in favor of the Company on an export source issue and for the IRS on another, smaller issue. The IRS appealed the decision to the

United States Court of Appeals for the Ninth Circuit, and the Company filed a cross-appeal of the decision. In 1995, the Court of Appeals

affirmed the decision of the Tax Court. The IRS has subsequently requested a re-hearing. The Company has also received an examination

report for the years 1983 through 1987. Intel has lodged a protest, which relates solely to the export source issue referenced above, to the IRS

Appeals Office, but no decisions have been reached.

The Company's U.S. income tax returns for the years 1988 through 1990 are presently under examination by the IRS. Final proposed

adjustments have not yet been received for these years. Management believes that adequate amounts of tax and related interest and penalties, if

any, have been provided for any adjustments that may result from unsettled portions of the 1978-1987 cases or the years now under

examination.

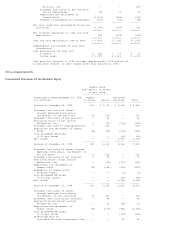

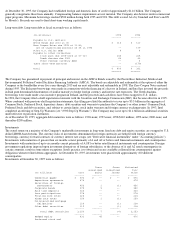

Employee benefit plans

Stock option plans. Intel has a stock option plan (hereafter referred to as the EOP Plan) under which officers, key employees and non-

employee

directors may be granted options to purchase shares of the Company's authorized but unissued Common Stock. The Company also has an

Executive Long-Term Stock Option Plan (ELTSOP) under which certain key executive officers may be granted options to purchase shares of

the Company's authorized but unissued Common Stock. Under all plans, the option purchase price is not less than fair market value at the date

of grant. The Company accounts for stock options in accordance with APB Opinion No. 25, "Accounting for Stock Issued to Employees." In

accordance with SFAS No. 123, "Accounting for Stock-Based Compensation," the Company intends to continue to apply APB No. 25 for

purposes of determining net income and to adopt the pro forma disclosure requirements for fiscal 1996.

Options currently expire no later than ten years from the grant date. Proceeds received by the Company from exercises are credited to Common

Stock and capital in excess of par value. Additional information with respect to EOP Plan activity was as follows:

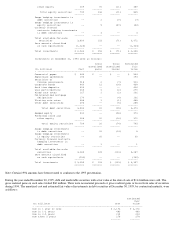

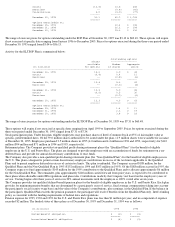

State taxes, net of federal

benefits 132 105 98

Other (33) (51) (98)

------- ------- -------

Provision for taxes $ 2,072 $ 1,315 $ 1,235

======= ======= =======

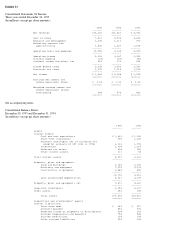

(In millions) 1995 1994

- -------------------------------------------------------------------------------

Deferred tax assets

Accrued compensation and benefits $ 61 $ 49

Deferred income 127 127

Inventory valuation and related reserves 104 255

Interest and taxes 61 54

Other, net 55 67

------- -------

408 552

Deferred tax liabilities

Depreciation (475) (338)

Unremitted earnings of certain subsidiaries (116) (51)

Other, net (29) --

------- -------

(620) (389)

------- -------

Net deferred tax (liability) asset $ (212) $ 163

======= =======

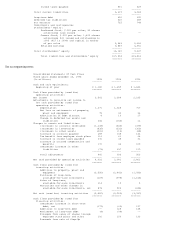

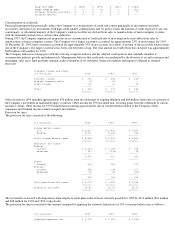

Outstanding options

Shares -----------------------

available Number Aggregate

(In millions) for options of shares price

- ------------------------------------------------------------------------------

December 26, 1992 65.4 73.6 $ 669

Grants (15.2) 15.2 357

Exercises -- (9.0) (56)

Cancellations 1.8 (1.8) (24)

------- ------- -------

December 25, 1993 52.0 78.0 946

Grants (12.0) 12.0 397

Exercises -- (8.2) (54)

Cancellations 1.6 (1.6) (33)

------- ------- -------

December 31, 1994 41.6 80.2 1,256