ING Direct 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 Who we are 2 Report of the Executive Board 3 Corporate governance 4 Consolidated annual accounts 5 Parent company annual accounts 6 Other information 7 Additional information

of consumers by pooling their long-term risks and providing

guarantees at affordable prices. Through the accumulation

ofpremiums, insurance companies are also major institutional

investors that provide long-term funding to companies and

institutions via the capital markets. By spreading risks and

extending long-term funding, the insurance industry thereby

alsoplays an invaluable role for society as a whole in dampening

volatility through economic cycles.

In order to achieve these goals it is very important that the Solvency

II framework, as originally envisaged, will become market-based,

avoids pro-cyclicality and should be able to withstand market

volatility. The framework should therefore ensure that the measures

to be implemented are robust enough throughout market cycles.

Moreover, there needs to be a balance between on the one hand

pricing that is affordable and on the other hand meeting capital

objectives with which the industry can fulfil its long-term

obligations. Such a balanced market-based framework should be

designed to last for a long time (to come) and should maintain the

ongoing trust from consumers, thereby positioning the European

insurance industry for the future.

ING wants to work constructively with its colleagues in the

insurance industry to advise EU policy makers and regulators to

come up with concrete proposals to meet these objectives. It is

important that the framework is built to last and will service society

as a whole for a long time to come.

In March 2011, the European Insurance and Occupational Pensions

Authority (EIOPA) published the results of its Fifth Quantitative

Impact Study (QIS5) on Solvency II. ING participated in QIS5

independently as ING Insurance, and also as ING Group, which is in

line with our internal preparations to become fully Solvency

II-ready. Based on the results, EIOPA and the Dutch central bank

confirmed that the financial positions of European and Dutch

insurers remained sound. Individual results were not disclosed.

The results have been fed into the European Commission’s process

for fine-tuning the Solvency II framework and implementation.

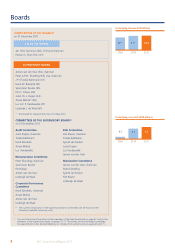

ALIGNMENT OF REMUNERATION POLICIES WITH CRD III

Since the start of the crisis in 2008, ING has been continually

reviewing and amending its remuneration policies in response

tothe ongoing review of the financial system and related public

debate, as well as in line with applicable regulatory developments.

In 2010, the European Commission issued the Capital Requirements

Directive III (CRD III), which contained specific requirements in relation

to the remuneration of those who have a material impact on the

company’s risk profile, the so-called Identified Staff. From 1January

2011, the directive had to be implemented into national law.

In 2011, ING’s remuneration policies for the Executive Board and

Identified Staff were amended in line with the CRD III requirements.

The amended policy for the Executive Board was adopted by the

annual General Meeting of Shareholders in May 2011. Our

remuneration policies continue to have an increased focus on

long-term value creation, risk and non-financial performance

measures to improve sustainable business practices.

ING’S APPEAL AGAINST THE EC DECISION

In January 2010, ING filed an appeal with the General Court of

theEuropean Union against specific elements of the European

Commission’s decision of 18 November 2009 which approved the

state aid received and ING’s restructuring plan. ING requested the

Court to annul the decision of the European Commission insofar:

• as it states that the agreement between ING and the Dutch

State concerning a reduction of the repayment premium for

thefirst EUR 5 billion tranche of core Tier 1 securities leads to

additional state aid of EUR 2 billion;

• as the Commission has subjected the approval of the state aid

tothe acceptance of price leadership bans; and

• as the Commission has subjected the approval of the state aid to

restructuring requirements that go beyond what is proportionate.

The Dutch State joined ING in 2010 in its appeal with the General

Court to contest the EC decision insofar as it qualifies the core

Tier1 amendment as additional state aid. The Dutch central bank

joined the proceedings in support of ING’s appeal. In July 2011, oral

arguments of the appeal case were heard by the Court. The ruling

of the Court was on 2 March 2012. ING welcomes the judgment to

partially annul the EC decision. From 2 March, ING has been in the

process of carefully assessing the full judgment as well as its

consequences.

15ING Group Annual Report 2011

Financial and regulatory environment continued