Huntington National Bank 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

On July 2, 2013, the Federal Reserve voted to adopt final capital rules implementing Basel III requirements for U.S. Banking

organizations. The final rules establish an integrated regulatory capital framework and will implement in the United States the Basel

III regulatory capital reforms from the Basel Committee on Banking Supervision and certain changes required by the Dodd-Frank Act.

Under the final rule, minimum requirements will increase for both the quantity and quality of capital held by banking organizations.

Consistent with the international Basel framework, the final rule includes a new minimum ratio of common equity tier 1 capital (Tier 1

Common) to risk-weighted assets and a Tier 1 Common capital conservation buffer of 2.5% of risk-weighted assets that will apply to

all supervised financial institutions. The rule also raises the minimum ratio of tier 1 capital to risk-weighted assets and includes a

minimum leverage ratio of 4% for all banking organizations. These new minimum capital ratios were effective for us on January 1,

2015, and will be fully phased-in on January 1, 2019.

The following are the Basel III regulatory capital levels that we must satisfy to avoid limitations on capital distributions and

discretionary bonus payments during the applicable transition period, from January 1, 2015, until January 1, 2019:

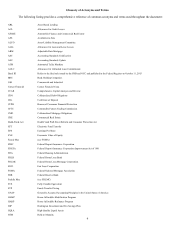

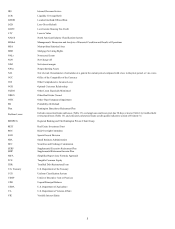

Basel III Regulatory Capital Levels

January 1, January 1, January 1, January 1, January 1,

2015 2016 2017 2018 2019

Tier 1 Common 4.5% 5.125% 5.75% 6.375% 7.0%

Tier 1 risk-based capital ratio 6.0% 6.625% 7.25% 7.875% 8.5%

Total risk-based capital ratio 8.0% 8.625% 9.25% 9.875% 10.5%

The final rule emphasizes Tier 1 Common capital, the most loss-absorbing form of capital, and implements strict eligibility

criteria for regulatory capital instruments. The final rule also improves the methodology for calculating risk-weighted assets to

enhance risk sensitivity. Banks and regulators use risk weighting to assign different levels of risk to different classes of assets.

We have evaluated the impact of the Basel III final rule on our regulatory capital ratios and estimate, on a fully phased-in basis, a

reduction of approximately 40 basis points to our Basel I tier I common risk-based capital ratio. The estimate is based on

management’s current interpretation, expectations, and understanding of the final U.S. Basel III rules. We anticipate that our capital

ratios, on a Basel III basis, will continue to exceed the well-capitalized minimum capital requirements. We are evaluating options to

mitigate the capital impact of the final rule prior to its effective implementation date.

Based on the final Basel III rule, banking organizations with more than $15 billion in total consolidated assets are required to

phase-out of additional tier 1 capital any non-qualifying capital instruments (such as trust preferred securities and cumulative preferred

shares) issued before September 12, 2010. We will begin the additional tier I capital phase-out of our trust preferred securities in

2015, but will be able to include these instruments in Tier II capital as a non-advanced approaches institution.

Generally, under the currently applicable guidelines, a financial institution's capital is divided into two tiers. Institutions that must

incorporate market risk exposure into their risk-based capital requirements may also have a third tier of capital in the form of restricted

short-term subordinated debt. These tiers are:

x Tier 1 risk-based capital, or core capital, which includes total equity plus qualifying capital securities and minority interests

subject to phase-out, excluding unrealized gains and losses accumulated in other comprehensive income, and nonqualifying

intangible and servicing assets.

x Tier 2 risk-based capital, or supplementary capital, which includes, among other things, cumulative and limited-life preferred

stock, mandatory convertible securities, qualifying subordinated debt, and the ACL, up to 1.25% of risk-weighted assets.

x Total risk-based capital is the sum of Tier 1 and Tier 2 risk-based capital.

The Federal Reserve and the other federal banking regulators require that all intangible assets (net of deferred tax), except

originated or purchased MSRs, nonmortgage servicing assets, and purchased credit card relationships intangible assets, be deducted

from Tier 1 capital. However, the total amount of these items included in capital cannot exceed 100% of its Tier 1 capital.

Under the general risk-based guidelines to remain adequately-capitalized, financial institutions are required to maintain a total

risk-based capital ratio of 8%, with 4% being Tier 1 risk-based capital. The appropriate regulatory authority may set higher capital

requirements when they believe an institution's circumstances warrant an increase.

Under the leverage guidelines, financial institutions are required to maintain a Tier 1 leverage ratio of at least 3%. The minimum

ratio is applicable only to financial institutions that meet certain specified criteria, including excellent asset quality, high liquidity, low

interest rate risk exposure, and the highest regulatory rating. Financial institutions not meeting these criteria are required to maintain a

minimum Tier 1 leverage ratio of 4%.